Obligations on Your Side Hustle Money

Kyle has been volunteering with the production team at our church for about a year, mostly running the slides and handling the video-playing. One of the men who runs the sound board is taking a sabbatical and they are looking for someone to fill his weekends. Kyle has wanted to learn how to run a sound board for a while so this is a perfect opportunity. Plus, we found out that it is a paid position, not volunteer as we had thought!

Kyle has been volunteering with the production team at our church for about a year, mostly running the slides and handling the video-playing. One of the men who runs the sound board is taking a sabbatical and they are looking for someone to fill his weekends. Kyle has wanted to learn how to run a sound board for a while so this is a perfect opportunity. Plus, we found out that it is a paid position, not volunteer as we had thought!

When Kyle tallied up how much this side hustle might earn him ($70-80 every three weeks) he blurted out “I’ll be able to buy a Kindle!” But what was running through my head was “Actually, you’ll have to save up twice as long because of taxes, tithe, and retirement!”

The reason I thought this is because of the rules we and the government have concerning our income. When we have an extra $10 here or there in income I don’t worry about changing our contribution levels, but I don’t consider a regular paycheck, however minor in comparison with the bulk of our income, to be negligible.

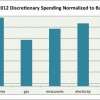

Taxes: This additional income will of course be taxed at our marginal tax rate, 15% federal + 7% state, instead of our overall tax rate (8% federal and 4.5% state), so that’s a 22% bite right there.

Tithe: We would give 10% of this income away, either to our church or other charitable organizations.

Retirement: I think that 15% toward retirement is a good baseline, and since we are not yet maxing out our Roth IRAs I would want to take a portion of this hustle to bump up our contribution.

All together, those obligation sum to 47% of the income. It’s quite demotivating to realize that we’ll only get to pocket half of what Kyle makes from this hustle!

Do you consider your various obligations when you receive a paycheck from your side hustle, or do you ignore them until you square everything up at year-end? What percentage of your extra income is spoken for?

photo from ceasedesist

Filed under: giving, retirement, side income, taxes, values · Tags: part-time job, retirement, second job, side hustle, taxes, tithe

Tax Time! What Are Your Rates?

Tax Time! What Are Your Rates? Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income? Side Income

Side Income October 2012 Month in Review: Money

October 2012 Month in Review: Money

Since you don’t have to report self-employment income below $4000 and I’ve never made that much on the side, I’ve never really worried about it. For now, it just all goes towards paying debt.

Edward Antrobus recently posted..My Personal No-Spend Challenge

I think you have to report ALL income, even if you don’t get forms for it… (http://www.irs.gov/newsroom/article/0,,id=175963,00.html) What’s your source for a $4,000 exemption?

I’m also seeing some sources saying that you don’t have to file at all if your income is less than about $10k per person, but nothing about the difference between self-employment and other types of income. Is that what you were thinking of?

Actually, I’ve been going off the advice of the janitor of the church I attended as a kid. She was an independent contractor and was paid $3999/year because “income under $4000 didn’t have to be reported.” She’s been doing the cleaning for more than 20 years… that’s a lot of back taxes!

I did see in that IRS article that self-income under four hundred (not thousand) dollars doesn’t get self-employment taxed. But still counts towards general income tax.

Edward Antrobus recently posted..My Personal No-Spend Challenge

This is not accurate. Even if you make $20, technically by IRS standards you are to report it. I am not aware of IRS rules 20 years ago and perhaps it has changed but I have been freelancing for 4+ years and its been this way the whole time.

Holly recently posted..A September Update on My Garden

Well, right now I am a student so my taxes are a lot less than what they might be if I weren’t. But next year, when I’m graduated (woohoo!) I’ll have to pay a lot more taxes. I wouldn’t find the retirement contribution demotivating at all! That’s savings for future you!

Daisy recently posted..How to Step Up to Change – Coping Mechanisms For Those Who Are Resistant

Kyle made this point to me just yesterday! “You act like the money we contribute goes away. It doesn’t go away! It’s part of our net worth!” But I’m thinking in a cash flow mindset, not a net worth mindset.

I have more income taxes deducted from my bonuses than my marginal income tax rate since that isn’t quite enough (I’m not really sure why exactly), so between that and my 20% retirement contributions (well, taxable investments that I count as for retirement), I only see 40% of my bonuses. But that 40% ends up going to cash savings anyways – I don’t let myself spend any money from my bonuses, that all has to come from my normal paycheck.

If I were you, I would be excited to have some more money going to retirement contributions since you were thinking of cutting down on that!

Leigh recently posted..Clothes I Bought: June 2012

I’d be more excited to put the extra money into our short-term savings since we need to replenish them after some medical and auto work. :/ I don’t quite understand how deductions are calculated, either… I swear I checked the right boxes or whatever on the W-4 but it seems that not quite enough is taken out each month. I guess since you are a person excited by savings it works to put your bonuses entirely there – I think I would want to spend some of it, thinking that I had enough savings from my normal paycheck!

Well, sometimes I do things like that too. When I borrowed money from various savings buckets back in December/January, I put that money back with my January bonus before putting anything into savings buckets like I normally do. Savings is super exciting! Haha. I love my savings spreadsheets. So much more fun than spending money.

Try the IRS Withholding Calculator: http://www.irs.gov/individuals/article/0,,id=96196,00.html

That’s helped me make my paychecks have a more correct amount taken off each month.

