Are You a Tightwad, a Spendthrift, or Unconflicted?

Yes, there is an academic definition! Rick, Cryder, and Loewenstein developed the Tightwad-Spendthrift scale, published in 2008 in the Journal of Consumer Research. I came across it when reading a paper investigating the connection between spendthrift/tightwad disparities in spouses and marital satisfaction (more on that later). I gave myself the test and I want you to take it, too!

Yes, there is an academic definition! Rick, Cryder, and Loewenstein developed the Tightwad-Spendthrift scale, published in 2008 in the Journal of Consumer Research. I came across it when reading a paper investigating the connection between spendthrift/tightwad disparities in spouses and marital satisfaction (more on that later). I gave myself the test and I want you to take it, too!

From the appendix of “Tightwads and Spendthrifts”, here is the (adapted) Spendthrift-Tightwad Scale:

1. Which of the following descriptions fits you better? Score yourself between 1 and 11, where 1 is “tightwad (difficulty spending money)”, 6 is “about the same or neither,” and 11 is “spendthrift (difficulty controlling spending).”

2. Some people have trouble limiting their spending: they often spend money – for example, on clothes, meals vacation, phone calls – when they would do better not to. Other people have trouble spending money. Perhaps because spending money makes them anxious, they often don’t spend money on things they should spend it on.

a. How well does the first description fit you? That is, do you have trouble limiting your spending?

1: Never; 2: Rarely; 3: Sometimes; 4: Often; 5: Always

b. How well does the second description fit you? That is, do you have trouble spending money? (reverse-scored*)

1: Never; 2: Rarely; 3: Sometimes; 4: Often; 5: Always

3. Following is a scenario descriving the behavior of two shoppers. After reading about each shopper, please answer the question that follows. (reverse-scored)

Mr. A is accompanying a good friend who is on a shopping spree at a local mall. When they enter a large department store, Mr. A sees that the store has a “one-day-only-sale” where everything is priced 10-60% off. He realizes he doesn’t need anything, yet can’t resist and ends up spending almost $100 on stuff.

Mr. B is accompanying a good friend who is on a shopping spree at a local mall. When they enter a large department store, Mr. A sees that the store has a “one-day-only-sale” where everything is priced 10-60% off. He figures he can get great deals on many items that he needs, yet the thought of spending the money keeps him from buying the stuff.

In terms of your own behavior, who are you more similar to, Mr. A or Mr. B?

1: Mr. A; 2; 3: about the same or neither; 4; 5: Mr. B

* Reverse scoring means recording for that question the score of 6 minus the score you choice, i.e. if I answered “never” I will add 5 to my running score tally.

If you scored between 4 and 11 you are labeled a “tightwad;” if you scored between 12 and 18 you are labeled “unconflicted;” if you scored between 19 and 26 you are labeled a “spendthrift.”

I wasn’t sure if I would be a tightwad or unconflicted, and I scored a 12, so I barely squeaked into the unconflicted category. Kyle scored 12 also! I knew we would be close on the scale but I thought he would be a couple points further away from “tightwad” than I was.

One aspect of this test that I found difficult was the objective language: “they would do better not to,” “they should spend it on,” and “needs.” I don’t think it’s trivial to step outside yourself to assess how much money you should ideally be spending and contrast it to your real behavior. The simple example is of Mr. B passing up buying stuff he “needs” even though it is on sale. I guess I think that if Mr. B really believed those items were needs he would buy them and the mere fact that he passed them up means that they were not in fact needs. If you are at an extreme end of the scale perhaps it is easier to say “I should be freer with money” or “I should be tighter with money” but I think it’s difficult for those of us without major outside pressures to move toward the middle of the scale (because we are already there) to objectively assess ourselves.

What was your score and if you are married what (do you think) is your spouse’s score/designation? Is it what you expected? What do you think the strengths and limitations of this test are?

photo from freedigitalphotos.net

Filed under: the literature · Tags: academic paper, quiz, spendthrift, tightwad

Can You Change Your Tightwad/Spendthrift Personality?

Can You Change Your Tightwad/Spendthrift Personality? What Happens When a Spendthrift Marries a Tightwad?

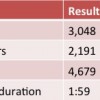

What Happens When a Spendthrift Marries a Tightwad? Blog Statistics Update August to September 2012

Blog Statistics Update August to September 2012 What’s an Impulse Purchase?

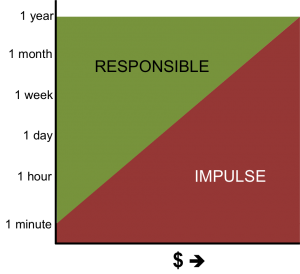

What’s an Impulse Purchase?

