Do You Ever Just Give In and Spend?

I’ve written several times about our targeted short-term savings accounts. For the most part these work very well for us in saving for our anticipated expenses. But sometimes, the system backfires – specifically, when we need (?) something that we haven’t saved for, or haven’t saved enough for. Dividing up our cash among all these accounts means we have to do some psychological tricks to get the money from elsewhere.

We’ve had two instances of this recently – a suit and a hard drive.

A few weeks ago I was invited to interview for a summer internship and the dress code was “business formal.” I had to look up the term! Since I only have a scant business casual wardrobe, I did not own a black skirtsuit and had to buy one. I suppose I could have tried to borrow one, but 1) you know how I feel about that and 2) I was hoping that the interview would lead to an offer and I would get more use out of the garment (it didn’t). So now I have a $125 black skirtsuit that I’ll presumably use in the future, but not immediately.

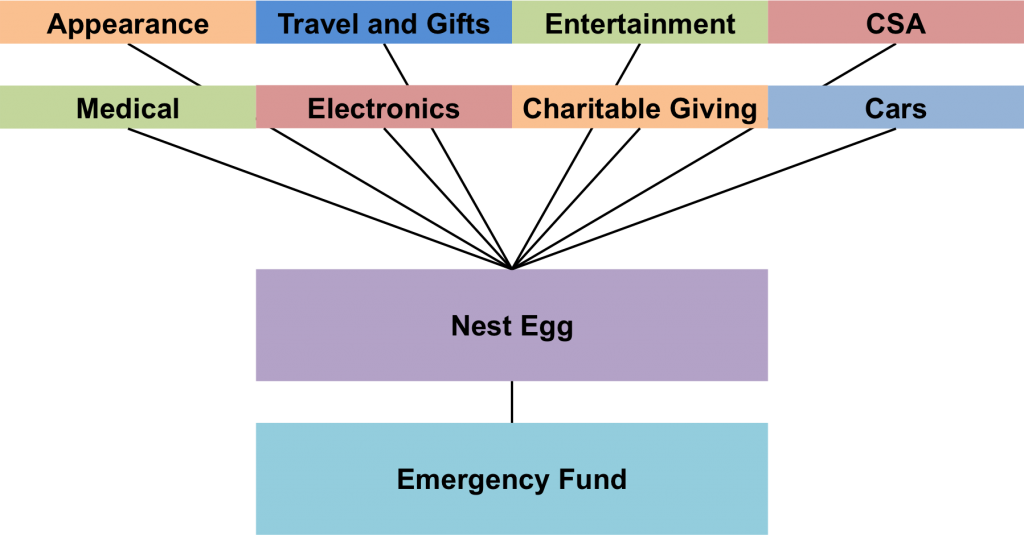

The problem was that we didn’t have the money in our Appearance account to pay for the suit. That account is one of our most underfunded accounts – it seems like the money just washes in and out and we can never accumulate anything. So we borrowed the money from the account we consider our nest egg. That account serves as an intermediate step between our short-term targeted savings accounts and our emergency fund. If we run dry in one of our targeted accounts, we usually stop spending. But if it is a real need, we do on occasion dip into the nest egg and plan to repay the amount. It would take about 2.5 months to save up enough in our Appearance account to repay the suit.

Just last night Kyle bought a hard drive and a few other accessories for his new-last-year laptop. He researched the products thoroughly and has been tracking the price of the hard drive for months. However, we didn’t keep funding our Electronics account after we bought our laptops. While the hard drive isn’t a need, it is something Kyle has wanted for a long time and I’m tired of telling him no! He told me a couple days ago that the next time the hard drive’s price fell below a certain level he would buy it and I said OK. We are starting to fund our Electronics savings account again, but the first six or so months are going to have to repay our nest egg for this purchase.

I don’t know. It’s hard to say no to a need or a long-term want when you have cash, even if it’s not earmarked for that purpose. On the plus side, we’re not going into debt. On the minus side, we’re not exhibiting very good foresight or self-control. We don’t do it all the time, but occasionally we just give in.

Have you made a purchase recently that violated your money management principles?

Filed under: budgeting, choices, spending, targeted savings · Tags: hard drive, splurge, suit

Spend $1600 or Become a One-Car Family?

