Targeted Savings Account Calculation: Cars through Aug2013

This weekend I re-projected the amount of money we need to save monthly into our Cars targeted savings account. I’d like to share my method with you so that you can see as an example how we decide how much to save into each savings account. The Cars account is a good one for this exercise because the payments we make out of it are very well-defined (unlike Travel or Appearance) but they’re shifting a lot in the upcoming year because of our present one-car situation.

We are currently saving $320 per month into this account, which is a bit of a burden as we also need to repay ourselves for our recent dental work. So I wanted to see if we could get by with a lower savings rate now that our estimated repair date for my car has been pushed back to April 2013. (Kyle talked with his advisor this month and they expect that he will graduate in May 2013, a semester later than we had hoped. So that means we will be able to keep up the one-car lifestyle for at least an additional semester.)

The estimation starts with the current balance in our Cars Account, which is $990.78. I would like to keep a $500 buffer in that account in case Kyle’s car needs repairs (not accounted for in this calculation) or if something else comes up related to our cars. That leaves $490.78 available immediately for necessary payments.

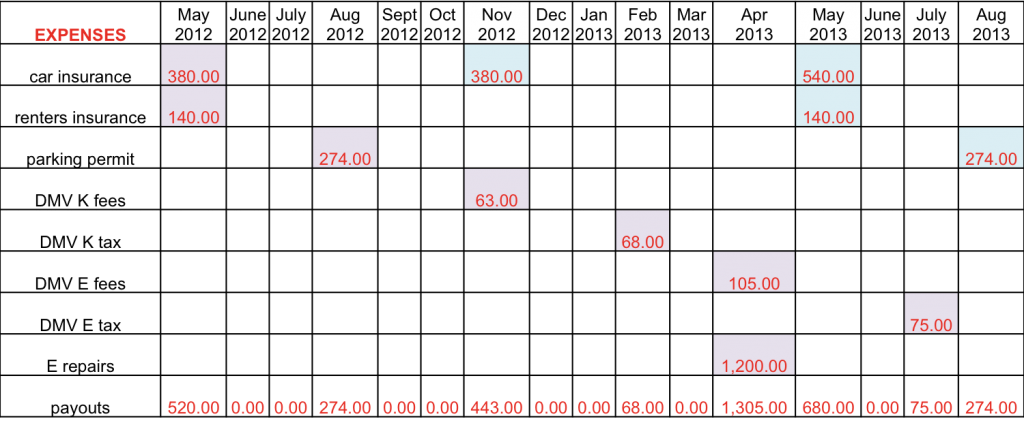

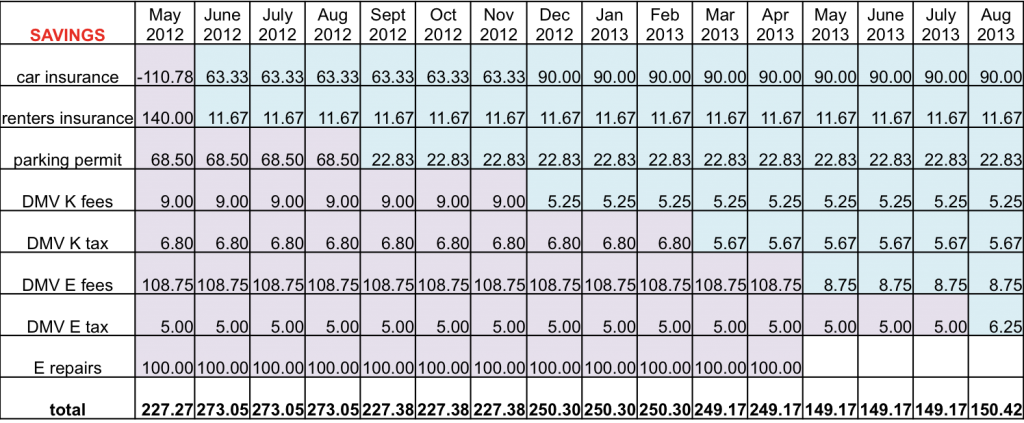

The next step was to map out all our projected expenses related to our cars (excluding gas). I went out 16 months (May 2012 to August 2013) to capture all the expenses that will pop up again once we put my car back in commission. There are eight expenses we needed to account for in that time – car insurance (we pay for 6 months in advance), renters insurance (this isn’t a car-related expense but because we have it bundled with our auto policy we keep it in Cars), work parking permit, DMV expenses (registration fees and taxes), and the repairs we need on my car.

The first time the expense in each category comes up it is labeled with a purple background, and subsequent times are labeled with a blue background. I draw the distinction because the blue-labeled payments have a regular pay-in period (6 months for car insurance, 12 months for everything else) whereas the pay period for the purple expenses has been cut off at May 2012 as I am re-calculating how to save to get to those expenses.

You can see that in many months we won’t have to pay any expenses, but the peak month will be April 2013 when we repair and re-register my car.

