Why Do You Travel and How Much Do You Spend?

I recently wrote a post for a higher education blog that gave an overview of how Kyle and I managed and used our money in our last year of grad school (2013-2014), which I consider to be our most (financially) optimized year. The commenters and some people on Twitter really did not care for the post and criticized various aspects of it. Most of the criticism was around the theme that our stipends were very high and cost of living very low so the piece was not useful to them.

Anyway, I’m not going to defend the post here (and I haven’t elsewhere) because I really think it needs no defense. But I do want to discuss a theme in the criticism that I found interesting.

A number of the comments on the post and on Twitter specifically pointed to the amount of money we saved into our Travel targeted savings account as evidence that we have too much disposable income to be relatable. To illustrate the concept of targeted savings accounts, I had written, “For example, we had a travel account into which we saved $350 a month, and we only dipped into it when we incurred a travel expense.” (For context, in that year, $350/month was around 7-7.5% of our gross income.)

For me, reading those comments exposed an interesting juxtaposition between how I, with full information about my life, view my spending habits, and what someone with only the numbers in front of them imagine my spending habits to be.

These commenters were looking at the numbers and thinking that $350/month for travel was an enormous ‘want’ expenditure for a grad student couple – which it absolutely is. Perhaps they were even thinking of it as a luxury.

But I, knowing the reasons for our travel and the manner in which we do it, see it as a high-priority area of spending that almost rivals paying for internet or a cell phone. Travel, internet, and cell phones are not ‘needs’ in the sense that you would die without them, but after our needs are covered you can bet that we are putting that kind of spending high on the priority list.

I’ll address each of those perspectives in turn.

We Spend a Lot of Money on Travel

Setting aside $350/month for travel (actually, our peak savings rate from earlier in grad school was $500/month – that lasted only 3 months!) for two grad students is a lot of money, no matter what your stipend is. We were fortunate to have stipends that allowed us to live a comfortable day-to-day lifestyle, grow our net worth, and spend money on large, irregular ‘wants’ like travel.

I can easily say that $350/month is a lot of money for travel because we were really, really trying to spend a lot of money on travel (or rather, set a lot of money aside in the anticipation that we would spend it). We had to work our way up to being able to save that amount of money each month; it wasn’t something we were able to do from the get-go. So it’s not that surprising that another grad student, even one receiving a similar stipend, would balk at that number – our earlier selves would have, too.

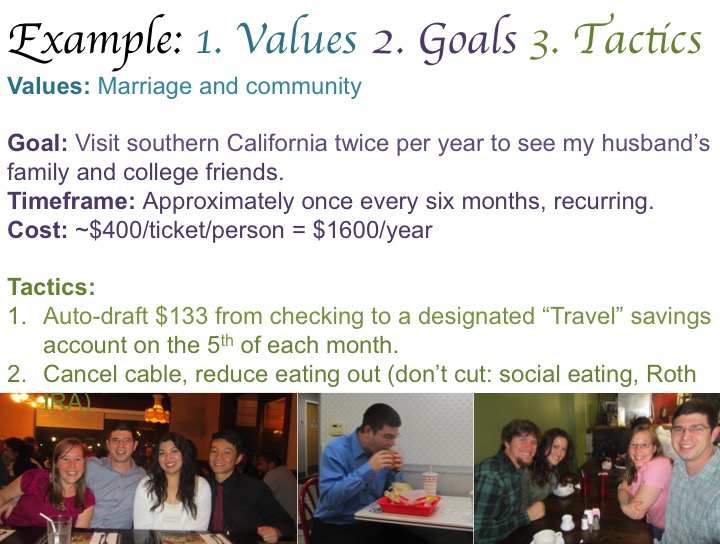

Over time, as we clarified what was most important to us, we realized that we wanted to be putting more and more aside for travel expenses so we weren’t stressed about money when travel opportunities presented themselves. We worked very hard on our budget to set aside $350/month in 2013-2014, making sacrifices in our day-to-day lifestyle to be able to fund those irregular expenses, such as moving to reduce our rent, cutting cable, using an alternative cell phone provider, eliminating eating out for convenience, benching one of our cars, and on and on! Again, this was something we optimized over time, and in the post I only presented the final product, not the process we went through to get there. (This is a process I discuss a bit in my presentations on personal finance for graduate students, and in fact I use our Travel targeted savings account as an example.)

The Where, How, and Why of Our Travel Is Not What You Might Imagine

I suspect the commenters on my post were reading the word ‘travel’ as synonymous with ‘vacation.’ Perhaps that is a reasonable assumption, and if the entire post had been about our travel budget I’m sure I could have clarified my own meaning a bit more. We drew on our Travel targeted savings account for all of our purchases related to leaving our city (flights, gas, motels, food, etc.), and I can assure you that next to none of it was for what I consider vacation.

