Spend $1600 or Become a One-Car Family?

Irony: My car breaking down the day after writing about our disagreement over carpooling to work!

When I published that post on Monday becoming a one-car family seemed a remote possibility, but as of this writing on Tuesday evening we are giving it serious consideration. So much can change in 36 hours!

For the last few months, my car has been shaking considerably when its speed exceeds 65 mph. I knew I would eventually need to get that checked out but it didn’t seem like an acute problem. On Monday morning when I was pulling out of my parking space at our apartment, I hear a weird creaking nose that seemed to be generated by my wheels turning. I thought that was strange, so Kyle drove me to work and we thought we’d check it again the next day when it wasn’t so cold. On Tuesday morning, my car wouldn’t start. The engine didn’t turn over at all. We eventually were able to jump it (on about the 5th try) and we decided to drive it straight to my mechanic.

Later Tuesday afternoon we got the diagnosis: the car needs a new alternator, four new tires, and new shock and struts. The total bill was $1600.

We quickly ran down the balance in our “Cars” savings account and our upcoming expenses. We can reasonably spend the entire balance now without major repercussions in the next 8 or so months, but that’s only $600. For a long time we weren’t funding it anticipating maintenance/repairs and even though we have been recently it’s still underfunded for that purpose. One of the pitfalls of targeted savings accounts!

We have the remaining $1000 available in cash but it would knock our savings pretty significantly. We also had to consider the current value of the vehicle (around $3000) and the “life” left in it (we had hoped for many more years as the car is a 2002 and has fewer than 100 kmiles on it).

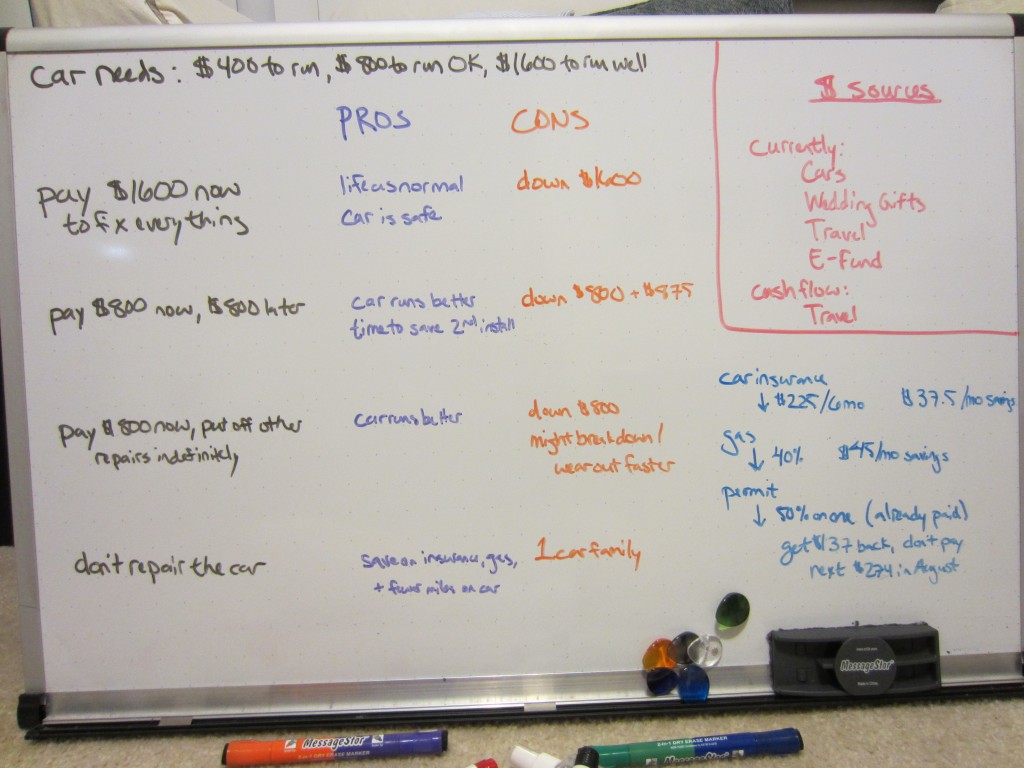

From that point, we saw four options: complete the full repairs immediately, pay $800 now to get the car running pretty well and the remaining $800 a few months down the line, pay $800 now to get the car running and put off the other repairs indefinitely, and not complete the repairs/stop driving the car.

