Evolving Personal Finance » Entries tagged with "savings"

June 2017 Budget Report

June struck me as a very simple month for us, financially. Nearly all of our variable spending was on groceries. We only bought gas once. We didn’t eat out at all. We only bought four items from Amazon, which is pretty low these days! We were fairly busy around town attending birthday parties and going to the zoo, but didn’t have to spend major bucks to do so. Over the last six weeks, we finally … Read entire article »

Filed under: month in review

What is the Purpose of an Emergency Fund?

In my last post on emergency funds, I looked at Dave Ramsey’s (and many others’) suggestion of an emergency fund size of three to six months of expenses and calculated what that would be for our current budget ($7,500 to $15,000). But at the end of the post I questioned whether a three to six month emergency fund is really appropriate for us. I am an overthinker, so I have trouble just accepting that we … Read entire article »

Filed under: emergency fund

Money Updates from the EPF Household

Today’s post is a collection of odds and ends – thoughts and observations about our life as it intersects with our finances. None of these topics are enough for a full blog post at this point so this is a clearinghouse for our thoughts at this moment. Townhouse Water Damage We had a bit of a scare a couple weeks ago with the townhouse we rent. A leak developed in the ceiling of the lower floor, directly … Read entire article »

Filed under: budgeting, cars, housing, marriage, personal, savings, targeted savings, transitions, travel

Trying Hard to Not Time the Market

Kyle and I have a decision to make! We have some subsidized and deferred student loan debt (i.e. sitting at 0%) and we also have the full amount of money we need to pay off these loans set aside. Most of that money is invested in mutual funds, but about $6,000 is in a CD that is maturing this month. When we first allocated our savings, we knew we should be conservative because we had a … Read entire article »

Filed under: debt, investing, savings, stock market

Pulling Back the Veil on Our Daily Money Management

I thought it would be helpful for some to get really into the nitty-gritty of how we manage our money on a daily (or at least monthly) basis. It’s simple to say “we have joint accounts” or “we use Mint” but what does that really mean? (You can reference a copy of our current budget if you like.) Start with a Clean Slate On the first of the month the only money in our checking accounts is … Read entire article »

Filed under: budgeting, credit cards, found money, side income, spending, targeted savings

Choosing Our Own Destination

I couldn’t have imagined this two years ago but it seems to have arrived: Kyle and I have zero pending wedding invitations! And not even any engaged friends to whose weddings we are confident we will be invited. We love attending weddings and especially love attending weddings to which we need to travel because that almost always means we get to see far-flung friends. We RSVP yes whenever we possibly can and regret all the weddings … Read entire article »

Filed under: travel

Laying a Path from Here to There

I’m afraid of drifting through life – of letting time pass without accomplishing anything. Sometimes I feel like we’re drifting financially while we’re in graduate school because we don’t have several major monetary objectives toward which we are working. While I think goal-setting has been a bit overblown and doesn’t necessarily work well for everyone, I believe we all need to have a vision for our lives and to take steps to realize those visions. If … Read entire article »

Are You Sure You Want to Spend $27000 on Your Wedding?

Today we are featuring a guest post from Edward Antrobus as part of this month’s Yakezie Blog Swap – click over to his blog to check out my participating post. Edward is a blogger, home cook, and construction worker. Enjoy! The cost of the average wedding is over $25,000. That number doesn’t even include the cost of the dress! (I’ve never understood that. Isn’t the wedding dress a wedding-related cost? Why wouldn’t you include it in the … Read entire article »

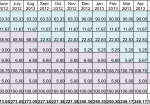

Targeted Savings Account Calculation: Cars through Aug2013

This weekend I re-projected the amount of money we need to save monthly into our Cars targeted savings account. I’d like to share my method with you so that you can see as an example how we decide how much to save into each savings account. The Cars account is a good one for this exercise because the payments we make out of it are very well-defined (unlike Travel or Appearance) but they’re shifting a … Read entire article »

Filed under: budgeting, cars, targeted savings

How to Save When You Don’t Have Earned Income

For those of us without earned income, the standard retirement advice does not apply. Not only do our workplaces (if we even have them) not provide retirement plans, but we’re locked out of contributing to IRAs. Assuming we’re making enough money to be able to save, how can we advance our goals? 1) Evaluate your financial situation holistically. Not everyone needs to save for retirement at all times. There are other legitimate savings goals that you can … Read entire article »

Filed under: retirement