Spend $1600 or Become a One-Car Family? Do I Want a Camera or Subjects?

Do I Want a Camera or Subjects? How Do You Decide What to Spend on a Wedding Gift?

How Do You Decide What to Spend on a Wedding Gift? If I Were My Financial Advisor, What Would I Tell Me?

If I Were My Financial Advisor, What Would I Tell Me?

It’s funny because when I had to buy a suit for a job interview, mine did the same thing. I had to take money out of my EF for it, and it totally went against my grain.

Oh.. you just hit close to home.

Just this weekend I found myself purchasing a suit that I needed for a work “situation”.

That was $250 that we had worked very hard to save up (you have to do a lot of couponing to save $250).. And it hurt a bit.

There is much hope that my work situation will improve by more than $250 after purchasing this suit.. But that is far from certain. It was a gamble, but hopefully it pays off.

Life often smiles on folks who are welling to take chances, I suppose.

It’s terrible how easy it is to spend huge chunk of money while it takes so much effort to save it through small cuts and frugality! It is so much nicer to increase income – I hope your situation works out that way!

YES! I totally do this. I moved this month, so I spent way more on entertainment (re: social eating since I would go out for dinner with coworkers) and eating out (re: dinner out by myself or picked up to go).

When my old laptop was getting WAYYYYY too warm, I decided I had to buy a new one. But I didn’t want a $500 laptop – I wanted a $1,500 laptop. I had been putting it off for awhile, so when I finally bit the bullet, I had about $700 saved for the laptop. That $800 meant I saved $800 less towards my down payment fund that month 😛

What I try to do is to “fix” my spending plan after things like this happen – so now my laptop budget is $1500 / 3 years / 12 months per year = $41.67 per month. That’s my way of feeling slightly better about it at least…

I think that it sounds like you guys are doing fine. I used to borrow from my cash reserves all the time when I was younger, but I kept a spreadsheet to re-pay myself. The important part is that you’re not going into debt and that’s exactly why you have cash reserves, even if it’s not an emergency.

Your finances look very organized. I’m sure you will attend more interviews and you will get a lot of use out of your new suit as they are always in style.

After my son was born last year, I decided that it was finally time to lose some weight. I did well and ended up losing just over 40 pounds in eight months. The only problem was that NONE of my clothes fit! I had to go out and buy everything again. Fortunately, my office is business casual so it wasn’t that expensive but it did hurt the cash flow for months. I need to lose another 40 pounds but I am not sure the budget can handle it!

I lost a lot of weight in 2011 as well and it has been hard on our Appearance budget. Every time a special event came up it seemed I needed a new outfit – the suit, business casual, a dress for a wedding – in addition to new jeans every so often. My wardrobe is pretty scant currently and I guess I’ll re-populate now that my size has stabilized. There is a definite downside to losing weight! Of course if you have to buy new clothes it’s much more fun to get a smaller size rather than a larger! I decided to only buy pants if I was skipping a size (12 to 8, 8 to 4) but that definitely meant a lot of time spent in pants that were practically falling off! Congrats on your successful weight loss!

Wow! Your finances are really organized and I like your system!

I think the flooding in Thailand last year caused a shortage in hard drives. A shortage in the hard drives caused the prices to sky rocket, so I can understand why the hard drive price was pretty high!

The floods seemed to have really made the prices of hard drives go up. However, I was buying an SSD drive which hasn’t had the same price increase. In fact, I’ve been following SSD prices for about 6 months now and they’ve steadily decreased from about $2/Gig to $1/Gig so I’m fairly happy with the price we paid.

I don’t have a business casual skirt either, but luckily I don’t think I’ll need one soon….

I’ve been lucky that things have gone according to plan for quite a while now. I shouldn’t say that out loud because that’s right when the muffler decides to drag behind the car…..

Emily, I’m biased here, but I think that building a work wardrobe is really important. I finished graduate school last year, and when I was on campus, at conferences, or at interviews, the way in which I dressed affected how I carried myself as well as how others perceived me. A black skirt suit is something that you will get a lot of use out of!

In my last couple of years of graduate school, I regularly scouted the Nordstrom sales online to build a work wardrobe. When I started my new job, I had a great collection of dresses, blouses, and dress pants that were mostly 30-70% off the retail price.