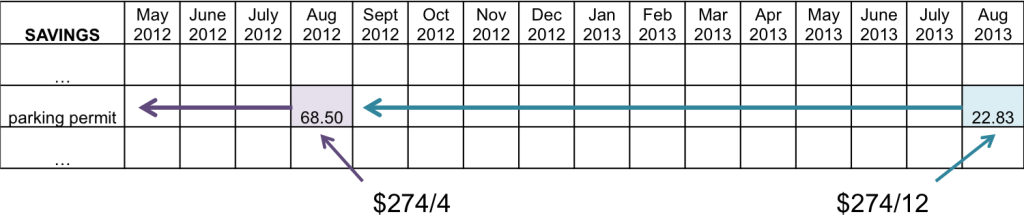

The next part is a little trickier to understand so bear with me. I want to populate a table like the one above with the savings needed in each category. Let’s take the parking permit category as an example.

Our parking permit is $274 per year and we pay in August. So to save for the payment in August 2012 we divide the full amount by the four months we have between now and then. For the payment in August 2013 we divide the full amount by twelve months.

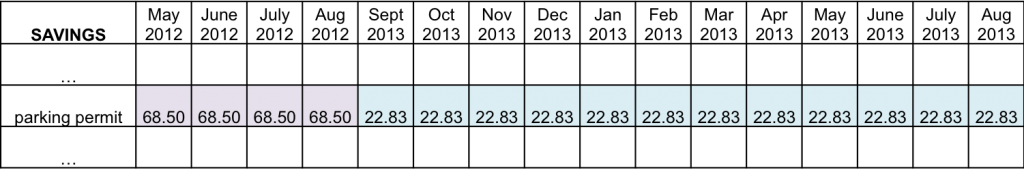

Then I fill the table filled in with the proper values for all the intervening months.

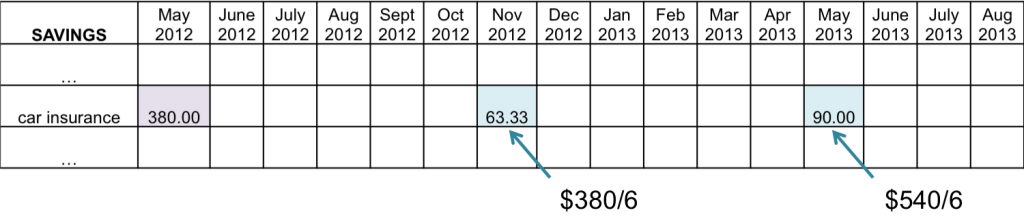

Here is another example for the car insurance category. We are going to make a $380 (our one car rate) payment in May 2012 and another in November 2012. In preparation for our two-car insurance rate resuming for our May 2013 payment, I’m estimating that our rate will go back up to $540. I’ll keep the same savings rate for this category for post-May 2013 as we will continue to be insured.

OK so you get the idea. Here is the full savings rate table filled out.

You can see that the amount it says I need to save in May 2012 is over $700, but that isn’t taking into account the amount available in the account, which is $490.78. Subtracting the available balance from the car insurance entry in May 2012 will give us the proper savings rate for that month.

It looks like the highest necessary savings rate over this 15-month period is about $275, or $45 less than our current savings rate! I don’t like changing our savings rates every month, so we’re just going to call this $275/month at least through when we pay for our 2012-2013 parking permit in August, and then we might drop the rate to about $250/month. Once we repair my car next April we very likely won’t drop the rate to $150/month but rather re-evaluate again. Ideally, Kyle would be starting a postdoc (or a real job!) somewhere in the Triangle so we would hugely beef up our savings rate for repairs and so we can pay cash for our next car.

Whew! So that is how we figure out how much to save in certain targeted savings accounts. This is the most precise one because I know all these values pretty exactly (excluding inflation/depreciation). For our other accounts I have to make educated guesses in at least a couple of the covered line items and in some cases (Electronics, Appearance) we’re pretty much guessing based on past spending trends.

Do you project categories of expenses like this to make sure you save enough, or is your monthly buffer large enough to absorb most costs?

Filed under: budgeting, cars, targeted savings · Tags: car insurance, car repairs, fees, savings, taxes

The Benefits of Targeted Savings Accounts – and Their Uncertain Future

The Benefits of Targeted Savings Accounts – and Their Uncertain Future Hard and Soft Earmarks in Targeted Savings

Hard and Soft Earmarks in Targeted Savings Targeted Savings Accounts and Funemployment for the One-Car Win!

Targeted Savings Accounts and Funemployment for the One-Car Win! Hobbies vs. Values in Targeted Savings

Hobbies vs. Values in Targeted Savings

I love this! You explained this so much better than I possibly could. I do something similar, but I keep a spreadsheet and everything in my checking account instead of using targeted savings. Usually some other category is floating high enough to cover deficits.

If I had a buffer for everything, I just wouldn’t spend any money. So I like this way better.

Leigh recently posted..Direct Deposit Experiment

I thought you would enjoy this after you explained your complex way of budgeting! I wouldn’t want to do this for our whole budget as there are so many unknowns but this is a high-stakes savings account so it’s worth the effort. I figured the images of various stages would help – when I saw the final product I was thinking no one would be able to even look at it let alone understand it.

