Evolving Personal Finance » Entries tagged with "fellowship"

Winning a Fight with the IRS

I’m very, very excited about the content I have to share with you today. The story comes from someone who found EPF while searching for resources regarding grad student taxes and how to argue with the IRS. After emailing back and forth a few times about how to approach her problem, she offered to share her research and work with you through EPF. I will refer to this reader as Amanda in this post. Thank … Read entire article »

Filed under: grad school, taxes

We’re Evolving!: Our Next Transition

When we founded EPF in 2011, a major component of is purpose was to keep us financially honest during our several anticipated life transitions. Well, it took until 2014 for the first one to occur, but now we seem to be on a roll. Transition #1: Kyle defended and became a postdoc in the same lab he did his PhD in. Essentially the only change was a salary bump. Transition #2: I defended and became funemployed. The major change … Read entire article »

Filed under: budgeting, career, funemployment, housing, income

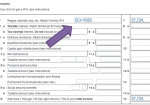

How to Enter 1099-MISC Fellowship Income into TaxACT

This post is the second in this series on how to convince tax software to accept grad student fellowship income – last week was TurboTax, this week is TaxACT. I’ll refer you to sections of that post so I don’t have to repeat the information but you also don’t miss it. Please read two words of caution regarding my qualifications (none) and the wisdom of using tax software to begin with. Also, please again ignore the … Read entire article »

Filed under: grad school, taxes

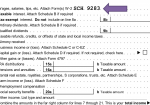

How to Enter 1099-MISC Fellowship Income into TurboTax

Update February 2017: I have updated and expanded this post into an entire section of Grad Student Finances. Read the entire 2016 grad student tax guide, jump to the step-by-step instructions for entering grad student income of various types into TurboTax, or go directly to the equivalent of this post on entering 1099-MISC fellowship income into TurboTax. This post is a step-by-step guide to show you how you can enter 1099-MISC box 3 income and withholdings that … Read entire article »

Filed under: grad school, taxes

Why Don’t More People Do Their Own Taxes?

First, I need to get this out of the way: I don’t consider using tax software to be “doing your own taxes.” I hear that kind of language all the time, but I disagree with it. When you use tax software, you are not using your brain and you don’t gain any understanding of how income taxes are calculated or why. I have observed that very few people I know prepare their own tax returns, despite … Read entire article »

Filed under: grad school, taxes

I Don’t Work for the Money

I often read in the PF blogosphere about the importance of achieving financial independence through the generation of passive income streams. Some bloggers will go on to explain that until we achieve FI, we are trading time for money, and time should be recognized as a more precious resource than money because it is non-renewable. I turned over the phrases “trading time for money” or “working for money” while Kyle and I traveled for Thanksgiving. (Aren’t … Read entire article »

Filed under: income

DECREASE IN PAY ACKNOWLEDGEMENT

I received an email last week that gave me a bit of a scare! The subject line included my name and “Pay Decrease.” When I opened the email, the attachment was titled “DECREASE IN PAY ACKNOWLEDGEMENT.” I kind of freaked out until I read the body of the email, but even after that reassurance I was pissed at the manner they let me know about this change! Even my advisor agreed that it was “unfortunately … Read entire article »

Filed under: grad school, income

Favorite Posts, Mentions, and Top Comments Week of 17Mar2013

This week is all about watching March Madness! My PI walked into my office when I had it streaming one time this week. :/ We also saw Anything Goes at our local theater – Kyle really liked it and I thought it was pretty good. On Friday night we went to a Grad Christian Fellowship gathering and hear from a bioethicist faculty member, which was fascinating and provoked a lot of great discussion afterwards. Finally, one of our friends in Kyle’s program defended this week – congratulations Dr. S! Posts I Liked Kraig from Young Cheap Living explains why he’s bucking the standard advice to use tax-advantaged retirement accounts and buy a house. Well Heeled Blog draws attention to the trend of freezing eggs to extend the childbearing years in favor of focusing … Read entire article »

Filed under: weekly update

What Is a Courtesy Letter and Does It Mean I Don’t Have to Pay Taxes?

I think that one of the most confusing points regarding grad student taxes is the nature of the “courtesy letter.” I have personally never received one from my university or funding agency but I know many students in my lab, department, and university who have. You may not even be sure what you have received is a “courtesy letter” at all, but I’ll let you in on a few of it likely characteristics: It’s confusingly worded. It … Read entire article »

Filed under: grad school, taxes

How to Tell If Your Means Are Just Not Enough

I write quite often on this blog about the virtue – nay, requirement – of living within your means. Even though I am earning a salary that many would consider laughable for my education and experience, I am determined not only to live within my means but give and save as well. I think everyone else should strive for this too – whatever your income, you shouldn’t be running up debt for your living expenses. However, … Read entire article »

Filed under: budgeting, choices, debt, frugality, grad school