I hope that your interview went well! 🙂

You’re totally right – I’m glad I have this staple in my wardrobe now! I would feel a bit better about it if I had some specific events coming up to which I could wear it, but I know they’ll come up plenty over the next couple years.

Part of my issue here is that I really hate shopping for clothes, So I generally only do it when I’m under the gun of a specific event! Combining that with our lack of funds for clothes shopping and it’s a real rarity. But I agree with you that it’s better to build up a wardrobe from good deals than always having to pay asking price because you’re pressed for time. Thankfully my suit was on sale, but that was pure coincidence.

I’ll have to “grow out of” my sloppy everyday lab outfits eventually. 🙂

If something is needed for your perceived appearance at work, then its not a bad investment, to me at least. And the hard disk also could save money in the long-term if the new laptop decides to stop one day.

I like the idea of targeted saving accounts. A few banks offer sub-account feature..did you try any of those?

We have all these savings accounts with Ally, along with our primary checking. Is that what you mean by sub-account? They are actually (virtually) separate accounts, not just mathematical delineations of one account.

I do this to some extent as well. In fact I’m in the market now for a new hard drive and, well, a new laptop. For those long term wants though I often find that if I compare the incremental increase in satisfaction from the purchase doesn’t immediately justify buying. Basically this means luxury items get put off a long while.

Love it! I’m glad I’m not the only one that spends money on things that we haven’t saved for.

It’s tough to budget for EVERYTHING and I don’t think it’s wrong to occasionally buy something that hasn’t been budgeted – as long as you have the cash of course.

Being disciplined is a great thing but having a splurge moment and saying YES to a long-term want is a good thing.

We try to put some misc. money into our budget for little splurges, but occasionally something like you mentioned will come up and we’ll have to spend money we weren’t planning. It used to bother me a lot and I felt like I was not succeeding, but when I took a step back and tried to be positive about all the goods decisions I made the rest of the month, I didn’t feel so bad. I try not to let one unexpected splurge or necessity lead to others. Just because I had a brownie for breakfast doesn’t mean I should eat the rest of the pan for lunch 😉

[…] within our means: Ummmmm, depends on how you define it. We aren’t taking on any more debt, but sometimes we “borrow” money from ourselves, or some months we go over-budget and money gets shifted from the next month or savings to cover […]

[…] Emily at Evolving Personal Finance discussed the urge to spend in Do You Ever Just Give In and Spend? […]

[…] Emily @evolvingpersonalfinance wrote a post about Do You Ever Just Give In and Spend? […]

[…] Personal Finance published Do You Ever Just Give In and Spend?, saying, ‘It’s hard to say no to a need or a long-term want when you have cash, even if […]

[…] We don’t have a whole lot of conflict because of our differences, but rather I think our distinct definitions of frugality synergize to making us a frugal couple by any definition – or very possibly a cheap one. I deny or delay purchases that are not real needs and Kyle makes sure we get a good price when we do purchase something, which is something I neglect when I cave in and buy. (And very occasionally all that gets thrown out the window.) […]

[…] More Spending included Do You Ever Just Give In and Spend? in her Sunday link […]

[…] up committing to 4 pairs of shoes for $165 (two had to be ordered in different sizes). So we overspent out Appearance savings account and nearly all of June’s savings to that account will have to […]

[…] him with the cost of the camera. But what would Kyle’s individual money go toward? We bought him an SSD a few months ago – should that have been his purchase alone? And last year we bought each of us a new […]

[…] literally never lived any other way. However, we don’t keep a super super strict budget – we don’t always tell ourselves no when the numbers say we should – and there are lots of different interpretations of how to budget. I can see how it might […]

[…] either. Nearly half of the money I spent was on two items – a dress for an evening wedding and a suit for an interview. The remaining $250 was a set of socks, three pairs of pants, one shirt, and three pairs of […]

[…] Personal Finance published Do You Ever Just Give In and Spend?, saying, ‘It’s hard to say no to a need or a long-term want when you have cash, even if […]

[…] Do You Ever Just Give In and Spend at Evolving Personal Finance […]

[…] Emily at Evolving Personal Finance discussed the urge to spend in Do You Ever Just Give In and Spend? […]