Great detail!!! I use a combination of both–projections for big-ticket budget items and a buffer for miscellaneous expenses. I do track every single penny in an extensive Excel sheet though and that certainly keeps me on track!

The Happy Homeowner recently posted..Minimize the Pain at the Pump: 27 Ways to Save on Gas

Sometimes I wish I could still track everything using Excel. Mint is great and makes everything easy, but I would rather be able to play with the details more. Unfortunately my husband doesn’t want to put in all the work to track manually. I’m pretty happy just playing with our targeted savings account though.

This is very similar to what I do to target Roth IRA contributions and student loan payments (N graduates this summer, and me in a few years). Since currently I get paid six times a year, we make these contributions a few times a year rather than monthly. Although, it turns out our monthly buffer has almost always been just right for us to meet these targets.

We made it month-to-month before we started doing all the targeted savings stuff but it really eases my mind to see the money already labeled for its purpose.

I think it’s great to keep a buffer in expenses like “cars” and “health” just because there are so many unknown variables. I would just worry that by cutting your savings rate down, you’re reducing your buffer a bit. Have you thought at all about the repairs costing more than your current estimate? (The repair shop could start charging more for labor etc.) Just some food for thought! I love that you budget so far into the future with your targeted savings! I do the same thing in my budget but sometimes I feel like it’s a bit overkill! Or maybe it’s just the scientist way of doing things… 🙂

Julia recently posted..I wish I was a minimalist…

Actually, delineating that we want to keep $500 in our Cars account as a buffer is the first time we’ve ever had an official buffer! Before my car died, we tried to nonspecifically oversave in case of repairs. So I’m actually happy that we listed that amount. The $320/mo savings rate was based on an estimate of repairing my car in January 2013. The repairs being more than my our current estimate had not occurred to me so thanks for that pointer. I think we’ll just try to keep the savings at the $275/mo level to prepare for that possibility. I’d also feel more comfortable if our buffer in that account was $700 or 800 but that isn’t feasible in the short-term.

This is the furthest out I’ve ever projected for one of our targeted savings accounts – usually I don’t go beyond a year because things repeat, but since we are adding the second car back there were a few more wrinkles. And like I said in the post, this one is the easiest!

I used to do this with everything down to the penny. Not so much anymore, but I’ll get back on board. It’s not that our buffer is too big, it’s just that we don’t have a ton to throw into savings.

femmefrugality recently posted..Guest Post on More Than Mommies

We struggle with wanting to save more than we feasibly can as well. We don’t really keep any buffer in our checking account so we pull from nonspecific savings if we have a really off month.

Dang! I bet you NEVER get surprised by anything ever!

Frugal Portland recently posted..Fantastic Ideas for Businesses

Haha, my car breaking down and causing us to adopt a one-car lifestyle was surprising! When I first started living independent from my parents lots of things surprised me – like property taxes for my car. I had no idea. But that’s what I love about tracking expenses – the longer you do it, the more you can anticipate.

Holy cow this is analytical! I LOVE it! If you’re doing this now with something small like your car expenses, I can’t wait to see how you organize your future retirement plans. You’re going to put my spreadsheets to shame! 🙂

MyMoneyDesign recently posted..How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Thanks! I’d love to be able to do some more math on retirement stuff, or in general to have a more complicated financial picture to play with. Of course when we do have more complexity (house, kids, jobs) I’ll probably have less time/energy to do this kind of thing.

[…] @ Evolving Personal Finance writes Targeted Savings Account Calculation: Cars through Aug2013 – I detail a methodology for projecting how much we expect to spend out of a certain targeted […]

[…] at Evolving PF explained how their car targeted savings account works. This sounds so similar to my spending plan system, but she explained it far better than I ever […]

[…] budget categories this month. Starting next month we are shifting $45 from our going into our Cars savings account to adding to our Medical account savings […]

[…] was our first month with our new lower Cars savings rate and increased Medical savings rate ($45 shift). Other than that, we didn’t make any […]

[…] example of a hard earmark in our money management is our Cars account. We have a regular schedule of insurance, registration, and fee payments that come up one to two times per ye…, plus we have a good idea of the amount we need on hand for future repairs. The only way we would […]

[…] a 6-month leave of absence. So that’s $3,600. We have our car insurance deductible covered by our Cars targeted savings account, but let’s say there was some accident at the house and we needed our renter’s deductible as […]

[…] the past few months that we have really left our money management on autopilot. I haven’t even played with spending scenarios recently, as I love to do! But even without me looking for issues to tweak, three areas of our […]

[…] To get my car back into driving condition this spring, we had to buy new tires (one of the recommendations from three years ago) and do some other repairs. Before we benched the car we had done $400 of the recommended $1600 of work and over the three years we also bought a new battery. So I was thinking that $1200 of work would be the minimum we would have to spend, and we prepared by saving a ton of money into our Cars targeted savings account. […]

[…] at Evolving PF explained how their car targeted savings account works. This sounds so similar to my spending plan system, but she explained it far better than I ever […]