January 2013 Month in Review: Money

January was a fun month for us! We went skiing with some friends, got a lot accomplished at work, started watching basketball socially again, went out for Restaurant Week, had a picnic, and had the excitement of two snowfalls. We went over our grocery budget again (again, again… what kind of budgeter am I?) and you’ll have scroll down to see our bottom line.

The Everyday Budget

Our non-discretionary categories aren’t changing at all now – INCOME, SAVINGS, GIVING, rent, and internet – which you can find in our last budget iteration. The exception is that Kyle works at our church occasionally, and he received one paycheck in January, from which we transferred an extra $34 to our Roth IRAs and made an additional donation to our church.

We are still dealing with some cell phone bill weirdness. I paid my bill on my new smartphone as usual and finally cancelled the service on my last one, so my cost for this month was $22.18. Kyle returned his ATT smartphone and then bought one from Verizon. We’re still waiting for all the fees to shake out, but the difference between the return and the purchase as of now is $67.09 (out). However, we didn’t pay a normal bill for his phone this month because of how the cycles fell, which should be around $64. I’ll post about this in more detail when we get the ATT account completely closed.

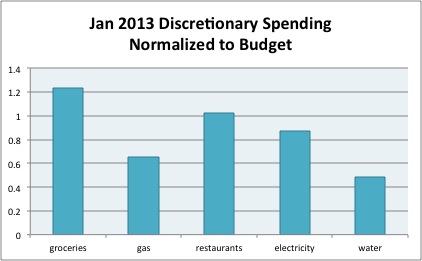

In terms of our discretionary spending:

Groceries: Over again by almost $100. I’m disappointed in myself. Read more about that in our next grocery update.

Gas: Only two fill-ups this month that weren’t for our ski daytrip.

Restaurants: We spent exactly our entire budget on one meal for Restaurant Week. In addition, Kyle bought a mini-cheesecake from our friend’s new business for $2 when we visited her at a bar one night. We had to turn down a few other invitations because we had already met our budget.

Electricity and Gas: Amazingly under budget!

Water: Under budget as well!

Every month we also have some random other transactions that aren’t covered in the budget but aren’t supposed to be taken out of a targeted savings account:

- We broke a switch in our apartment, so Kyle bought a replacement for $5.88 and installed it. He also broke a light cover but we haven’t replaced that yet.

- We spent $9 on (super-ugly forever) stamps.

Spending Out of Targeted Savings

Aside from, our ski trip, this was a very quiet month for our targeted savings accounts. We spent $421.34 from these accounts this month and added $252.32 above our normal savings rates.

Travel and Personal Gifts

We took $54.41 from this account to pay for gas for our ski daytrip and added in the discretionary part of Kyle’s paycheck, $100.18.

Cars

no spending this month

Entertainment

We used $205.72 to pay for the equipment rental and lift tickets for our ski daytrip.

Appearance

We spent $41.81 on pants and sunglasses for our ski daytrip.

Medical

no spending this month

Electronics

We transferred $50 from this account to our Nest Egg to repay that account for our up-front cell phone costs.

Charitable Giving

no spending this month

Nest Egg

We received a Christmas gift of $100 that went straight into this account. As we haven’t yet set up a separate account for blogging expenses, we removed our year’s hosting fees from this account, $119.40. We also transferred $50 from our Electronics here.

Taxes

We transferred $52.14 into this account to set aside for taxes on Kyle’s extra paycheck from this month.

Budget Adjustments

This month we discovered that we don’t pay payroll taxes, so we didn’t experience the decrease in take-home pay that we had anticipated. In fact, our take-home pay, for whatever reason, increased $8.12!

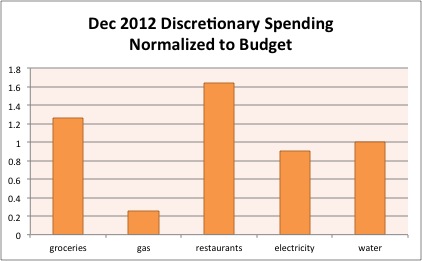

Bottom line: We squeeeeeeaked by under budget this month by $0.61! I thought we were over budget right up until yesterday but I wasn’t sure why (aside from the grocery overspending.) Then as I prepared this post I checked through our ski trip calculations and realized that I hadn’t reimbursed our checking account from our savings accounts quite as much as I should have. Sometimes there are perks to this accountability! I’m glad to be back in the black this month after last month’s (non-Christmas-related) debacle.

When you receive cash gifts, do they go into your checking account for whatever or do you earmark it? How did your budget fare with the increase in the payroll tax? Do you ever spend an entire budget category in one go?

Filed under: month in review · Tags: busted budget, skiing, snow

February 2013 Month in Review: Money

February 2013 Month in Review: Money March 2013 Month in Review: Money

March 2013 Month in Review: Money December 2012 Month in Review: Money

December 2012 Month in Review: Money April 2013 Month in Review: Money

April 2013 Month in Review: Money

Cash of any kind goes into my bank account and then I re-jig how much to leave in there versus sticking it in investing.

