I Will Not Accept Your “Exciting” Rewards

When I started graduate school and was on my own for the first time I decided it would be useful to have a credit card. I searched around and chose the BP Chase Visa rewards card because 1) there are BP gas stations everywhere in Durham, 2) the card was very positively reviewed, and 3) the cash back rewards were the best I could find for my needs. The card offered 5% back on gas, 2% on dining and travel, and 1% on everything else. Emily and I currently have three rewards credit cards, but the BP card has remained our primary.

As this was my first credit card, I realize I have become weirdly attached to it. When I first got the card it had a very low credit limit – so low that when I bought my desktop computer I couldn’t fit the whole purchase on the card and had to put part on my debit card. Every six months or so I would get a notice that my credit limit had been bumped up slightly, which gave me a little sense of pride. I feel that my credit limit increases have marked my journey as a financially responsible person. Needless to say, I’ve been very happy with the card.

Unfortunately, we received a letter from Chase a little while ago that said there would soon be “Exciting new ways to earn and redeem” rewards for our card. The letter included phrases like “you’ll enjoy a new rewards program“, “earning is easy,” and “enjoy 2 ways to redeem.” Normally, the word “unfortunately” doesn’t belong alongside these positive phrases, but this letter was Chase’s way of telling us that they were drastically cutting our rewards program. In my opinion it’s bad enough that they were cutting our rewards, but to add insult to injury they seemed to want us to be happy about it. They also explained the new rewards in such a complicated manner so that it wasn’t obvious whether our rewards had changed or we were just getting a new way to redeem the rewards.

At first glance, the main difference between the new rewards program and the old one is a new way to redeem the rewards. In addition to applying the cash back rewards to your credit card statement you can redeem the rewards at the pump as you are buying gas. To accommodate this new redemption process, all of the rewards gained are in terms of “cents per gallon” (CPG) rebates instead of straight percentages. For example, if you accumulate 15¢ in CPG rebates and you fill up for 10 gallons of gas you get save 0.15 CPG * 10 gal = $1.50. Note that rebates are good for a one time fill up on up to 20 gallons of fuel.

Let’s take a look at the new rewards for purchases at BP. For every $100 I spend at BP I get 15¢ in CPG rewards. If I filled up for 20 gallons of gas every time I filled my tank (the max amount of gas rewards can be applied to) I would get 0.15 CPG * 20 gal = $3 or 3% cash rewards for gas purchases. Since our gas tank only holds about 13 gallons the rewards come down to about 2% for our car. Even worse, I would only accumulate rewards on the price of the gas after the rebate had been applied, not on the full price of the fill up as we currently do. If I’d rather apply my rewards to my statement credit instead of redeeming them at the pump I would get $15 cash for every $1 in CPG rebates I had accumulated. That means that for every $100 spent we get 0.15 CPG * ($15 / 1 CPG) = $2.25 or 2.25%. (Does anyone else think that I shouldn’t have to do unit conversions to figure out my rewards?) Therefore, you should redeem rewards at the pump if you buy at least 15 gallons, and if not apply them to your statement credit. In the same way the rewards for non-gas purchases go down to 0.75%.

Therefore, our rewards have now shrunk from 5% gas, 2% travel and dining, and 1% everything else to 2.25% gas and 0.75% everything else in exchange for being able to redeem rewards at the pump. In light of this, Emily and I have decided that we aren’t going to be using our BP card much any more, which means we won’t be buying BP gas preferentially. I can’t believe BP and Chase are really trying to get away with reducing our credit card’s rewards by announcing a new “feature.” Do they really think customers will not notice that they are losing rewards overall? This is made worse by the fact that many users’ rewards will be worse if they apply them at the pump (the new exciting method) instead of to their statement credit. I understand that BP/Chase probably needs to cut the rewards for financial reasons, and I would accept if they just told me the rewards were being lowered. But do they really need to insult their customers’ intelligence by acting like the change is a positive thing? I wish companies could just show their customers some respect.

Have your rewards ever been cut? How did the company handle it and how did you respond? Have you received any intentionally confusing material from your financial institutions?

photo from kbaird

Filed under: credit cards · Tags: BP, car, cashback, gas card, rewards

Current Credit Cards Rewards Strategy

Current Credit Cards Rewards Strategy Choosing an Amex Card

Choosing an Amex Card Why We’re Not Getting the Chase Sapphire Preferred Card Even Though It’s a Great Deal

Why We’re Not Getting the Chase Sapphire Preferred Card Even Though It’s a Great Deal Adding Credit Cards – How Many Is Too Many?

Adding Credit Cards – How Many Is Too Many?

bummer! we’ve had the same experience with our rewards cards… our chase freedom card (which is a cash back card) used to give us a “bonus” if we waited to redeem our rewards until we reached a certain dollar limit, but they did away with that years ago.

one recommendation: don’t close that credit card. your credit score takes into effect your length of credit history so if that’s your first card & you’ve established good credit, it’s worth keeping it open (crazy, right? myFICO has a good overview of some of the factors that affect your credit score).

just make sure to check your credit history at the 3 major bureaus at least annually (at annualcreditreport.com). I wrote a post awhile back on checking your credit report: http://suzmca.blogspot.com/2010/02/will-real-free-credit-report-please.html

Thanks Suz,

Yeah, Emily and I had discussed that we couldn’t actually get rid of the card for the reasons you state, although that seems like the rational thing for me to do. It makes me sad that I have to frame all my decisions in terms of how it will affect my credit score. Just like how “teaching to the test” severely alters teaching practices, but that’s a discussion for another day.

