Our Short-Term Savings Accounts

The aspect of our financial situation of which I’m most proud is our short-term targeted savings accounts. I’m proud of them because they are a solution to a recurring monthly-budgeting problem – regular but infrequent expenses – that I came up with all on my own. (Not that I’m the only one, of course – I just did it independent of those others.) And I actually think they’re really fun.

Targeted savings accounts:

1) Take the stress out of the unexpected. Of course emergencies (however you define them) will come up and your emergency fund can take care of them. However, those expenses that you know are eventual and not-quite-emergencies (car maintenance, dental work) can still cause stress if you don’t have enough in your checking to cover them when they come up, and the targeted savings accounts can come to the rescue.

2) Create space for fun. On the frugal scale I tend to come down on the stingy side. In a given month, I sort of have to have my arm twisted to spend money on dining out and entertainment. By essentially making indulgence a budget category, it’s much easier for me to say “yes” to fun, even rather expensive fun.

3) Help prepare for large periodic expenses. I know that just trying to keep a large enough balance in our checking account to pay for something like plane tickets wouldn’t work out well for us. Money has a tendency to slide out of checking accounts unconsciously, at least in my experience. Multiple accounts also help me keep track of progress better than putting it all in one account.

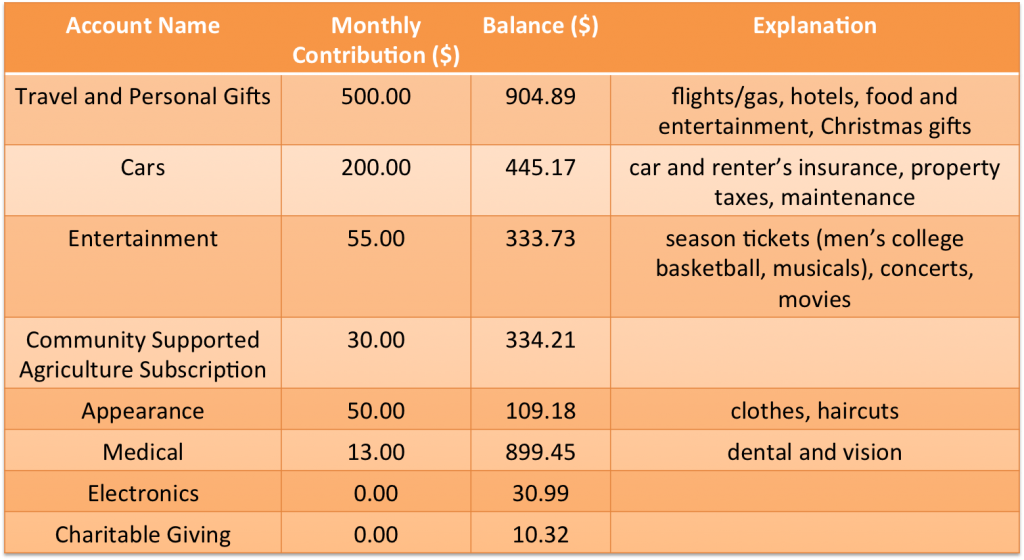

Here are our savings accounts and corresponding monthly contributions and balances. In addition to these accounts we also have an emergency fund and a nest egg.

The Electronics account was created to pay for our laptops last summer. We contributed found money to it only and haven’t closed it yet because we still occasionally pay for accessories. The Charitable Giving account also is mainly funded by found money, at least until March 2012.

Anyway our balances are pretty healthy at the moment so that is pleasing, but we do have some sizeable pending expenses – a haircut for me, repairs on both our cars, a wedding and a reunion to attend, and our CSA subscription. So they’ll be partially depleted shortly but very likely without stress.

How do you cover large, irregular expenses if you’re on a tight budget?

Filed under: budgeting, savings, targeted savings

The Benefits of Targeted Savings Accounts – and Their Uncertain Future

The Benefits of Targeted Savings Accounts – and Their Uncertain Future Targeted Savings Accounts and Funemployment for the One-Car Win!