I think my wife and me both fall in the middle somewhere. We’re very tight when it comes to what we spend on largely, but we do save up bits here and there, so that we can go out to the movies and dinner and order anything we want without worry. So, a little bit of both!

TB at BlueCollarWorkman recently posted..How to Prevent a Balcony Collapse

That’s our approach, too! I think we spend pretty close to what we “ideally should.”

I am somewhere between and tightwad and unconflicted. I know that I am not as cheap as I used to be!! I have relaxed a little and am much happier =)

Holly@ClubThrifty recently posted..Combining Finances: Holly’s Perspective

That’s a great point about being able to change over time. I think I’ve changed from being more of a spendthrift (b/c it wasn’t my money!) to unconflicted. I’m a little concerned I’ll inflate back to spendthrift, though – is that the fear of a tightwad?

With me I kind of alternate back and forth. With certain things I’m totally a tightwad, but then there are days when I just let loose and buy whatever I want. So I’m not sure how accurate that test would be for someone like me. I think for most people it really would depend on the situation.

Modest Money recently posted..Importance of Blog Networking

Hm, so you sort of occupy both extremes of the scale! Do you think that’s a balanced approach or would you prefer to swing less?

I do need to still work on limiting the times when I get too carefree with my money. It’s not really the ideal balance.

Modest Money recently posted..Promoting Financial Affiliate Programs

I scored a 16, but mostly because the 2nd & 3rd questions were kind of ambivilent for me. Like Jeremy, it all depends on the situation. In general, I’m probably a tightwad, but on certain things I would probably do better to “forget” my wallet.

Edward Antrobus recently posted..Oportunity Cost: Do You Pick Up Change?

Yeah, for question 3 I was like “I literally have never and would never be in that situation!”

I scored an 11 which puts me at the end of the tightwad category. I think I’m ok with this!

Kyle @ YPFinances recently posted..10 Things To Know When Planning a Las Vegas Bachelorette Party

Hey Kyle! Glad to hear from you!

I’d be fine with that score, too. It’s pretty useful to be a tightwad, especially not an extreme one.

I scored a six… maybe I am not doing it right? Or maybe I really am a tightwad?

Kathleen @ Frugal Portland recently posted..Camping: Not Much Cheaper than Hotels

That is a bit extreme, BUT you are trying to get out of debt! I think it’s called for.

Surprsingly, I scored a 14 – which makes me “unconflicted”. I would have thought I would’ve been in the “tightwad” category, but apparently not! I almost wish that score was a few points lower, but I’ll take for what it is 🙂

Tie the Money Knot recently posted..6 Types of Financially Toxic People

Similar to my expectation, then. I think if you’re unconflicted you are less compulsive about one behavior or another, so you can choose to be more of a tightwad without feeling like you have to.

[…] Personal Finance – Are You a Tightwad, a Spendthrift, or Unconflicted? Emily shares a great scoring system developed by the Spendthrift-Tightwad scale. So, what was your […]

[…] the past few years, and what the reasons for that might be.Emily @ Evolving Personal Finance writes Are You a Tightwad, a Spendthrift, or Unconflicted? – Take this survey used by academics to pin yourself and your spouse on the tightwad-spendthrift […]

[…] from Finance Fox included Are You a Tightwad, Spendthrift, or Unconflicted? in his weekend […]

[…] week we discussed a tool used by some researchers to peg people on a tightwad-spendthrift (TW-ST) scale – please take the quiz and share your (and your spouse’s) score on that post! But considering […]

[…] Are You a Tightwad, a Spendthrift, or Unconflicted, at Evolving Personal Finance […]

[…] 3) Are You a Tightwad, a Spendthrift, or Unconflicted? […]

[…] I’ve imposed those tendencies on Kyle to a great extent since we got married. Kyle is a saver as well but he enjoyed buying electronics before we were married and those purchases have slowed […]

[…] “tightwad, unconflicted” – these two weird, seemingly unconnected words are actually technical terms from The Literature […]

[…] money we touch is “ours.” While we are largely similar in our outlook on our money (we are both unconflicted tightwads), we do encounter friction from time to time – we have different definitions of frugality and are […]

[…] If you’re curious to find out what type of spender your target audience is, then we advise that you check out this ‘Tightwad – Spendthrift’ Scale: http://test2.evolvingpf.com/2012/08/are-you-a-tightwad-a-spendthrift-or-unconflicted/ […]