Evolving Personal Finance » Archive

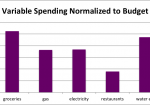

May 2012 Month in Review: Money

Like last month, this was a great one for coming in under budget overall! I think the key is that we have a high-limit grocery budget (in comparison with 6 months ago) and we’re getting our CSA boxes so we’re spending less out of pocket on food and have a lot of buffer in that area. We spent a crazy amount of money this month but our targeted savings accounts were able to cover nearly all … Read entire article »

Filed under: month in review

Weekly Update 18

Right now we are in the mountains of North Carolina on a retreat with our graduate Christian group! We’ve been hiking and swimming and hanging out and having a lovely time. We also had a really good small group meeting this week and I had one really successful morning at work! This week I attended my first meeting of the financial literacy committee at my university. They recently launched a website and have been putting on workshops related to personal finance for the last few years. I’m excited to see how I can get involved! Posts I Liked John from Married (with Debt) describes private mortgage insurance as a shadow debt. The Happy Homeowner wrote at The College Investor some insights into developing an emergency fund. Melissa from Bible Money Matters argues for continuing to … Read entire article »

Filed under: weekly update

Decisions We Are Wrestling With

Over the past few weeks we have had a few financial opportunities and decisions crop up and we’re taking our time trying to decide what to do in each situation. I’d like to take this post to share with you what’s been going on with us. Wedding We were invited to a wedding in Chicago (black tie!) at the end of June and we’ve been going back and forth about whether to attend. The wedding itself should … Read entire article »

My Dream in 23 Years – What’s Yours?

One of the important components of the All Your Worth Balanced Money Formula is the Dream Fund. Of the 20% of take-home pay that is supposed to go toward savings, 25% of it is for your dreams – aside from retirement and all of that. When I was a kid I thought I would want to own a beach house. Maybe some other people want a plane, an around-the-world cruise, or to pay for their … Read entire article »

How Might Your Spouse’s Love Language Affect Your Finances?

I’m sure that many of you are familiar with Gary Chapman’s theory of the Five Love Languages (affiliate link – thanks for using!). But have you ever considered how your love language and your spouse’s love language might affect your spending habits and career? For those of you who haven’t read any material by Chapman, I’ll briefly summarize the idea: Every person has an emotional “love tank” that can be filled or emptied by their relationships (we’ll … Read entire article »

Filed under: books, marriage, psychology

Weekly Update 17

Low-key week for us. The only out-of-the-ordinary event was a going-away party for some close friends of ours. We used to be in a church small group together so we got all the members of the group from when it disbanded together. It was a lovely evening and a great reminder to capitalize on the time we have with our friends while we still live near them! Kyle and I finally returned our long-held DVDs to Netflix, so we watched our two new received films this weekend. On Friday we watched Bridesmaids and we were really disappointed! The movie got such good reviews but we just found it very sad and not nearly as funny as some of Apatow’s other movies. I also think that movies with SNL stars are a … Read entire article »

Filed under: weekly update

We Have Too Many Gift Cards!

Kyle and I have recently been reminded of a pretty good problem to have: We have a ton of gift cards and we have no plan for spending them! Why We Have So Many Cards 1) I think we might receive more than the average people because I, particularly, am very difficult to buy for. People know that I like to read so they tend to give me gift cards to booksellers (we have a lot to … Read entire article »

Filed under: found money, frugality

Why Do Stay-at-Home Parents Need Their Own Credit Cards?

I read an article last week on CNN Money with a premise that I found absolutely ridiculous. The article covered a group of stay-at-home moms (parents?) who were protesting a portion of the Card Act that requires that credit issuers evaluate a credit applicant based on his/her individual income instead of household income. The result was that some stay-at-home parents with good credit scores have been denied credit cards when they applied for them in … Read entire article »

Filed under: credit cards, income, marriage

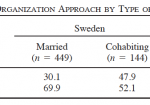

Joint and Separate Money Series: Odds and Ends

This is the third installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In each post in this series, I review the methodology and major findings of a paper in the field and then discuss how my husband and I fit into the results. I encourage you to share your reactions to the … Read entire article »

Filed under: marriage, the literature

Weekly Update 16

We had an unusually busy week for after-work events! And almost all of them were church/fellowship related. Monday: We helped prepare a dinner for 200 people at a local homeless shelter with a group from our church. Chiefly, I opened about 22 cans of black beans (and helped heat 67) an opened and organized Oreos. Tuesday: We attended a lovely event honoring the preparing for marriage ministry at our church. We went through the program two years … Read entire article »

Filed under: weekly update