What’s the Point of Calculating Net Worth?

I enjoy reading other PF bloggers’ monthly reports on their net worth progress, whether they use real numbers or percentage increases. I haven’t so far written a net worth post or series for us and as of now I don’t plan to. I just don’t see how it would be interesting or informative in our situation. So I’ll bore you with one post instead of with a series.

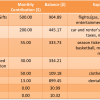

Here are the components that contribute to our net worth:

assets

- checking accounts

- targeted savings accounts, nest egg, and emergency fund

- CD for student loans

- investment accounts for student loans

- Roth IRAs

- cars, engagement ring, miscellaneous property

liabilities

- credit cards (paid off monthly)

- student loans

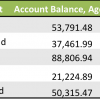

Our checking accounts cycle between $0 and $4,000 each month and the credit cards are paid off by the end of each month (usually three times per month). Our targeted savings accounts in theory are just savings for future spending so they don’t really count, and the balances in our emergency fund and nest egg are static right now.

We invested the money we saved to pay off my student loans so the balances are basically just subject to what the various markets are up to. We contribute a fixed amount every month to our Roth IRAs so those balances increase linearly plus or minus the effect of the stock market.

We invested the money we saved to pay off my student loans so the balances are basically just subject to what the various markets are up to. We contribute a fixed amount every month to our Roth IRAs so those balances increase linearly plus or minus the effect of the stock market.

We don’t have any property to speak of. Two 10-year-old used cars, some rings, computers, and various other things we aren’t interested in selling.

So our cash situation is pretty stable month-to-month in theory, and the only part of our account structure with any kind of slope is our investments. But I can just log in to my Vanguard account to check on that whole situation and I don’t need to do any additional sums or whatever. If I want to be really lazy, I can just check up on that day’s market moves and have a good idea. Our cars are depreciating but probably not super fast – also boring. We don’t have any net worth goals or anything that we’re trying to reach at this moment. We are satisfied with our current savings rates and are just trying to keep going like this until Kyle graduates in a year-ish. So if you want to know how our net worth is changing, a small portion of it tracks the markets and the rest stays the same unless we make a bunch of major purchases all at once from our savings accounts. :/

Do you think I should keep up with my net worth even though I believe it can be easily tracked just through Vanguard/the news? What is the most exciting or volatile category in your net worth calculation? Am I missing the point?

photo from 401K

Filed under: net worth, savings, stock market · Tags: assets, budget, debt, investments, liabilities, net worth, student loans, tracking, Vanguard, why

When Did We Acquire All This Cash?

When Did We Acquire All This Cash? Our Short-Term Savings Accounts

Our Short-Term Savings Accounts Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income? Book Review and Application: All Your Worth

Book Review and Application: All Your Worth

Hmmmm…

I don’t know if you need to keep track of it if it’s that simple. I think it’s fun to have a chart though and to be able to track it over a period of time.

The most volatile part of our worth is definitely our savings account right now. Some months we add a bunch to it and some months we spend a lot (like last month when we bought a car).

Eventually it will be our retirement savings but those accounts aren’t large enough yet.

WorkSaveLive recently posted..Recipe: Slow Cooked Beef Barbecue

I don’t know if there’s much of a point to it, but I do get excited when mine increases!

Daisy recently posted..No Spend Days: What’s The Point?

I track my net worth monthly (first day of the month) and keep a record. I don’t think it makes sense to do it more often because it fluctuates significantly within a month. Keep in mind, if you decide to start, you can track the assets and liabilities you want. I just track my bank & credit card accounts (all things I can check balances of online) but I think it depends on what level of liquidity you deem important. It’s also just nice to double check that you are moving in a positive direction. It can also help identify if something fishy is going on in your finances that you should be aware of. I’m planning a post on tracking finances soon!

Julia recently posted..Grad School Secrets: Delicious Food on a Budget

I’m with you. Mint tracks it for me, but according to the Kelley Blue Book, I could get a lot more for my car (my only asset) than I believe to be true. So yes, I’m happy it’s positive. But other than that, I don’t keep track. Maybe this is another thing that is more important once you own a house?

Frugal Portland recently posted..Reworking my Retirement Contribution: Opening a Roth IRA

That’s what I was thinking, too. With a house you have the huge debt that you’re constantly chipping at, plus every now and again you can update the value of the house. That would be more exciting.

To me, the point in calculating net worth isn’t in calculating it but in having the historical data. I’ve actually been calculating mine since I was 16 (!) and I still have all of the data.

It was kind of cool in college because I could easily look at the chart and tell whether I was on an internship or in school and when I got an income tax refund based on the slope!

