Evolving Personal Finance » Entries tagged with "taxes"

February 2016 Budget Report

This was a humdrum month for us financially, except for overspending in some of our variable budget categories. We have basically just been working our new Seattle routine. The weather is definitely changing for the better; February was much warmer than January, and there are sunny and non-rainy days from time to time. We finished filling up our 2015 Roth IRAs this month – earliest ever! From now until April 15-ish we’re putting our retirement money in my … Read entire article »

Filed under: month in review

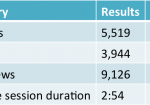

Blog Statistics Update March – April 2014

I actually stuck to my decision from last month to reduce my posting schedule even though it’s been really hard. In the last four weeks I’ve written six articles and done one roundup, when it used to be twelve and four. I miss writing as much as I used to and I definitely miss the greater volume of interactions with my commenters. But it’s actually really good that I made the decision to post less … Read entire article »

Filed under: blogging, month in review

Virginia Sent Me to Collections for Dodging Taxes

That sounds like an exaggerated, sensationalist headline, but it isn’t! The commonwealth of Virginia thinks that I failed to pay the income tax I owed in 2009, and last month they sent my information over to a debt collector, who renewed the efforts to track me down. Me – the personal finance blogger and tax reporting enthusiast – accused of not paying my taxes! In this post I will detail this experience, which from my perspective … Read entire article »

Would Someone Date You After Seeing Your Taxes?

The inspiration for today’s post came from a very random place. I recently added a new podcast that answers listener questions, usually about relationships. One question was whether it is appropriate to ask someone out on a date in her place of work (like your waitress at a restaurant, for example). The hosts tried to think of various service relationships that come up in everyday life and how the customer might go about asking out … Read entire article »

Tax Lies Told to Graduate Students

Update February 2016: This short post has been expanded to a 10-part series of common grad student tax lies on Grad Student Finances. Check it out for more detail, explanation, applicability, references, etc.! My little university community service project for this fall is working with a staff member to compile a comprehensive reference document for graduate students preparing to file their taxes. The purpose is to help graduate students make sense of the tax-related forms they … Read entire article »

Filed under: grad school, taxes

Obligations on Your Side Hustle Money

Kyle has been volunteering with the production team at our church for about a year, mostly running the slides and handling the video-playing. One of the men who runs the sound board is taking a sabbatical and they are looking for someone to fill his weekends. Kyle has wanted to learn how to run a sound board for a while so this is a perfect opportunity. Plus, we found out that it is a paid … Read entire article »

Filed under: giving, retirement, side income, taxes, values

Taxes You Should Be Paying

I had a really strange thought a couple weeks ago – hear me out and tell me what you think! Have you ever considered paying yourself what you think you should be paying in taxes? Do You Think Taxes Will Increase in the Future? I’m not sure if there is much debate over this issue, actually. The US national debt is 100% of GDP and we have among the lowest tax rates of our peer nations. Something … Read entire article »

Filed under: taxes

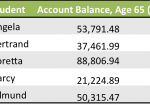

Can a Net Income Boost Compensate for Not Having Earned Income?

Two weeks ago I got a great comment on my Roth IRAs for Graduate Students post from Joe. He asked “Why would you want fellowship income to be reported as earned income? The payroll tax (6.2%+1.45%) that must be withheld from wages … in my opinion, makes the unearned income classification better.” The payroll tax exception for 1099-MISC income wasn’t something I addressed in the Roth IRA post (although I mentioned it as a perk for some … Read entire article »

Filed under: budgeting, retirement, taxes

The Fact and Fiction Behind “Two Can Live as Cheaply as One”

Everyone’s heard the phrase “two can live as cheaply as one.” In one sense it’s absolutely true: when you live in a home by yourself and someone moves in with you – a roommate or spouse who pays his own way – your per capita expenses will go down. You have someone to split the rent and utilities with. But the way the phrase is usually applied is to married couples – as if just … Read entire article »

Filed under: budgeting, choices, frugality, goals, lifestyle creep, marriage, spending

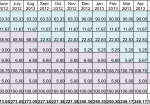

Targeted Savings Account Calculation: Cars through Aug2013

This weekend I re-projected the amount of money we need to save monthly into our Cars targeted savings account. I’d like to share my method with you so that you can see as an example how we decide how much to save into each savings account. The Cars account is a good one for this exercise because the payments we make out of it are very well-defined (unlike Travel or Appearance) but they’re shifting a … Read entire article »

Filed under: budgeting, cars, targeted savings