Proposed Series: Literature Review of Joint and Separate Accounts

During a conversation with my officemate about the diversity of comments concerning joint and separate money within marriage, she told me that during college she had read a sociology paper on the ideal number of accounts for a married couple (as she recalled, 5). It had not occurred to me that such topics would have been studied by researchers but I was immediately excited about the prospect of learning about such work. During college I took a course titled “Psychology of Close Relationships” in which we formulated questions, read the available literature concerning those questions, and wrote short review papers answering the question with a synthesis conclusion from at least three papers. I enjoyed that exercise immensely! It was the first time I had read social science papers and I found them much more engaging and relatable than much of the hard science literature I was reading at the time. So I am really pumped to investigate the research concerning two of my favorite subjects, marriage and money.

I would like to probe the literature on the issues and questions that came up in that post about joint and separate money. What I plan to do is write a post for each paper that I find relevant and interesting to that subject, reporting the major findings, methodology, and confounding factors/future work. I’ll write about how my husband and I fit into those findings and, when possible, where previous commenters fit in. Of course you will also have an opportunity to share your reaction to the findings in the comments.

I already have read a few papers and picked out some contenders for the series. For one of them, I would like to apply a categorization technique from the paper to the people who commented on the joint and separate finances post. If you haven’t yet commented but want to appear in the categorization, just head over to that post and tell me about how you and your partner handle your money mechanically and how you think of it theoretically. If you don’t have a spouse, let me know how you would like to handle them.

What do you think about this proposed series? Do you think there is value in consulting the social science literature, and if so would you be open to changing your behavior based on a consensus of findings? (Personal note: I do and I have.)

Update: The series is under way! Here are the installments:

Changes During the First Year of Marriage

Individualized Marriage and Money Management

Filed under: budgeting, marriage, the literature · Tags: couples, joint accounts, papers, psychology, separate accounts, sociology

Joint and Separate Money Series: Odds and Ends

Joint and Separate Money Series: Odds and Ends Joint and Separate Money Series: Changes During the First Year of Marriage

Joint and Separate Money Series: Changes During the First Year of Marriage Joint and Separate Money Series: Individualized Marriage and Money Management

Joint and Separate Money Series: Individualized Marriage and Money Management The Slippery Slope of Separate Money

The Slippery Slope of Separate Money

I would say that what a study says really has little/no bearing on my life. A study is simply to show what’s most popular or what they tend to find the average to be. Everybody is different and should cater according to their life and what works best for them.

With that said, my opinion on believing spouses SHOULD have joint accounts wouldn’t change…although the study could make me look like a moron. And I’m cool with that too. 🙂

WorkSaveLive recently posted..How to Retire Comfortably: Start With the End in Mind

Well, depending on the study it might show quite a bit more than what people do, but rather what makes for better outcomes (marital satisfaction, less divorce, etc.). They are very tricky though and have to be looked at critically. I agree that if you have a certain philosophical position (as you and I both do) a study on what works practically probably won’t influence us much. If some studies did show that separating money is better for whatever reason, the most I would do would be more watchful about problems arising from our system. But we’ll see!

That sounds like a great idea for a series, I would be very interested to read it. (Disclosure: social scientist here!) I would only change my behavior if I saw strong similarities between my own situation and the context of the people in the study, and I trust field collected data more than experimental and survey data for being able to estimate that, but even if a study doesn’t fit my personal criteria for “life-changing” I’m still interested to learn about the variety of people’s experiences.

I agree with you. The selection process for who is included in studies can make them seem not so applicable. What do you mean by field-collected rather than experimental/survey?

I would be intrested to read a series but whether it would affect me or not, I’m doubtful of. I have found something that works for us but if I see something that I think would be awesome, I would attempt to integrate it into our system.

bogofdebt recently posted..Spending Recap 4/23-4/29

I would definitely be interested in the series. I’d like to know what married couples are doing with their finances

Jessica recently posted..Transitions and Finances

I think the people it would influence most would be those that are not already in a relationship that’s serious enough for them to have considered the issue. It’s interesting to the rest, no doubt, but people have very strong and stout opinions on the issue that are not likely to change because of what other people are doing. That being said, I’d read it and comment all day!

femmefrugality recently posted..How to Become a Mystery Shopper

I agree – but encouraging people to think deeply in a new area is a good objective!

I’m nerdy and love to read studies so I say go through as many as you want. They have studies for everything these days. The other day I found a Harvard study for the optimal number of friends: 12-19.

Wayne @ Young Family Finance recently posted..Buying the Best Car for Your Money

Haha! I can definitely believe people would study that.

I’m very curious what these papers would present. Case studies are always a treat to read as well. I have found there is a fine line between maintaining separate accounts and lying to your spouse, but crossing that line has less to do with whether you use multiple accounts than whether you’re a liar. I’d be curious to see if research supports this point of view.

AverageJoe recently posted..How I Chose My High Yield Bond Fund

That is a good point. I haven’t seen a paper yet that addresses that but I will look.

I think it sounds like a really interesting topic but only depending on how it’s done. I’d say tackle 3 papers first and if there’s a lot of interest then keep going! Great idea.

Young Professional Finances recently posted..Tax Refund Shopping Spree

Fun idea, Emily! One of my favorite lessons from Intro to Social Psychology is that everybody thinks *they’re* the exception. [Except, of course, those of us fortunate to have had a liberal arts education!! 😉 heh…] If the experiments are well done, I think they are very insightful. I hope you can find some good ones!

I’d be interested in reading one study on the subject (comparing a few different couples). Very interesting topic, I look forward to it.

Julie @ Freedom 48 recently posted..April 2012 Financial Update

Since I’m against separate accounts, I’d be interested to hear why people would want them and how they justify them.

I don’t know if I’ll find much in the literature on this, though if I did I would post it. I actually spent a lot of last weekend asking people about their money management structures and got a variety of different, interesting answers – I’d suggest the same to you!

The underlying law that dictates the arrangement for marriage account settlement, in case of separation, would be also interesting to feature, I guess. It has a fixed rule – no matter what arrangement was made by the couple during marriage.

Amy @ Jobcred CV Builder recently posted..Make Your CV and Profile All About You

This isn’t something I plan to address in the near future – I’m sure someone else has done it well state-by-state. It only comes into play in divorce/death, right? Or unusual tax situations? For this series I’d just like to focus on how couples function.

We maintain same accounting, even our checking accounts are joint. Interested to know more about the studies.

SB @ One Cent At A Time recently posted..How Payment Method Impacts Product Quality Choice

[…] responded to my idea of doing a short literature series on joint and separate money in marriage, saying “Fun idea, Emily! One of my favorite lessons from Intro to Social Psychology is that […]

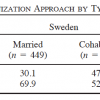

[…] is the first installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In […]

[…] is the second installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In […]

[…] is the third installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. […]

[…] we covered an interesting blog series that Emily is doing over at evolingpf.com titled Joint and Separate Money series. In the series she goes over some studies that she has found on couples and how they manage money. […]

[…] situation plays in very well with our discussion of joint and separate money management as well as attitudes. I would venture that the vast majority of stay-at-home parents have joint accounts and money […]

[…] from JW’s Financial Coaching recommended my series on Joint and Separate Money to his podcast […]

[…] looked back at some academic papers I read when I did my series on joint and separate finances and found the definitions of the relevant terms. I don’t usually use the academic terms for […]