Evolving Personal Finance » Entries tagged with "1099-MISC"

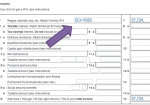

How to Enter 1099-MISC Fellowship Income into TaxACT

This post is the second in this series on how to convince tax software to accept grad student fellowship income – last week was TurboTax, this week is TaxACT. I’ll refer you to sections of that post so I don’t have to repeat the information but you also don’t miss it. Please read two words of caution regarding my qualifications (none) and the wisdom of using tax software to begin with. Also, please again ignore the … Read entire article »

Filed under: grad school, taxes

How to Enter 1099-MISC Fellowship Income into TurboTax

Update February 2017: I have updated and expanded this post into an entire section of Grad Student Finances. Read the entire 2016 grad student tax guide, jump to the step-by-step instructions for entering grad student income of various types into TurboTax, or go directly to the equivalent of this post on entering 1099-MISC fellowship income into TurboTax. This post is a step-by-step guide to show you how you can enter 1099-MISC box 3 income and withholdings that … Read entire article »

Filed under: grad school, taxes

Why Don’t More People Do Their Own Taxes?

First, I need to get this out of the way: I don’t consider using tax software to be “doing your own taxes.” I hear that kind of language all the time, but I disagree with it. When you use tax software, you are not using your brain and you don’t gain any understanding of how income taxes are calculated or why. I have observed that very few people I know prepare their own tax returns, despite … Read entire article »

Filed under: grad school, taxes

DECREASE IN PAY ACKNOWLEDGEMENT

I received an email last week that gave me a bit of a scare! The subject line included my name and “Pay Decrease.” When I opened the email, the attachment was titled “DECREASE IN PAY ACKNOWLEDGEMENT.” I kind of freaked out until I read the body of the email, but even after that reassurance I was pissed at the manner they let me know about this change! Even my advisor agreed that it was “unfortunately … Read entire article »

Filed under: grad school, income

What Is a Courtesy Letter and Does It Mean I Don’t Have to Pay Taxes?

I think that one of the most confusing points regarding grad student taxes is the nature of the “courtesy letter.” I have personally never received one from my university or funding agency but I know many students in my lab, department, and university who have. You may not even be sure what you have received is a “courtesy letter” at all, but I’ll let you in on a few of it likely characteristics: It’s confusingly worded. It … Read entire article »

Filed under: grad school, taxes

Grad Student Income Tax Site Up!

Hi there! This isn’t a normal posting day for EPF but I am just so excited to share this info with you I had to break the routine! The grad student income tax website that I’ve been working on for the past few months is now live! My partner, who works in the student loan office and is a CPA, did most of the writing and compiling and I helped in the research and editing to ensure that it addresses the particular tax challenges that grad students face. I think this is a great resource for students at our university and across the US. I hope fellowship recipients find it useful as they are preparing their taxes. If you have any comments or constructive criticism regarding the information or presentation, please email me … Read entire article »

Filed under: grad school, taxes

Tax Lies Told to Graduate Students

Update February 2016: This short post has been expanded to a 10-part series of common grad student tax lies on Grad Student Finances. Check it out for more detail, explanation, applicability, references, etc.! My little university community service project for this fall is working with a staff member to compile a comprehensive reference document for graduate students preparing to file their taxes. The purpose is to help graduate students make sense of the tax-related forms they … Read entire article »

Filed under: grad school, taxes

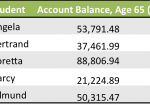

Can a Net Income Boost Compensate for Not Having Earned Income?

Two weeks ago I got a great comment on my Roth IRAs for Graduate Students post from Joe. He asked “Why would you want fellowship income to be reported as earned income? The payroll tax (6.2%+1.45%) that must be withheld from wages … in my opinion, makes the unearned income classification better.” The payroll tax exception for 1099-MISC income wasn’t something I addressed in the Roth IRA post (although I mentioned it as a perk for some … Read entire article »

Filed under: budgeting, retirement, taxes

Earned Income: The Bane of the Graduate Student’s Roth IRA

This is my contribution to The Roth IRA Movement started by Jeff Rose at Good Financial Cents. The post will briefly touch on the advantages of the Roth IRA account but will focus on how graduate students can determine whether or not they have earned income (now: taxable compensation). For more posts with greater detail on various aspects of the Roth IRA, please visit the Movement’s page. Also, I am not a CPA or financial … Read entire article »

Filed under: grad school, retirement