Joint and Separate Money Series: Odds and Ends

This is the third installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In each post in this series, I review the methodology and major findings of a paper in the field and then discuss how my husband and I fit into the results. I encourage you to share your reactions to the paper in the comments!

As I’ve been searching for papers to review in depth for this series on joint and separate money in marriage, I’ve run across a few papers that haven’t been totally on point but do contribute something toward the discussion. So I decide to share a segment of the findings of several papers.

Skogrand L, Johnson AC, Horrocks AM, DeFrain J. 2011. “Financial Management Practices in Couples with Great Marriages.” Journal of Family and Economic Issues 32:27-35.

The authors advertised in newspapers for couples with great marriages to volunteer for their study. Ultimately 57 couples returned the 31-page survey, which consisted of demographic data, open-ended questions, and a quantitative assessment of marital strength. This paper shares some of the results from the financial questions.

Regarding joint and separate accounts: “There was not a trend toward either joint or separate accounts. However, a few couples seemed to feel strongly about one method or the other” (p. 32). Except for some quotes, that was all they said on the matter! Considering that we learned from the individualized marriage study that 83% of couples practice pooling, does that mean that couples with great marriages pool at the same rate as the general population? Or that it was 50/50 pooling/independent, which would mean a much greater trend toward independent management? Against what did they control their finding? So many questions!

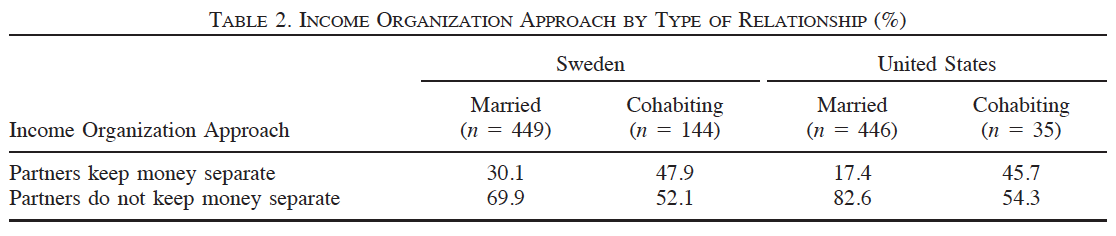

Heimdal KR, Houseknecht SK. 2003. “Cohabiting and Married Couples’ Income Organization: Approaches in Sweden and the United States.” Journal of Marriage and Family 65:525-538.

This paper compares the money management systems of married and cohabiting couples in the US and Sweden. The authors thought it would be interesting to look at Sweden because cohabiting relationships are more similar to marriage in Sweden than they are in the US as they are more stable long-term. They used surveys conducted in 1994 in both countries.

The only two factors studied that made couples more likely to keep money separate in both the United States and Sweden were type of relationship (cohabitors were more likely to separate) and ever having been divorced (people who had been divorced were more likely to separate). However, their hypothesis regarding the differences between the US and Sweden were not supported. “It was also expected that, because of the lesser institutionalization of cohabitation in the United States relative to Sweden, cohabitation would increase the likelihood of keeping money separate even more in the United States than in Sweden. Our results do not support this notion.”

The additional factors they studied that were significantly associated with keeping money separate in the US were age (older people more likely to separate) and couples wherein only the man was employed (couples with only women-only employed tended to have retired men, not stay-at-home-parent-men).

Yodanis C, Lauer S. 2007. “Managing Money in Marriage: Multilevel and Cross-National Effects of the Breadwinner Role.” Journal of Marriage and Family 69:1307-1325.

The authors conducted this study with 3 hypotheses in mind: 1) “as relative resource contributions approach equality, couples will be more likely to use joint management strategies,” 2) “as institutionalized ideologies and practices in a nation approach shared breadwinner roles, couples within that context will be more likely to use joint management strategies,” and 3) “as dominant ideologies and practices in a nation approach shared breadwinner roles, the importance of relative resource contribution for choice of management strategy will decrease.” They used data from 21 countries, examining both institutional-level and individual-level variables.

Overall (and in the US) about 75% of household practice joint financial management. There are some individual-level variables that make joint management more likely:

- income homogamy (hypothesis 1)

- beliefs about shared breadwinning roles

- having a college degree

- being younger

- having a higher income

Regarding the country-level variables (hypothesis 2), “both shared breadwinning practices and beliefs about shared breadwinning roles for women and men are associated with a decreased likelihood of one spouse managing.” Regarding the husband individually managing the couple’s money (hypothesis 3), “as women’s individual resource contribution increases relative to men’s, men are less likely to manage pooled assets.” Regarding the wife individually managing the couple’s money (hypothesis 3), “as women make more relative to men, they are neither more nor less likely to manage pooled assets.”