The How and Where

Virtually all the traveling Kyle and I paid for during graduate school is termed ‘obligation travel.’ That’s not a nice way of putting it, but it does apply. During our last four years of graduate school (following our wedding in 2010), we traveled to a destination of our choosing on exactly one occasion: our honeymoon. All of the other traveling we did was to see family or friends, nearly always for major holidays or weddings.

(My parents paid for most of our expenses for two family vacations during grad school, and Kyle’s parents paid for our flights to attend his grandfather’s funeral. We were conflicted about accepting those subsidies, but in each instance decided that participating in the occasion was more important than our pride regarding financial independence. They were all wonderful experiences that we were grateful to have offered to us.)

My parents and siblings lived a 4-hour drive from Durham, so we drove to see them them for Thanksgiving and a couple other times each year. Kyle’s parents and extended family lived a 5+-hour flight from Durham. From the time that we were married, we alternated which family we saw for Christmas/winter break. I don’t think we ever visited Kyle’s parents “just because” – it was always for Christmas or because we had another local event.

Our friends from high school, college, and grad school are now scattered all over the US. During our mid-to-late 20s, many of them got married, and we were delighted to be invited to a few out-of-town weddings each year. A typical instance of wedding travel for us would be to fly out on a Friday afternoon, attend a Saturday wedding, and fly back on Sunday afternoon or a Sunday-to-Monday red eye. If we were lucky, we could justify an extra day to make it a long weekend and do some extra activities in the city we were visiting.

The Why

I want to emphasize that we entered into this ‘obligation travel’ willingly and eagerly, and I don’t begrudge the situation at all. Kyle and I saved so much money into our Travel account because community is such a high value for us. Saving that amount of money toward travel allowed us to see our parents and friends a few times per year for holidays and major life events.

We were motivated to save so much into that account because in 2010 we had to decline invitations to two out-of-town weddings of college friends we care for very much because we could not afford the plane tickets. In fact, missing those weddings, in combination with the stress of paying for some season tickets, were the impetus for starting to use a system of targeted savings accounts in the first place.

I honestly wish we could have allocated even more money to traveling so we could have seen our loved ones more often and taken true vacations. We really wore ourselves out in the last couple years of grad school, working long hours and not giving ourselves the proper time and space to refresh. I mean, we didn’t even take staycations (no cost) or go on weekend getaways (wouldn’t miss work)!

If the commenters had in mind that our Travel funds were going toward all-inclusive international resorts where we were lounging on beaches with drinks in hand, they got the wrong idea. (One commenter mentioned Majorca. I had to look up where that is because I didn’t even know. It looks like a dream!) Often, our travel often includes driving up to 13 hours in a day, red eye flights, packing multiple days worth of food in coolers, and couch-surfing – all to see friends and family for a precious few hours.

Use of Money Reveals Values (If You Take the Time to Understand)

Knowing how much money someone spends on ‘travel’ is definitely an instance where dollar amounts don’t tell the whole story. Each of us knows the reasons why we spend money on travel and what value it represents in our lives – community, adventure, work-life balance, relaxation/comfort, family, multiculturalism, health, physical fitness, etc. But when we look at how much someone else spends in this category or any other, we don’t really know how or why the money is being spent. These comments were a real eye-opener for me on how easily we can make assumptions about other people’s lives when all we see are the numbers. I much prefer formats like live, one-on-one conversations in which we can really dig into the ‘why’ behind how we use our money and get to know one another.

How much (absolutely or by percentage) money do you spend on traveling? How do you interpret the word ‘travel?’ What is the core value behind your travel?

Winter 2012 Travel Plans

Winter 2012 Travel Plans First Major Travel Plans of 2012!

First Major Travel Plans of 2012! How to Spend Less When Attending Out-of-Town Weddings

How to Spend Less When Attending Out-of-Town Weddings Long-Distance Marriage: Travel and Advice

Long-Distance Marriage: Travel and Advice

Hi Emily,

Interesting post. I set aside $100-130 a month for our travel fund. This has been enough for myself and my two teens to take a yearly summer vacation of ten days or more. Some years we don’t spend all of it, so it’s saved for the next year. In addition, any weekend trips are taken out of that as well.

I’m like you in that I don’t consider going to see family a vacation, so these are for actual “vacations.” Luckily, most family lives close anyway. That does mean we aren’t saving on lodging by staying with family, but we’ve found other ways to save instead. We typically take driving trips and camp, couchsurf and use AirBnB to stretch our money.

We don’t have cable at all, have cheap cell phones and plans and don’t spend in lots of areas other people do. It’s just a matter of priority for us. We’d rather travel.

My values behind making this a priority have always been that I wanted to expose my kids to more than their own backyard as we live in a pretty homogenous area. I wanted them to see and experience different people, cultures and places.

I love the quote by Mark Twain –

“Travel is fatal to prejudice, bigotry, and narrow-mindedness.”

My kids are now 15 and 17 and are both very open minded, non judgmental individuals. I like to think that exposing them to more of the world by traveling has played a part in that.