We have the Chase Freedom card too but I guess we signed up after that bonus ended! That would have been sweet!

here’s that myFICO link… http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx

That’s frustrating. My rewards have never been cut but I just get a flat rate of 1% on everything.

Sounds like you’ve had more luck with the rewards. Guess we’re bound to lose some rewards when we try to squeeze everything we can out of them.

That is certainly frustrating! I recently opened a PerkStreet checking account because of their rewards program (1% on all purchases, 2% on all purchases if your have an account balance over $5k, and 5% on specific monthly featured programs).

Well, 6 weeks after I opened the account they announced that they were offering everybody 2% rewards (regardless of acct balance). The caveat was you could only get the 2% rewards on $2500 on in-store purchases (each year) and $2500 in online purchases (each year). This PerkStreet acct is my business account and I planned on spending roughly $20-30k out of it (equals $400 rewards). Now, with their new system I will only get $225.

I realize it’s only $175 we’re talking about but that will add up over time. I hate when companies change things. It’s really annoys me.

I wish they would at least tell you that their terms will be good for a defined period of time! That way you can evaluate how often you want to be changing accounts.

I looked at PerkStreet because I’m interested in getting rewards at Costco and Aldi, but they only offer the 1% on non-PIN purchases, and both those retailers require PINs. :/

Banks do this stuff all the time, whether it is with interest rates on checking accounts, CD rates, or reward credit cards that you talked about. I’ve just learned over the years that when picking a financial product, pick it based on whether I need it and will use it and not based on the “Special” introductory offer. That’s because the rewards always go down, not up. I know that stinks, but that is the way banks get you hooked onto their product in the first place.

So true that rewards will only go down with a certain product! We also don’t open accounts for the introductory perks but try to evaluate long-term. The BP card was great for us for over four years so that’s a pretty good run!

Kyle’s main point here isn’t that it sucks that the rates change, but rather that Chase went about telling us about it in a really deceitful way. Our banks change our rates all the time and we get a simple email informing us and that’s fine. To dress up the downgrade like it’s an advantage is ridiculous.

Some people might not notice especially if they market it as a “new rewards program” and throw in “earning is easy.” You were smart by dissecting the “new” offers. It’s a great lesson on what to do – work it out for yourself to see who is really gaining.

I was impressed when Kyle whipped out a pencil and started doing the math on the letter we got from Chase! I probably wouldn’t have thought to do it right away.

[…] Personal Finance discussed about credit card reward programs. Do they work and are they worth it? Read and find […]

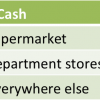

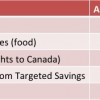

[…] Kyle wrote last week, we are losing most of the benefits of our current primary rewards card. We will still have our Chase Freedom card, which gives 1% on […]

[…] or statement credit” – Kyle has had one post on the blog so far, and he wrote it about BP/Chase downgrading our rewards while telling us it was an exciting opportunity. We were not […]

[…] explain $15 statement credit for every $1 in cents per gallon rebates with the bp card – I can understand your confusion. Luckily my husband did the math. […]

Agree with everyone here. We use to spend $2500 per month on this card and now down to $160.

I don’t like using rewards cards because with those cards, you are paying in some form or fashion. I stick to a Bank check card. If I don’t have the money, I can’t buy it!

Lance Mack recently posted..Anyone Can Now Accept Credit Cards, Anywhere – Quick Money

[…] at Small Budget Big Dreams listed I Will Not Accept Your “Exciting” Rewards in her […]

[…] such stations in Durham), and when we do we use our BP card. This used to be our base card, but they downgraded our rewards. Lately we have been buying gas more often at Costco and Kroger, though, so we may have to […]

[…] Perks: If you have a rewards card, you can earn cash, frequent flyer miles, or other types of sign up bonuses from your credit card just for your normal spending. There are other perks as well, like rental car insurance, extended warranties and zero foreign transaction fees – check the fine print on your card for the specifics! Be sure to choose rewards that best fit with your spending habits and lifestyle and watch out for downgrades in the rewards structure. […]

[…] after Kyle and I got married, because at the time he had a gas card that gave good rewards. After the rewards on our gas card were downgraded, we started playing the rewards game more, choosing cards for their long-term rewards potential and […]

[…] Even chasing rewards may turn into more hassle than it’s worth – it all depends on how organized you are, how predictable your spending is, and how many cards you can keep in rotation. Kyle and I generally prefer cash back rewards cards to travel rewards cards because of the ease of redemption, even if the travel cards could ultimately provide more rewards. If you are churning cards for sign-up bonuses, you have to be very careful to meet the minimum spend requirements and to cancel the card when it is no longer useful to you (if there is an annual fee). If you keep cards for long-term rewards or perk potential, you need to periodically re-evaluate if the offered rewards still match you spending habits (and that they haven’t changed). […]

[…] When the rewards on the gas card were downgraded, we started exploring which other cash back credit cards would fit our lifestyle long-term. We eventually added a few more cards to the mix, keeping one base card and signing up for some others for special kinds of spending and once for a free Kindle. We even asked ourselves how many cards would be too many because we loved further optimizing our rewards. […]

[…] Perks: If you have a rewards card, you can earn cash, frequent flyer miles, or other types of sign up bonuses from your credit card just for your normal spending. There are other perks as well, like rental car insurance, extended warranties and zero foreign transaction fees – check the fine print on your card for the specifics! Be sure to choose rewards that best fit with your spending habits and lifestyle and watch out for downgrades in the rewards structure. […]