Leigh recently posted..Clothes I Bought: June 2012

Right now, I don’t include my side hustles (mostly babysitting) with my income. I put that money towards a particular goal. I have a friend who is an accountant and she told me that if you are self-employed and make less than $600 then you don’t have to report it. I’m not really sure where her source is from nor have I really looked into it. Did your church have Kyle fill out a w-4?

Jessica recently posted..Spending Update: May-June 2012

I think your accountant friend is mistaken. It’s true that you won’t get a 1099 if you make less than $600 from a single source so it won’t be reported on your behalf, but you are still supposed to report it with your income. I mean, I’m sure a lot of people don’t if it’s under the table, but that’s the law as far as I can tell (see my response to Edward). Personally I wouldn’t report babysitting income if it was like $10 a couple times a year, but if I had a regular gig I would start adding it up and treat it as proper income.

Kyle is just getting trained right now so he hasn’t started filling out any paperwork for the position. I’m not sure at what point that will happen. I think he also has to officially become a church member, which he has resolutely refused to do up to this point. 🙂

Darn, I was so happy about my blog income until you reminded me that it will disappear into taxes! 🙂 I guess my answer is “no”, I often forget about the tax and other implications to income. I’m not sure why we’re programmed to only think in gross rather than net income.

MyMoneyDesign recently posted..Life Lessons I Learned from Super Mario

I think if we had major side income I would either increase our withholdings at our primary jobs so we’re still close to 0 or overpaying slightly at tax-time or start another savings account and put a bit of each side paycheck in it. Are you the type to set up a separate savings account?

[…] from Evolving PF talks about obligations on her husband’s side hustle – taxes, etc – that make it a little less […]

I gave up side hustling about a year ago, but am now getting slammed with the extra taxes. Gah.

eemusings recently posted..Link love (Powered by cold feet and Bones)

[…] from When Life Gives You Lemons featured Obligations on Your Side Hustle Income in her Saturday […]

[…] presents Obligations on Your Side Hustle Money posted at Evolving Personal Finance, saying, “When you make income on the side, do you […]

[…] Obligations on Your Side Hustle Money was featured in the Carnival of Money Pros and the Carnival of Financial Planning #243. […]

[…] 4) Obligations on Your Side Hustle Money […]

I just submitted a W-4 for a side job I am doing. Basically, a third of what I am earning will go to taxes. Bummer.

SavvyFinancialLatina recently posted..Aiming High, Hopefully We Land Somewhere Close

A third?! That’s demoralizing, but what can you do?

[…] I put together a proposal for what I would like to do with the money: after meeting all of our percentage obligations, we can open up a new savings account just for Kyle and put the remainder of the money there and […]

[…] added the non-obligated portion of Kyle’s sidle hustle paycheck to this account, $43.41. […]

[…] to go. Starting in January, our budget leftovers will all go into our Cars savings account and the discretionary part of Kyle’s side hustle paycheck will go to Travel and Personal […]

[…] budget operate off percentages of our total income (taxes, retirement savings, giving), we decided to take into account those priorities with each extra check we […]

[…] Our non-discretionary categories aren’t changing at all now – INCOME, SAVINGS, GIVING, rent, and internet – which you can find in our last budget iteration. Kyle also got an additional paycheck, which we broke up according to our usual percentages/destinations. […]

[…] the IRS meaning). $38 from Kyle’s side hustle, for instance, would be split up according to our percentage-based budgeting principles so that only about half of it would go to something of our discretion (our Travel account). But […]

[…] Our INCOME, SAVINGS, GIVING, rent, internet, and cell phone transactions are not changing at all now. Kyle had a bit of side hustle income as well, which we split up as usual. […]

[…] but not if you could Kyle’s small job at church! Darn side hustle increasing our income! We do contribute 15% of all extra income we earn toward our Roths so I think it’s fair to count that income “against” the […]

[…] $172.40 from Kyle’s side hustle, divided as usual […]

[…] $83.33 from Kyle’s side hustle, divided as usual […]

[…] $86.67 from Kyle’s side hustle, divided as usual […]

[…] accounts system. We’re regimented in the way we use money from our targeted savings accounts, treat extra income, and zero out every month. But this isn’t a deprivation issue or anything like that, just a […]

[…] $193.33 from Kyle’s side hustle, divided as usual […]

[…] Kyle’s been running the sound board at church approximately every third weekend this year, which brings in around a hundred dollars per month. This is the first full year he’s had this little job. He isn’t having any income tax withheld, so with every paycheck he receives we transfer 23% to our taxes savings account. […]

[…] expenses, not tuition, fees, or health insurance.) Our total income is slightly higher from Kyle’s tiny weekend almost-volunteer job, blog income, the occasional clinical study, and interest/dividend income – but not much. So […]

[…] allowed outside jobs, have found ourselves swept into this mania. I now refer to Kyle’s almost-volunteer super-part-time weekend job running the sound board during some services at our chu… as a side hustle. Certainly the bit of money we bring in through this blog can be called a side […]

[…] (my last day of work at my university is August 31). As with all of our extra income, I want to save 15% of it toward retirement. To use up all of the contribution room calculated above, I would have to earn $14,972.87 in the […]

[…] paycheck and Kyle’s first paycheck as a postdoc, plus $187 from Kyle’s church income (divided as usual with the discretionary portion going toward our DSLR savings account). Since we use the previous […]

[…] It’s not as simple as saying “I earned $80 this month, that means we can spend $80 on eating out!” I have to account for taxes and our percentage-based budget. […]

[…] drafted the numbers on whether we would be able to just bank the discretionary portion of my stipend and live on our ongoing monthly income. Even with Kyle taking on a roommate, it would […]