Any of these options were viable. We have the cash to finance any of the options (though painful) and ceasing to drive my car is also a possibility. After discussing it for some time, both of us felt the two most extreme options were best – either repair the car completely now and repay the money to ourselves over time or cease using the car and put off repairing it until we need to become a 2-car family again.

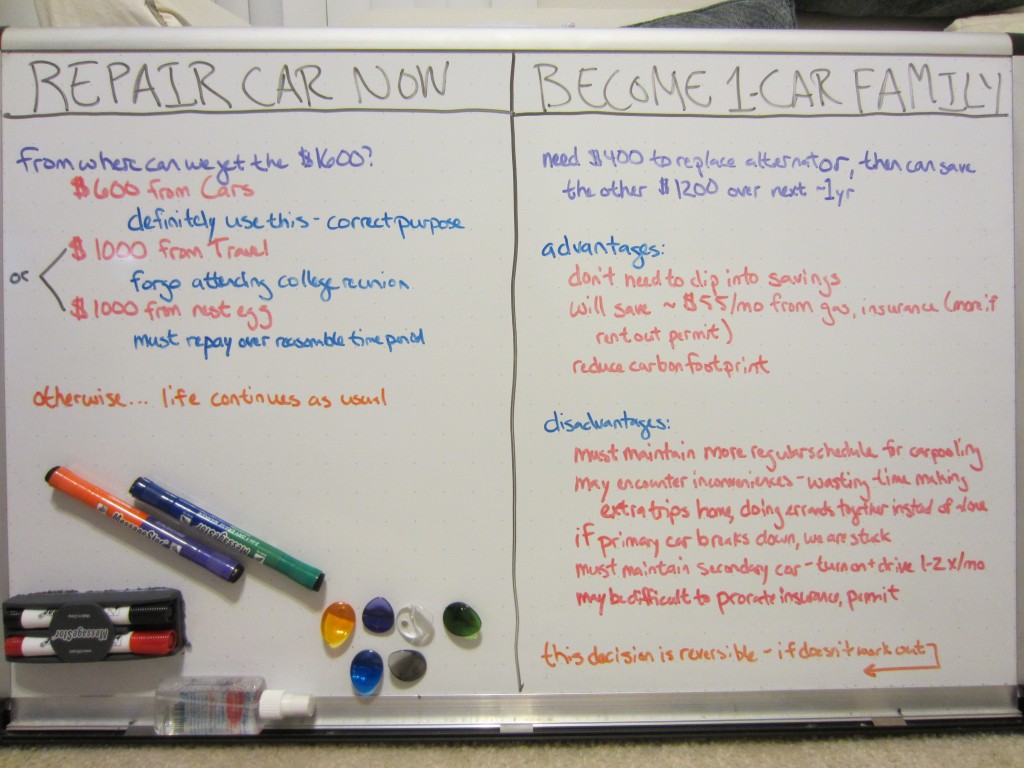

To repair the car now, we would use the $600 in our Cars account and take the other $1000 from either our Travel account or our nest egg. If we take it from Travel, we won’t be able to attend our 5-year college reunion in April. The nest egg is not supposed to be used for this purpose – we have vaguely said it should go toward a down payment for a house or a car, but it also functions as an extension of our emergency fund. If we take the amount from the nest egg, we will need to repay ourselves, ideally over the next year or less.

Forgoing repairs would mean that we won’t be able to drive the car any longer. On the minus side, we would have to rely completely on Kyle’s car, which would take some schedule adjustments. On the plus side, we would save money by removing the car from our insurance policy, using less gas overall, and possibly being able to rent out its parking permit. Since we work at the same place and have a lot of common activities, sharing a car isn’t totally unreasonable but it might be a bit annoying at times. We don’t want to get rid of the car because once Kyle graduates and gets a job and another university we’ll need a second car again. We would essentially just delay doing the repairs until that point, which would also give us some time to save the money we need so we don’t need to use our savings. We would just repair the alternator now and save the new tires, and struts and studs for that later time. The good thing about this choice is that we could undertake the one-car family experiment for a limited period (like 3 months) and if it doesn’t work out, we can just get the repairs done and we’re no worse off than if we did them right away.

After discussing all of this, I’m leaning toward trying the one-car idea and Kyle is leaning toward doing the repairs now. It’s not clear if we will have to give up on going to our college reunion (which I want to attend and Kyle doesn’t). Sorry to leave you hanging, but I don’t know which way this is going yet! Stay tuned for the decision in an upcoming weekly update.

