Evolving Personal Finance » Entries tagged with "targeted savings"

Targeted Savings for the Non-Broke

As of January, we have resumed our use of targeted savings accounts! I missed this system so in the last 2.5 years when our life has been in flux: becoming funemployed, living apart, moving to Seattle, and having a baby. But said baby is over six months old now and things are much more predictable, so we’re back to using targeted savings. But pressing “play” on our targeted savings system again is not like starting it … Read entire article »

Filed under: targeted savings

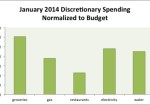

January 2017 Budget Report

January was a fairly quiet month around our house. We spent the first few days of it still in Virginia with my family, flying back on the 3rd. For the rest of the month I kept me and DPR almost completely housebound – it’s too cold and dreary for me to want to get out much. We did socialize a bit, but hosted our friends at our home instead of going out. If we were … Read entire article »

Filed under: month in review

Irregular Expenses Are Still Kicking Our Butts!

Somehow I thought that doubling our income would solve our irregular expenses problems, but I guess I was wrong! Our targeted savings accounts were our budgetary saviors during grad school. Our income was pretty low, so irregular expenses like plane tickets and car repairs would have totally overwhelmed our available cash flow in a given month. Our targeted savings account converted large irregular expenses to small regular expenses and helped us plan, save, and make spending … Read entire article »

Filed under: targeted savings

How Do You Decide If You Can Afford a Purchase?

Lately I have been thinking about how to determine whether to make a purchase of a “want” and I’d love some feedback from you all about how you make that decision. One of the purposes of a budget, in my mind, is to help you make that decision. A budget gives you guidelines for what you want your spending to be, and then all you have to do when contemplating a purchase is ask yourself … Read entire article »

Filed under: budgeting, spending, targeted savings

Do I Want a Camera or Subjects?

I’m “that person” in my group of friends – the one who always has a camera out, taking awkward candid photos. I estimate that I have tens of thousands of photos that I’ve taken with my two Canon point-and-shoots over the past 7 or 8 years. (But for all the flak my friends give me about annoyingly documenting everything, they frequently tell me how much they appreciate my efforts and several times have asked for … Read entire article »

Filed under: choices, spending, targeted savings

The Benefits of Targeted Savings Accounts – and Their Uncertain Future

Boy, am I grateful for our targeted savings accounts this month! We have spent a crazy amount of money this month, some of it unexpectedly. This month we have used our targeted savings accounts to purchase our Christmas flights ($625.20), six months of car insurance ($405.47), and other miscellaneous items ($149.85). All of that was planned and budgeted for so even though it was a lot of money it wasn’t stressful at all. Actually, we have … Read entire article »

Filed under: targeted savings

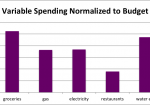

July 2012 Month in Review: Money

Wow, I’ve been so impressed at how many months we’ve had leftover money since I started writing this series! I’m not sure if it’s the season change or the accountability this series provides, but something is working! Or maybe it’s just that we pull from our targeted and general savings accounts so much. 😉 This month was characterized by majorly low grocery spending, which always is helpful in freeing up money for other categories. We … Read entire article »

Filed under: month in review

May 2012 Month in Review: Money

Like last month, this was a great one for coming in under budget overall! I think the key is that we have a high-limit grocery budget (in comparison with 6 months ago) and we’re getting our CSA boxes so we’re spending less out of pocket on food and have a lot of buffer in that area. We spent a crazy amount of money this month but our targeted savings accounts were able to cover nearly all … Read entire article »

Filed under: month in review

Spend $1600 or Become a One-Car Family?

Irony: My car breaking down the day after writing about our disagreement over carpooling to work! When I published that post on Monday becoming a one-car family seemed a remote possibility, but as of this writing on Tuesday evening we are giving it serious consideration. So much can change in 36 hours! For the last few months, my car has been shaking considerably when its speed exceeds 65 mph. I knew I would eventually need to get … Read entire article »

Filed under: budgeting, cars, choices, emergency fund, targeted savings