Targeted Savings Accounts and Funemployment for the One-Car Win! Short-Term Challenges to Speed Debt Repayment

Short-Term Challenges to Speed Debt Repayment Hard and Soft Earmarks in Targeted Savings

Hard and Soft Earmarks in Targeted Savings

hi Emily, I noticed that the medical insurance cost was 13/month for both vision and dental. just curious about the coverage, is it an economic and good dental insurance?

Good question, I can see how that could be confusing. Our health insurance is entirely paid for by our employer (no premiums to us). We are responsible for our own dental and vision expenses as well as co-pays for visits and prescriptions and such. The reason we are only saving $13/month right now is because the balance on that account is so high. Our goal was for it to reach $890, and we just haven’t spent much out of it because we haven’t needed dental or vision care recently. I plan to go to the dentist for a checkup in the next couple months, which will ding that account quite a bit and we’ll have to increase the savings rate to bring it back to $890. The revolving $13 at the moment is for a prescription that I fill once every 10 weeks. Does that make sense?

[…] my husband and I enjoy, even on our tight budget. You’ll probably notice a lot of overlap with our targeted savings accounts here – they tend not to be spontaneous but they are definitely […]

[…] because I wasn’t sure if our insurance would cover it, but in the end I decided that our Medical targeted savings account could cover the […]

[…] written several times about our targeted short-term savings accounts. For the most part these work very well for us in saving for our anticipated expenses. But […]

[…] Accounts for Irregular Expenses. This was my first guest post so thanks Derek! This post has a more personally detailed sister article that I wrote a while ago, although a few things have changed for our accounts since then (mostly, […]

[…] accounts! I wrote a detailed guest post at Life and My Finances about our accounts and I listed our balances a few months […]

[…] 3: Why the heck do you have all these savings accounts? Doesn’t this get confusing? How can you properly pull money for expenses as they come […]

[…] that after weeks instead of hours. I make a lot of those types of transfers in and out of our targeted savings every month so I guess it’s not surprising that I messed one up. Anyway I feel good about […]

[…] am I grateful for our targeted savings accounts this month! We have spent a crazy amount of money this month, some of it […]

[…] for random overages and small unanticipated purchases. For both our everyday budget and our targeted savings account rates, the categories that are fixed no matter what our take-home pay is come first (with dashes for the […]

[…] our targeted savings accounts. When we first set them up right after we got married, they were a great way to plan for irregular expenses and to motivate us to defer spending. More recently, I’ve realized that as our next year is so […]

[…] but we had to turn down a few wedding invitations. That was when we opened the first few of our targeted savings accounts so that we would be prepared for all these huge (to our budget) irregular expenses the following […]

[…] my husband and I enjoy, even on our tight budget. You’ll probably notice a lot of overlap with our targeted savings accounts here – they tend not to be spontaneous but they are definitely […]

[…] out as refined as it is now. Our savings rate was not nearly as high. We didn’t have our targeted savings accounts to help pay for huge one-time expenses. We paid too much in rent and spent too much on gas. Not […]

[…] Your personal savings has likely taken a hit during this first month of grad school. Make refilling your savings a top priority in the months to come so you can easily weather emergencies and unexpected or irregular expenses. […]

[…] years ago, Kyle and I took a look at our budget and our newly formed targeted savings goals and realized that our cable package was holding us back. We had much more pressing applications […]

[…] the money to pay off my student loan debt (effectively completing baby step 2). At that point we implemented our targeted savings account system and neglected to think about beefing up our […]

[…] I’m comfortable with calculating a smaller EF is that we have a bunch of cash available in our targeted savings accounts and general savings that could be reassigned in the case of a big emergency. I don’t consider […]

[…] The system we have set up to help us decide whether or not we can afford a purchase is a combination of a monthly budget and our targeted savings accounts. […]

[…] every month for irregular expenses using our short-term targeted savings accounts and then pull from those accounts when those types of expenses […]

[…] Our Short-Term Savings Accounts […]