Evolving Personal Finance » Archive

How Can We Plan Our Retirement in Our Twenties?

Basically any reading on the topic of retirement emphasizes the necessity of visualizing what we want retirement to be so that you can set a goal for a certain amount of savings/passive income to achieve by retirement age. I totally understand the utility of this exercise for 1) actual planning for people approaching retirement (in their 40s or 50s, say) and 2) motivation for young people to start saving (aggressively). But, really? I don’t know about … Read entire article »

Filed under: retirement

Are You a Tightwad, a Spendthrift, or Unconflicted?

Yes, there is an academic definition! Rick, Cryder, and Loewenstein developed the Tightwad-Spendthrift scale, published in 2008 in the Journal of Consumer Research. I came across it when reading a paper investigating the connection between spendthrift/tightwad disparities in spouses and marital satisfaction (more on that later). I gave myself the test and I want you to take it, too! From the appendix of “Tightwads and Spendthrifts”, here is the (adapted) Spendthrift-Tightwad Scale: 1. Which of the following … Read entire article »

Filed under: the literature

We’re So Not Entrepreneurial, But Maybe We Can Change

I took a career/personality assessment test a couple years ago through my university’s career center called the Strong Interest Inventory, and it told me that I don’t have the aptitude to work for myself. I really didn’t need a test to tell me that – I could just look at the evidence of my life, and Kyle’s too. Not only have I never run a business, I’ve never wanted to. I haven’t even pursued side … Read entire article »

Filed under: income

Weekly Update 30

We’re moving this weekend. And I have lab meeting on Monday. What else can I say? Posts I Liked Average Joe from The Free Financial Advisor explains that getting out of debt (alone) isn’t a goal. Michelle from See Debt Run recalls a professor who claimed that her homemade, organic spaghetti sauce was cheaper than Spaghetti-Os, so Michelle runs the numbers on one of her own crock-pot beef stews and finds that it was only $0.60/serving. Money Life and … Read entire article »

Filed under: weekly update

Toeing into the E in EPF

I thought I’d take this Friday post to update you all on the random money goings-on around the EPF household. We are gearing up for our first financial transition, moving from the apartment Kyle’s lived in for 5 years (and I for 2 years) to a townhouse that’s both cheaper and closer to school and church. In addition we’ve had some other small bumps in the road and changes and are looking forward to some … Read entire article »

Filed under: budgeting, credit cards, targeted savings, transitions, travel

How to Make an Irregular Income as Regular as Possible

One of the clients I coached recently wanted to talk over how to handle his irregular income. He was having trouble sticking to his budget because he ran his own business and his income fluctuated month-to-month. I read a bunch of blog posts on the subject and my client found the strategies I suggested helpful, so I thought I would put all of it together in a blog post – with whiteboard drawings! Here’s what it … Read entire article »

Filed under: income

Family Beach Vacation

Kyle and I spent last week vacationing in the Outer Banks with my parents and siblings. My family used to rent a beach house for a week every summer, many times in the Outer Banks, but we haven’t been on this type of vacation together in over 10 years, so it was rather a blast from the past. My parents had no expectations of financial contributions from us for this vacation, which was wonderful – this … Read entire article »

Filed under: travel

Weekly Update 29

Spent the week relaxing in the Outer Banks with Kyle, my parents, and my siblings! Nice vacation in advance of this craziness over the next two weeks: moving, preparing for and giving lab meeting, and starting classes! Posts I Liked Kraig from Young, Cheap Living explained very well all the reasons that he tracks his (and you should track your) spending. Jason from Work Save Live explains how to set up a functional budget with a highly irregular income … Read entire article »

Filed under: weekly update

Blog Statistics Update July – August 2012

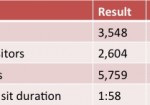

This is my one-month update on how EPF is doing based on our July 16 – August 15 data. People who listen to us, as of August 15, 2012 RSS subscribers: 91 (+22) Twitter followers: 75 (+16) Facebook fans: 18 (+2) Still looking for more FB fans! I really want to get to the 30 mark so that I can see some analysis. J Rankings Alexa: 156,559 (+22,048) Google PR: 2 (no change) MozRank: 4.82 (+0.97) Again my Alexa ranking increased, but I don’t care as … Read entire article »

Filed under: blogging, month in review

How to Cut Your Food Spending – Scaling Back on Eating Out

For those looking to cut back on their spending, eating out is a prime target. While there are some people for whom eating out has become a lifestyle, we all know that it is totally optional! This post will help you find ways to cut back on how much money you spend on eating out as well as get more for the money you do spend. Planning in this area will pay off big time … Read entire article »