Danell, thank you so much for clearly sharing your values and motivation behind your travel spending! You are really viewing it as an investment in your children’s character. It is so wonderful that you have made a way to take that yearly vacation and also see your extended family regularly.

I’ve heard that comments on blogs can some times be very nasty, and I’m sorry. Commenters sometimes tend to focus on what they can’t do rather than what they can do, especially when it is anonymous / behind the safety of the internet.

That being said, it was great you were able to have so many savings accounts! By being proactive about minimizing expenses, you made room for the things you valued and lived within your means.

Kudos to you both!

The comments didn’t both me too much. Most of the criticism (general venting?) wasn’t actually about the post I wrote, so I tried to read through it to see what their real points/needs were.

I think it was hard for some of the lower-income commenters to hear the message about living out your values because at TRULY low income levels, it’s all about survival – needs only, no room for wants no matter how they fulfill your values. But for everyone living above the subsistence level, it’s an important concept!

We spend a LOT of money on travel, and we’re fortunate that most of it is for travel of our choosing, not obligation travel. We do travel to visit my BF’s family, but they live in an amazing city in South America, so it still kind of feels like a vacation to me!

That’s awesome that even your obligation travel is like a vacation. I love Kyle’s parents’ location (southern California) so traveling there doesn’t feel like much of an obligation! We have lots of friends in the area, so it is also a frequent wedding destination for us. That is great, though, that you are traveling largely where you choose to.

Back in grad school we did basically the same thing — traveled to see the parents, and travel for the occasional wedding. (We didn’t go to all weddings we were invited to, but we did go to those of close friends.)

I think if you can afford to travel at all during grad school, those destinations/reasons seem to be the top priority. We love attending weddings so we try to make it to all the ones we are invited to, although I think we’ve had to turn down a couple since that initial summer. Thankfully the (first?) peak wedding time of our life seems to have passed and we have more flexibility now.

From what I recall we said no to a wedding in France and to a wedding on a cruise ship. There were a couple of weddings only DH went to (one in FL, one in Mexico) but I didn’t go because we couldn’t afford it. We were also lucky that we were able to combine one wedding with a conference *and* we had local friends letting us stay free in their house after the conference hotel ran out, another wedding we were able to stay with DH’s parents, for another we stayed with DH’s siblings. The remaining weddings we both went and paid for hotel and plane tickets.

Everyone spends their money on different things. I don’t understand why some tend to be so angry when it comes to travel spending. We’re all about travel and spend a good amount on it. In fact, we just bought an RV and are traveling non stop in it. I love it!

I think traveling almost uniquely gives an impression of opulence and need to keep up with the Joneses! But we are all at different points in our financial journeys so there’s no point in comparing.

What do you think the value motivation is for you with respect to traveling?

$50k might be the median household income in the US and is definitely higher than what many grad students live on, but that doesn’t change the fact that many $50k households don’t live within their means, or are unable to attend events like weddings because they haven’t saved up in advance.

I also think it’s worth noting that a $25k stipend for a STEM PhD student is likely a small fraction of what your degree could earn you later in academia or industry. When I was in grad school, many of my peers basically treated their stipends like a small blip in their future “normal” incomes and spent money (some of which was student loans) based on how they wanted to live, not how much money they actually had. I remember one group trip to hang out for a week in South America had a price tag of $5k. Maybe that’s the kind of travel those commenters had in mind?

Good thing you are making that comment here and not in the other comments section! I don’t think your sensible view would be as welcome.

Yes, I agree with you. I also agree with many of the comments on the post that went beyond the scope of my piece.

I have seen that attitude as well among some grad students, and I really hope it doesn’t come back to hurt them later. It’s always a gamble when you say “I’ll get around to X habit later,” whether it’s financial health or anything else. I am happy with the path we took during grad school and that we truly learned to live a balanced life within our means at that income level. We are seeing the fruits of it already.

I love to travel! I don’t even think you needed to explain yourself for it. People all have something they decide to spend their money on. At the core of it, like you mentioned, the way you use your money is showing what you value. Nothing can replace that community and family. Kudos to you for making community a priority!

Have a great weekend!

Thanks, Sylvia! I think behind all our high-priority “wants” are values that anther person could at least understand if not agree with.

I and my family travel because we want to spend quality time together at different places. And, when we travel, we spend a lot and do not mind expenses especially on food because what we do is We just save a lot for this expense prior to travel to meet those expenses during travel, Emily.

That is a similar system to what we use. It’s funny how we can be highly frugal 95+% of the time to allow ourselves to be un-frugal in the rest. Nothing wrong with that!

[…] game if you don’t take some time to take care of your physical, emotional, and social needs. If traveling is something that meets those needs for you, that’s great! Start saving for travel so that you can afford to reward yourself with a trip […]

If you’re saving for a specific thing, you shouldn’t feel guilty about spending the money on that specific thing!

Yep – it’s all in the plan!