Mochi and Macarons recently posted..January 2013 Budget Roundup = Increase of +$9959.43 or +4.98%

Since Ally just recently implemented smartphone check deposit directly to any of our accounts, I was able to deposit directly to savings for the first time instead of doing transfers through checking accounts, so that was exciting for me. Do you differentiate between earned and unearned income in what you decide to do with it, or do you have a universal plan?

I’ve never spent an entire food budget in one go, though it sounds like a good time. I try to keep my entertainment budget pretty low, so when I buy concert tickets or something then I use it all up in one go.

Ross recently posted..Frugal February Challenge: Affording the Chicago Marathon

I can definitely see how Entertainment budget could be spent in one purchase. We actually make ticket purchases that are about 4 months of Entertainment spending levels, which is why we have it as a targeted savings account.

Your take-home pay probably increased because tax brackets go up for inflation a bit each year.

http://en.wikipedia.org/wiki/Income_tax_in_the_United_States#Federal_income_tax_rates

The top of the 10% bracket in 2012 was $8,700 but it’s now $8,925. The top of the 15% bracket in 2013 was $35,350 but it’s now $36,250. And so forth.

I’m paying less federal taxes out of each paycheck as well, but I also increased my allowances to 2 and increased my 401(k) contribution by 1% to take the $500 increase in contribution room into account. So my direct deposit went down by about $150 despite the extra 2% in social security taxes. I wasn’t really sure what my paycheck would look like, so I’m super glad I don’t spend very much of it!

Leigh recently posted..2013 Investing Plan

Good catch on the tax bracket inflation! I’m sure you’re right.

Our withholdings are a bit mysterious to me, but they seem to work at the moment. I think Kyle has too much taken out and I have too little, but it has balanced out at year end the last two years.

It’s nice that your reduced take-home pay is at least partially for self-saving reasons! $150 less isn’t much.

How do you have no payroll taxes taken out? Are you 1099 employees? My husband doesn’t pay social security tax because of his state pension, and he got a small raise, so that offsets my 2% decrease. Glad you got to go skiing. It is so expensive, but really fun.

Kim@Eyesonthedollar recently posted..6 Months of Blogging!

I was going to ask the same thing:)

Great job on the budget! I haven’t been skiing for years. Of course, the hills I have skied on are more like bunny hills. I’d love to take a trip to the mountains and do it for real.

Greg@ClubThrifty recently posted..My Dog Pablo: The Freeloading Genius

I hadn’t been in about 15 years! Kyle and I decided that if we do it alone in the future we’d want to go for a multi-day trip, but going on a day-trip with friends is great, too.

No, we are not currently 1099 employees. (Though if by “1099 employee” you mean self-employed, I think they would still have to pay FICA, right? It’s just not withheld.) You can read about my discovery that we aren’t paying payroll taxes here. Basically, students don’t have to pay FICA if they are employed by their universities for work “in pursuit of” a course of study. And I haven’t realized this in the 6 years we’ve been doing this grad school thing.

Good work on the budget! When we receive cash gifts that typically goes to fun money for us or saved in our vacation fund. In terms of the payroll tax it did not affect us much. We have to pay estimated taxes and just kept including that amount in what we pull out with pay we receive.

John S @ Frugal Rules recently posted..Frugal Friday: Blog Posts That Ruled This Week, How Can it Be February Edition?

That was really forward-thinking of you to keep pulling out the 2% during the break and not let your budget adjust! What did you/do you plan to do with the money you piled up?

Great post! You are really detailed…that’s awesome! When we receive unexpected money, it goes into our savings and is designated for some special project we have going at the time. And yes, with four kids at our house we have often spent a whole budget category in one go 🙂

Brian @ Luke1428 recently posted..Gambling on Super Bowl XLVII – What I Didn’t Know

Thanks for sharing, Brian! For how long do you fund a single priority before moving on, generally?

We usually have multiple priorities at a time. Right now we are consistently saving each month for a new car, this summer’s vacation, a remodel of our kid bathroom, and some storm doors for our house. Money goes into savings for each of those categories every month until we have enough to take care of it. So if we received extra funds, we would probably put it towards the cheapest project to knock that off the list, as the others will take longer to save for.

Brian @ Luke1428 recently posted..Gambling on Super Bowl XLVII – What I Didn’t Know

Sounds like you’re trying to do a lot at once! I have this strategy, too, although sometimes I think the one-goal-at-a-time approach might be more fun.

Well $0.61 under is better than $0.61 over, right? When I get cash gifts from family I put them directly into my savings account, unless they were earmarked for something in particular (mom gave me money for jeans for my b-day etc.).

Definitely better, but I didn’t bother zeroing out such a small amount. I would do the same with gifts but thankfully the recent ones haven’t been designated.

[…] @ Evolving Personal Finance writes January 2013 Month in Review: Money – Our cash flow this month was the closest ever to our projected budget, but we were over in […]

Nice work! You’re very diligent.

Kathleen, Frugal Portland recently posted..February net worth: I saw my shadow

I consider that a high compliment. 🙂

[…] January 2013 Month in Review: Money was included in the Yakezie Carnival and the Festival of Frugality. […]