July 2012 Month in Review: Money

Wow, I’ve been so impressed at how many months we’ve had leftover money since I started writing this series! I’m not sure if it’s the season change or the accountability this series provides, but something is working! Or maybe it’s just that we pull from our targeted and general savings accounts so much. 😉 This month was characterized by majorly low grocery spending, which always is helpful in freeing up money for other categories. We also spent way more money than usual out of our savings accounts in a remarkably small number of transactions.

The Everyday Budget

Things that stay the same every month and are not interesting to report:

- INCOME: our paychecks

- SAVINGS

- Roth contributions

- targeted savings accounts

- GIVING

- tithe

- EXPENSES

- rent

- cell phones

- internet

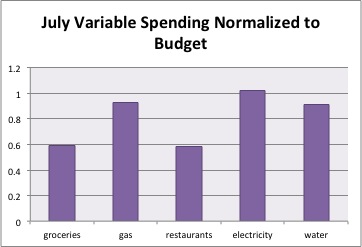

In terms of our discretionary/variable spending:

Groceries: Well under this month, as I expected! We are trying to eat down the food we have to prepare for our move so I hope next month will be low as well. But we had thirteen separate transactions in this category this month, which is more than normal – we did a few runs to the grocery store for only one or a couple items, so I’d like to clean that up next month.

Gas: Two.5 fillups this month, plus I went on a day beach trip with some friends and chipped in for gas and parking. Normally we wouldn’t buy a half-tank, but Kyle thought the station we were at was overpriced.

Restaurants: We only ate out once this month, on my birthday. I actually also got two free dinners at great (and outside our price range) restaurants in town as part of a career workshop series I’ve been attending. Kyle, of course, continued to score lots of free lunches at work.

Electricity: Woah! We went over our budget for the first time since we lowered it to $100/month. I admit we got a little lazy and used our clothes dryer a few times. I hope we can nip this back under the budget by switching back to line drying.

Every month we also have some random other transactions that aren’t covered in the budget but aren’t supposed to be taken out of a targeted savings account. Usually I separate these transactions into income and expenses, but this month we spent some money directly due to having received it, so I’ve paired those transactions.

Income and Expenses:

- We redeemed some credit card rewards.

- net + $34.99 to general budget

- Birthday Gifts

- Kyle received $500 as a cash birthday gift.

- Kyle bought himself some birthday presents with the gift money:

- a mic $71.85

- an audio interface $162.50

- cables for all his new toys and a graphics pad $56.88

- a mic stand $14.93

- net: + $193.84 to our Nest Egg account

- more of this may be spent, as Kyle is still considering buying a Kindle

- A few months ago I won a door price at our university. It was a HUGE headache involving multiple trips to buildings on/near campus that are not walkable and a couple hours, but I finally received the money this month.

- The door prize was $100.

- I joined a professional society for $30 to get (my boss) a discount on a conference registration.

- net: + $70 to general budget

- Kyle had to get a NC license as his CA one finally expired.

- The license fee was $32.

- net: – $32 to general budget

Spending Out of Targeted Savings

In total, we spent $1576.57 out of our savings accounts this month (!!).

Travel and Personal Gifts

I added up all the weekend-of expenses from our Chicago trip (June 30 – July 4) and that money came out of this account ($616.57).

Cars

no spending this month

Entertainment

no spending this month

CSA and Local Food

no spending this month

Appearance

no spending this month

Medical

We paid for our birth control from this account (last time for the forseeable future). The total price was $30 but I covered $25 of it with a gift card from our insurance company, so we only transferred $5 from this account.

Electronics

no spending this month

Charitable Giving

no spending this month

Nest Egg

We are using money from this account for our moving expenses and are planning to pay back into it with our savings on rent. So far we have paid our application fee ($60) and our security deposit ($895). Our current place didn’t require a sizeable deposit but this new one asked for one month’s rent so we had to pull it from somewhere! This account was also boosted by last month’s and this month’s budget leftovers and the remainder of Kyle’s gift money.

Budget Adjustments

I did a reevaluation of our targeted savings accounts this month. I proposed some changes to Kyle but he didn’t think they were necessary. In the course of the review, though, I realized that we already have enough money in our CSA account to pay for our subscription next summer, since our farm shifted up their schedule and the growing season we want (spring and summer) is shorter than before. So we’re going to redirect the $25 that we’re currently saving to that account toward our Cars savings account starting next month.

Bottom line: Not including last month’s leftovers, we had $142.46 remaining in our checking account at the end of the month.

How was your July budget/spending? If you’ve ever had a big housing deposit to pay, where did you draw it from? Have you seen your utilities spike with the heat?

Filed under: month in review · Tags: security deposit, targeted savings

May 2012 Month in Review: Money

May 2012 Month in Review: Money July 2013 Month in Review: Money

July 2013 Month in Review: Money June 2012 Month in Review: Money

June 2012 Month in Review: Money September 2012 Month in Review: Money

September 2012 Month in Review: Money

My utility bills have spiked–well the electric one. The water and gas have decreased or stayed the same. We try to turn up the AC to 80 unless we are sleeping and then it’s 75. It doesn’t matter if we are there during the day or not-it is still going to be on 80. My fiance doesn’t like to be hot when he’s sleeping so it works out okay. We’re currently saving up a deposit/rent/rental truck fund for January because we want to move really badly. I’d rather save up for it over the long term than take it from the efund but I may have to.

bogofdebt recently posted..August’s First Friday Link Love

We keep our A/C at 82 F when we’re not home and 74-76 F when we are. That component definitely could be contributing to our electricity cost, but I bet it’s the dryer that tipped us up those $3. 🙂

We definitely didn’t save up for our move since we only decided when we got notice of our rent increase that we needed to move. :/ Thankfully we don’t have to dip into our official EF for the money and we will just be paying ourselves back out of the rent savings. I wouldn’t even know how much money to save up in advance since I haven’t make a move of this magnitude without the help of my parents before. How much money do you think your move will be?