What would you do in our situation? Would you give up a trip to repair the car or take a hit to your savings? If you have ever shared a car with your spouse, how did you make it work?

Filed under: budgeting, cars, choices, emergency fund, targeted savings · Tags: car repairs, one car family, reunion, targeted savings, whiteboards

Do You Ever Just Give In and Spend?

Do You Ever Just Give In and Spend? Targeted Savings Accounts and Funemployment for the One-Car Win!

Targeted Savings Accounts and Funemployment for the One-Car Win! I Love My Car Even If No One Else Does

I Love My Car Even If No One Else Does Targeted Savings Account Calculation: Cars through Aug2013

Targeted Savings Account Calculation: Cars through Aug2013

I would lean toward the one car family idea. If my husband’s car broke down, we could actually pretty easily become a one car family because i will now only be about 3 miles from work, I could just bike to work or take public transportation (GAH!) if need be. And he only works a couple of days out of the week (although 24 hour shifts)….

yeah i would struggle through the one-car situation until you HAD to replace it.

Using only one car seemed impossible when we got married, but now that our schedules have shifted a bit I think we don’t have any major conflicts. The biggest challenge will be getting up in the morning to get to work at a reasonable hour (reasonable to me) because we are both not morning people. Left to our own schedules Kyle’s is shifted 1-2 hours later than mine. Public transport is an option in our city but a pretty poor one.

I’m looking at this as possibly the push we needed to get us to carpool to work 100%, something I thought we should have been doing anyway. 🙂

A few years ago, N and I became a one-car family. Very similar story: Car#2 needed repairs that would cost more than it’s worth. We decided to sell Car#2 and try just using Car#1. If we couldn’t do it, we could always go back to getting a second car.

A few things that may have made this choice easier for us: We were already not using the car to commute (<3mi from home to work). The cost of the repairs were over $2k, and the Kelly Blue Book price of the car was less than ~1k.

The difficult part was… we were living in two different cities! It's more complicated than I can explain here, but we made it work–N did the grocery shopping when he had the car and I biked or got rides to evening activities. We used the train to get back and forth. We are now in one place, and the idea of a second vehicle seems excessive.

Re: having the same schedules as your spouse. I've really enjoyed being on the same work schedule. It used to be that N worked from home and often into the night, making it hard for me to get out of the house in the morning. Or when I did, I was "rewarded" with feelings of exhausted 2 hrs earlier than him, which left little time in the evenings spend together. Now that he's teaching 8AM classes, we're both out of the house at 7:30AM, and in bed before 11PM. Maybe you'll begin to enjoy the benefits having the same schedule? Not having a second car to act as a crutch might be just what you need to ensure that you experiment with it for at least a few weeks.

Are there zipcars or ZimRide programs in your area? I know these may have the associated cons (like keeping a regular work schedule), but they might provide an alternative, if not for now, in the future when you could be working in two different locations.

Good luck as you weigh the odds and take on the next lifestyle challenge!

Wow, that’s a crazy story! After all that of course having two cars would seem excessive! I can definitely see why you chose to sell the car in that situation and attempt the one-car lifestyle. Durham does have Zipcar (added after we moved here) so we can keep that in mind.

I would love to have the same schedule as Kyle. The last few months have actually been relatively good with us going to bed at the same time most nights and leaving the house around the same time. We’ve been carpooling 1-2 times per week instead of rarely a year ago. I hope using one car will get us even further on the same schedule. Unfortunately it’s up to Kyle to do all of the schedule-shifting and I don’t think there are any external factors to force change. I would suggest a standing 10 AM meeting with his advisor but they have more of a drop-in-to-chat-a-few-times-per-week style. 🙂

Hmmm I’m not sure what I would do. I haven’t had any car repair bills in forever. We wouldn’t be able to become a one car family just because of our work schedules, but if it’s possible for you to do it, then I would.

I definitely shouldn’t have ignored the problems with my car for as long as I did. Now that it’s 10 years old I need to be more vigilant about proper maintenance. I hope your car continues functioning well!

First of all, I love your whiteboards! Maybe it’s the engineer in me, but I think things make so much more sense when they are laid out on a whiteboard.

Anyway, I think your one sentence at the end sums up my views: “If it doesn’t work out, we can just get the repairs done and we’re no worse off than if we did them right away.” Since there are no disadvantages to trying it, why not just see how you do? You don’t even have to take the car off your insurance so it wouldn’t be a big decision – just pretend like you don’t have a car and see if it’s more inconvenient than you think. Even if it’s just for a week, it doesn’t hurt to try.