I’ve really enjoyed reading for and writing this series! This will be the last post on this topic from the literature, at least for some time. I found another paper as I was searching for this series that I might write about in a little while, but it’s on a different angle of money in marriage. One thing that I’ve realized is that how Kyle and I manage our money is very typical! We pool everything, which is the most common choice, and many of the individual-level variables that make pooling more likely that I’ve read across many papers applies to us. I wouldn’t change our practices even if I found out we were in the minority because our decisions about money management are influenced most by our mindset regarding unity in marriage, but I guess it’s nice to know so many other people think and practice the same way we do.

Did anything in the results presented in this post strike you? What do you think of the result from the great marriages paper? Are you managing your money with your spouse typically or atypically?

Filed under: marriage, the literature · Tags: cohabitation, great marriages, joint accounts, marriage, separate accounts, Sweden

Joint and Separate Money Series: Changes During the First Year of Marriage

Joint and Separate Money Series: Changes During the First Year of Marriage Joint and Separate Money Series: Individualized Marriage and Money Management

Joint and Separate Money Series: Individualized Marriage and Money Management Proposed Series: Literature Review of Joint and Separate Accounts

Proposed Series: Literature Review of Joint and Separate Accounts The Slippery Slope of Separate Money

The Slippery Slope of Separate Money

I’ve really enjoyed this series!

I find it interesting because both myself and my partner are very set on marriage lasting a lifetime (for us, that is – I’m not claiming to be in the position of being able to make that judgement for anyone else) but we’re also set on separate finances with a side serve of joint financial management. Maybe this is because we were both already earning a full time income and living alone when we met?

I’d be interested to see a study of money management in couples who have divorced parents / role models, because for me personally seeing what a lot of women go through after a divorce has made me very keen to be self-sufficient no matter how lovely and permanent my partner is.

Sophie recently posted..Saving Money On Home Decorating

Thanks!

While I didn’t run across it in anything I read, I would imagine that for some people seeing parents or other people close to them divorce would have a similar effect as going through a divorce themselves and make them more likely to keep separate finances.

Wait! What about the first paper? What were some of the results of the financial questions? Maybe they’re defining “joint” and “separate” differently as well- the difference may seem obvious but it really appears to be much more of a spectrum – but I’m much more curious how people with great marriages manage their finances!

The middle section of the paper was qualitative. This was the one question related to finances:

“Talk about money. Disagreements over money are perhaps the most common type of disagreements couples have. How do you manage money? How do you deal with debt? Who is in charge? What conflicts do you have over money, if any, and how do you resolve them?”

The results were reported in the pattern of “X of the 64 couples practiced Y and here are several quotes supporting the various positions.” For example, one result I didn’t mention was that in 41 couples one spouse was the primary money manager. Other results the paper explained were in the areas of trust, communication, debt, living within means, financial challenges, and views of other couples.

The two quotes they included regarding joint and separate accounts were:

“No separate accounts. We don’t have ‘my money’ and ‘your money.'”

“We have had separate checking accounts and have had them since realizing two people writing checks from one account doesn’t work. She pays the household bills from her account and I pay all the farm expenses from mine.”

I really wish the authors had explained their coding and results more thoroughly for the joint and separate account question!

“However, a few couples seemed to feel strongly about one method or the other…” Agreed. Some people are pretty adamant.

I never thought a study author would survey US and Sweden, of all places….

AverageJoe recently posted..Worst of the Free Financial Advisor, Episode #9: Top 5 Ways to Save Money at the Grocery Store

I ran across several studies involving Scandinavian countries, actually. Maybe funding is easy to get there, in addition to the stated differences in cohabitation rates and institutional attitudes toward women working and such.

I’m surprised so many cohabiting couples in the US keep their money “joint!”

femmefrugality recently posted..All the Money in the World

That surprised me, too. It seems imprudent. However, I realize I am quite conservative in comparison with US averages with regard to what is advisable before marriage.

I moved in with my wife two weeks before the wedding, but I wouldn’t really consider that cohabitating. While I understand why people would have separate accounts while living together, it makes things awkward I would think. Who’s turn is it to pay for dinner? Or do they split the check every time?

Edward Antrobus recently posted..If You Can Read, You Can Cook taco seasonings have launched! Win a free jar!

It’s become apparent in this series that people come to many different arrangements. Married couples keep separate finances, so a cohabiting couple definitely could if they wanted to. I don’t really see how it’s much different from dating someone or living with a roommate, though, if you don’t want it to be.

[…] presents Joint and Separate Money Series: Odds and Ends posted at Evolving Personal Finance, saying, I provide short summaries of three papers concerning […]