I calculated the amount of rent that we could afford to pay, added the deposit as an extra month of rent and added a pet deposit fee in there too. I also know we spent about $250 on a moving truck (which included gas) so estimated that too. Right now, unless I stop saving and paying down debt, I’ll probably have to get into the efund but I’m trying not to have to do that. It’s looking close to $1000 before the month’s rent is added into it (but we would be able to pay that out of the “rent” paycheck).

bogofdebt recently posted..Spending Recap 7/30-8/5

Our electric bill went up as well, mainly due to the insane heat that we’ve been having! Can’t wait until it cools down.

Michelle recently posted..I finally have my Masters

I hate when it cools down but you’re still paying the high electricity bills from a couple months back!

I like your top in your birthday dinner photo! You look very pretty.

I had some ridiculous grocery store trips last month. Since I walk past the store on my way home from work and stop in for what I need, I had a few trips where all I spent was $0.20-$0.40 on vegetables 🙂

Wow – $100 for electricity? Your electricity is expensive! I’ve been averaging about $10/month for the last few years, but now with a bigger place and me paying directly for the hot water heater (and it being electric), I’m curious as to how much my bill will be. I should find out within the next month as I’m billed bimonthly for electricity. I don’t have A/C, so my utilities don’t spike with the heat 🙂

On the birth control thing – I’ve been seeing posters saying that the free birth control doesn’t kick in until the new plan year :/ I’ll see when I next pick one up. I sure hope it’s now as that would save me quite a bit of money!

My July budget was okay… I was pretty busy and still am, so I haven’t looked at it in too much detail. Moving was definitely expensive, but it wasn’t really any worse than I had estimated.

The largest housing deposit I’ve had to pay is the $350 I paid in February and I took that out of savings because moving was completely unexpected and then I paid it back as I rearranged money from my January bonus.

Leigh recently posted..My Mom and Money Advice

Thanks! You’re so sweet. It’s actually the dress I bought to wear at my high school graduation, so it’s 9 years old now! I still wear it a few times per year to casual summer weddings and when I want to dress up for church, dates, and such.

What vegetables are you buying for $0.20-0.40?! Like, one onion? 🙂

I never thought about our electricity as being expensive, and we brought our budget down from $120/month last summer. We do run the A/C a lot as well as fans. Oh, and Kyle leaves his desktop on 24/7 and I’m sure we’re sucking a lot of vampire power. Our apartment doesn’t have gas but our new townhouse will, so I’m not sure what the ratio will end up being.

Our new plan started August 1 so I think I should already have the benefit, but we’ll see next time I pick it up! It won’t actually save us much as we pay $30 for a 10-week generic, but hey, every bit helps.

I like checking out our budget right when the month ends (and a bit in advance, too) so that I can do something with our budget leftovers right away!

The $895 deposit is pretty steep and they have a lot of anal clauses in the lease about the carpet so I’m worried they’re going to take a bunch of money from the deposit when we leave if they judge the carpet to be damaged. We’ll consider renting a steam cleaner when we move out to prevent that from happening.

I still have the top and skirt from my elementary school graduation, 11 years ago 🙂

Haha, yes I buy one carrot at a time 😀

Oh, I made a principal only mortgage payment with the leftovers, but I haven’t spent time analyzing my spending other than just plugging it into the formula.

My new plan doesn’t start until April 1st, so I have a feeling I’ll still be paying full price. Oh well! I budgeted for it with my FSA assuming the bill wouldn’t kick in anyways.

I’ve found some places to have really anal clauses in the lease, but then not to act on them. I hope it doesn’t turn out to be too anal for you guys!

Leigh recently posted..My Mom and Money Advice

The birth control comment piqued my curiosity — you going to be in the family way soon?

Kathleen @ Frugal Portland recently posted..A MUCH Better Metric — Net Worth!

Haha, no no no… I was referring to the Obamacare/ACA benefit of $0 copays on birth control kicking in this summer.

You are doing a great job. I’m just setting in and trying to figure out how much I should be spending every month on groceries/food out. I think I’m going to try to bring my lunch every day to school – cafeteria food can be bland and pricey – but make room in my budget for some good happy hours and dinners out.

Well Heeled Blog recently posted..Money Attitudes at Business School

Groceries are always hard for the first couple months after you move! I agree – I much prefer food from my own kitchen to anything one can get on-campus, though before I got serious about what I was eating I liked to have Panda Express once in a while. 🙂 I think your priorities are right on.

My electricity bill was out of control in July. I assume it was just excessive use of air conditioning that caused it. Afterall, it’s been over 100 degrees off and on!

I’m hoping that next month won’t be so darn hot where I live.

Good job staying on budget!

Holly@ClubThrifty recently posted..Why I Prepay My Mortgage

This summer hasn’t been too terrible overall with the heat here – then again, we were in Chicago during the record-setting weekend. I don’t think we’re running the A/C more than last year, but we’ll see if my dryer correction makes a difference in our next bill.

[…] from Frugal Portland asked if we are “going to be in the family way soon?” See July 2012 Month in Review: Money to see how the misunderstanding […]

[…] mentioned our reduced use of our clothes dryer when I was discussing our last electricity bill. For the last year we’ve been (mostly) hang-drying our clothes to save the cost of running the […]