Thank! I adore whiteboards and how they help me think! Kyle bought that one for me for my birthday a couple years ago and I was SO EXCITED! I use it all the time.

What you suggested is what we decided to do. We picked up my car today but are planning to leave it unused for two weeks to see how we handle sharing Kyle’s car. If it all goes well we will make the non-use a little more permanent with the insurance and permit and such.

Go for the one car! When I was in graduate school, we went down to one car. Honestly, it was perfectly fine once we got used to it. We needed a car to get our son to school. If I had the car, then my husband would bike 3 miles to work. If he had the car, I would bus five miles into the university.

I think the key is having alternative transportation options – whether it’s a bike, a bus, or a friend. What’s available where you live? And does your uni offer free public transport? (Mine did, so it really helped!)

I think the public bus system would have to be our alternate, so we need to figure out how it works! My neighbor/labmate took the bus to work for a while when her car was being repaired so I’ll ask her to show me the route and give some tips.

I’m a big one-car family guy if you can swing it!

The trial is underway! I hope we decide to make it permanent.

Awesome! Let us know how it goes. I’d love to bike most of the time but my work building makes you leave before 5:30 if you do and there’s no way I could do that. Oh, and I also don’t want to be the sweaty guy in the office either… hmmm…

I’ll definitely post about how the experiment went and what our final decision is in a week or two. We’ve already done some calculations and it turns out having the second car doesn’t add too many expenses for us. There are definitely economies of scale with paid-for cars.

That’s weird that they make you leave that early. Do you know the reason?

[…] with dealing with my car. We went to bed Tuesday night without a decision on what to do. We had discussed our options extensively (with whiteboards!) and couldn’t come to a clear resolution, so I left it up to Kyle to decide. He woke up […]

Not sure if you’ve done this but you may want to get a 2nd opinion on the cost of the car repairs, or buying the parts yourself and having someone install them, the alternator can usually be purchased rebuilt or from a salvage yard for much, much less than new

We haven’t gotten a second opinion yet. I do trust the mechanic we used but we just had a friend recommend another mechanic who he really likes. The alternator has already been replaced but we might get this other recommended mechanic to give us a quote for the remaining work. It’s enough money to make it worthwhile and the car does start now! We checked the parts prices at least for the entire quote and found them reasonable.

[…] have decided to become a one-car family! If you remember, three weeks ago my car wouldn’t start and we found out it needed $1,600 in repairs. We paid $400 to get it running and evaluated the possibility of relying completely on Kyle’s […]

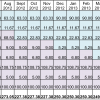

[…] The next step was to map out all our projected expenses related to our cars (excluding gas). I went out 16 months (May 2012 to August 2013) to capture all the expenses that will pop up again once we put my car back in commission. There are eight expenses we needed to account for in that time – car insurance (we pay for 6 months in advance), renters insurance (this isn’t a car-related expense but because we have it bundled with our auto policy we keep it in Cars), work parking permit, DMV expenses (registration fees and taxes), and the repairs we need on my car. […]

[…] apart before we were married and didn’t increase our frequency of commuting together until my car broke down. Since our jobs both provide health insurance we didn’t access any benefits previously […]

[…] need to be saving a lot into our “Cars” account for the upcoming repairs to my car, but we don’t know quite how aggressive to be there so that’s why we’ve modulated that […]

[…] March, my car needed some repairs and we decided that we didn’t really need the second vehicle given that we work at the same place […]

[…] and I have shared one car for nearly a year now! We made the decision to become a one-car family after we realized that we […]

[…] that come up one to two times per year, plus we have a good idea of the amount we need on hand for future repairs. The only way we would repurpose this money is if an emergency comes up that disrupts our plans […]

[…] be! In addition to not traveling like we normally would have, we’ve also been saving up to repair my car. In spring 2012 it broke down and we realized we didn’t actually need two cars, so we stopped […]

[…] and buying only one parking permit. I still think that is a good way to calculate our savings. The repairs we had to make on the car we benched are still pending, so I don’t want to add in any no-repairs savings at the moment, although of […]

[…] was keeping in mind that if we do all the planned spending we would like to (big vacation, camera, car repairs) in the fall and I am un/underemployed for a while, we might dip back below $100k for a bit. So […]

[…] we brought my car in for some repairs in the spring of 2012 and were presented with $1,600 in proposed work. That was back when we didn’t have as much cash on hand as our targeted savings account […]