I also group my accounts. With my grouping system, you would have:

1) Cash: checking accounts, targeted savings?, less credit cards balance

2) Savings: nest egg, emergency fund, CD for student loans

3) Investments: student loans, Roth IRAs

4) Property: cars, engagement ring

5) Liabilities: student loans

As you say, you can easily track how the Investments group is doing just by going on the Vanguard website.

For me, my most exciting and volatile category is my Investments. I’m maxing out my 401(k) again this year, so it is going up by a huge amount each month, which is really cool to see the slope of that line 🙂

I think it’s just nice to have the history of my net worth. I also have transaction data from back when I was 16 and it’s pretty cool to see that I was saving 80% of my income then 🙂

I actually don’t include my car in my net worth, even though it’s only a year and a half old. So my net worth took a huge hit for that back in 2010.

Leigh recently posted..Should I really be using a stable value fund as my fixed income allocation?

That’s a good point. I know how all those pieces have changed over time individually through my tracking, but I don’t know (or it would be a pain to back-calculate) the sum of all of them at a given time. I know a precise number for our net worth that I pulled together the day I wrote this post, so I might update that monthly or something. I still don’t think it’s interesting enough in our situation to post about though, and while I would share that number transparently I don’t think Kyle is comfortable with that.

I don’t think the power is in sharing it publicly either. I think the power is in tracking it yourselves. Some people choose to share it publicly, but if you are internally motivated enough, that’s not really necessary or much help. I’ve actually been doing net worth updates privately in OneNote myself for a few years now, talking through all of the changes, reflecting on my budget and spending, etc. Doing public updates is helping me to look at the big picture (Cash, Savings, Investments) versus just at the details.

I don’t know if I will keep doing these publicly after I do buy a condo since I don’t want to disclose the value of the condo or the loan amount, whereas the specifics of how much is in my Roth IRA or in my 401(k) is obscured by being grouped into Investments.

You could always use OneNote or a text file to journal these things and use Excel or just use it as a talking point between each other or something. Again, I’m not advocating sharing it publicly at all – I’m advocating calculating it and tracking it privately.

Leigh recently posted..Should I really be using a stable value fund as my fixed income allocation?

I like having little goals and seeing proof that my hard work and discipline is paying off! That’s the only reason for me to have charts and such. When I post things like that, it’s for me…not for anyone else. I try to put something else interesting in the post so it’s not the most boring post in the universe, though. 🙂

I finished university with a net worth of whatever was in my pocket since I managed to leave with no student debt but no savings also. So right before I started my first post-school job, I decided to start tracking my net worth on a monthly basis. It has been fun watching it go up from basically zero – like Leigh said, you can pinpoint life events based on how it changes at a particular point in time which is kind of fun. But like you, I also see no point in sharing the information publicly. Everyone’s situation is going to be different.

Earth and Money recently posted..Book Review – Refuse to Choose!

I think that calculating your net worth may seem like a chore now given you’ve got essentially nothing to add to it, but I promise it’s worth it (also, it wont take long). Right now my only asset is a car, and some savings accounts and debts from student loans. However, I used to have much more debt 2 other student loans, 3 credit cards, and have since paid them off – it was awesome to get into positive net worth territory (only to plunge back to negative when I sign for the house, but it’s nice knowing that i’m making real progress each month, as the amount gets bigger.

Jeff @ Sustainable Life Blog recently posted..Tenets of Sustainability: Sustainability can be Cheap

It’s not a chore – it’s actually so simple an exercise it hardly takes any time. I definitely see how tracking debt payoffs/progress toward positive net worth would be exciting, but we aren’t working on short-term goals like that.

I like reading net worth and cash flow updates, because it satisfies the vouyeristic craving that people have. Posting mine helps keep me honest. Not that I would lie about the numbers (or that anyone would know if I was doing so), but if I wasn’t publishing it, I might be tempted to skip the exercise.

Edward Antrobus recently posted..March Net Worth Update

I’m a voyeur too so I love reading the updates. And I agree blogging helps with accountability.

Thanks everyone for chiming in! You’ve convinced me to track our net worth for a few months to see how it makes us feel to see the numbers increasing. I probably won’t post about it, though.

I don’t really see the point of publishing a net worth for all to see. Is it really anyone’s business but my own? I also don’t worry too much about finances. Keeping track of every penny in and out would be time consuming and likely wouldn’t help me save more in the long run. I know that the overall trend of my worth is sloped upwards, and that is enough for me.

Mike@Investing in Silver recently posted..Gold vs Silver Investments

I love tracking every penny and I definitely think it helps us since we’re on such a tight budget. So it is kind of funny that I know the individual pieces of our net worth so precisely but not the total sum.

We do it once a year. Mainly for decisions about where to save money: retirement vs. cash vs. 529 etc.

Nicoleandmaggie recently posted..What would you do if you didn’t have (to have) a job?

As of right now, I’m still trying to figure out how I want to calculate it. My guy and I combine our finances so I could combine our networth or I could half everything and go from there. But I know personally mine is very negative. It might motivate me even more to pay down my debt if I were to share it though.

bogofdebt recently posted..High Cost of Not Having Insurance Part 1

I believe tracking networth is similar to tracking your expenses in your budget. The point is to have data to analyze to identify trends (good or bad) so your can correct them. Think of your networth as the forest and your budget as the trees. If your forest isn’t growing you have a problem within the trees.

YFS recently posted..UpliftingSisters.com Prom Dreams Giveaway

I guess I think that I wouldn’t necessarily make any big changes even if we tracked our net worth because we’re just trying to save certain percentages of our income. Actually I rather think realizing that we have so much cash on hand might encourage me to go on vacation or something. 🙂

While I like net worth tracking for my own purposes, it’s probably not yet time for you to focus on it. It seems school is WAY more important, and your net worth changes will be more important after that hurdle is behind you.

AverageJoe recently posted..Sprint Teaches Me Geography

I think tracking networth is good because it keeps you focused and always having it on your mind. When you set a budget and forget it you tend to stop looking at things and before you know it years pass and you look at your retirement accounts and you are not where you should be at. I would say if it is all on vanguard make a regular habit of tracking it…plus seeing it go up will give you fuel to add more to your retirement or save more emergency fund….seeing no liabilities will also have a positive impact on your knowing that you do not owe anyone. Like any tool if you are good about saving and good with your money. You do not have to create an off line one, if it is all right infront of u on vanguard.

Hm, but part of my “problem” here is that I have no idea how to set net worth goals and no benchmarks to measure myself against. Right now our net worth is about 85% of our annual income. How do I decide if that is sufficient? The single number actually doesn’t say much – we have a big chunk in cash so I don’t really consider it long-term savings, and that’s why I prefer to just check our Roths (which I do several times per month).

Some people set net worth goals, but I am actually really against them because when you have a certain portion of your net worth invested in the stock market, your net worth can fluctuate enough that you may or may not hit the goals on target, despite your best efforts. So I set savings goals instead and that I find is much more effective for goal setting.

Leigh recently posted..Should I really be using a stable value fund as my fixed income allocation?

I agree that I prefer to track “input” goals rather than “output” goals. It’s rather pointless to set output goals when you don’t have control over the process that creates the output, unless you have a long timeframe for course correction.

Spoken like a true research scientist 🙂

Leigh recently posted..Should I really be using a stable value fund as my fixed income allocation?

I don’t track my net worth down to every dollar but I do like checking on it once in awhile. Since I use Mint.com it shows my net worth every time I log in. I felt horrible when I was at a negative NW, but it motivated me to focus even more on my debt. Now that I’m positive, I don’t ever want to go negative again!!! But I will have to once I go back to grad school. Sigh!

From Shopping to Saving recently posted..Look Who Showed Up Late to the Yakezie Party

We use Mint too, but its investment feature doesn’t seem to work well so it doesn’t tell us an accurate net worth. Also I never added my student loans and student loan cash in so it doesn’t know about those increases. It’s great for our cash though. What kind of program are you going to do for grad school?

I keep track of my net worth… about once a year! Oops. I’ve been more concerned with tracking my retirement savings, but I think I need to start tracking net worth as well. It’s just a little depressing to think my net worth will drop by $40K+ in a year because of grad school.

Well Heeled Blog recently posted..Are You an Abstainer or a Moderator?

It is depressing, but it’s an investment of another type.

[…] just found Evolving Personal Finance and really like it. If you haven’t read it, go check it […]

We found ourselves in an unusual position. We purchased a house that actually had equity in it and wound up with a positive net worth. The equity offset all our current debt. Not that we want to count on that or plan on that at all, but it was comforting to be in the black.

Andi @ Making The Life You Want recently posted..Great Grandpa Harry’s Law

Wow, that is a lucky break!

[…] Evolving Personal Finance asks about the point of calculating your net worth. […]

[…] sites in US and Canada. Book mark worthy page. Evolving Personal Finance has a good point on calculating net worth. Add-vodka presents some Tips for interns and newbies. Free Financial Adviser talking about […]

Student Loans is a big issue for me if I ever consider moving back to the country where I used to live and study, any advice on how to avoid paying student debt??

Do you mean avoiding paying student debt already incurred? No, I don’t know anything about that. I believe in paying the debts you incur except in extreme circumstances.

[…] events labeled on it. I would love to make a graph like this – perhaps I will regularly track our net worth after […]