Evolving Personal Finance » budgeting

Where Should We Give?

In March 2009, I pledged a certain amount of money to our church for an expansion campaign. It included an up-front donation and monthly installments over a three-year period. Next month is the last I’ll make that monthly installment and (after re-adjusting my tithe) we are going to have $58 a month freed up in our budget. Since we are accustomed to giving away that amount of money, we are not just going to completely keep … Read entire article »

Our Luxuries

I recently started a gratitude/praise journal and it is slowly helping me become more aware of all the “little” things in my life that are truly wonderful that I tend to overlook. I thought I would list out here the luxuries or indulgences my husband and I enjoy, even on our tight budget. You’ll probably notice a lot of overlap with our targeted savings accounts here – they tend not to be spontaneous but they are definitely … Read entire article »

Emergency Budget Exercise

How would you survive if you lost your primary source of income? The US is (arguably) just starting to rebound from a really tough economy and job market in which we’ve seen more long-term unemployed people than ever before. In addition to the job market, an accident or illness could befall your family rending you unable to work. These are depressing situations to consider, but better to consider them before they happen than to be … Read entire article »

Filed under: budgeting, emergency fund, personal

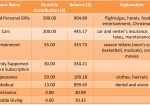

Our Short-Term Savings Accounts

The aspect of our financial situation of which I’m most proud is our short-term targeted savings accounts. I’m proud of them because they are a solution to a recurring monthly-budgeting problem – regular but infrequent expenses – that I came up with all on my own. (Not that I’m the only one, of course – I just did it independent of those others.) And I actually think they’re really fun. Targeted savings accounts: 1) Take the stress … Read entire article »

Filed under: budgeting, savings, targeted savings

Psyching Out My IRA

For the last six months or so I’ve wanted to max out my IRA. Like, I’m dying to. I’ve looked at our budget numerous times, attempting theoretical cuts here and there that could get me to the limit. I took my contribution from just under 10% of my gross income to about 16% but going the rest of the way is just not happening. Why do I want to max out my IRA? Two psychological precepts … Read entire article »

Filed under: budgeting, goals, retirement, savings, stock market

Awesome Financial Benefits to Being a Grad Student (and Terrible Detriments)

So, graduate school kind of sucks – especially Ph.D.s because they go on forever. (Can you tell I’ve been at it a while?) However, there are definitely some financial benefits to being in school, particularly the kind of school that pays you to be there (though not nearly as much as we’d be getting in the real world). Kyle and I collaborated on this list, but we’re represent a small slice of grad student experiences. … Read entire article »

Filed under: budgeting, grad school

Keeping Christmas in Perspective

Christmas 2010 was a financial disaster. It was our first Christmas as a married couple and we had major clashes over gift-giving philosophies that resulted in higher-than-usual spending for both of us. We also flew to CA – our largest single expense. When I tallied it all up in January I resolved that we wouldn’t let another year play out that way. I completely lost focus on “the reason for the season” and got caught … Read entire article »

Book Review and Application: All Your Worth

Last month I read All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Warren Tyagi (affiliate link – thanks for using!). The authors have another very interesting book titled The Two-Income Trap that I have skimmed and am now more interested in reading in full. You may recognize Elizabeth Warren’s name because she was the deputy director of the new federal agency spearheading consumer finance protection until last summer. I really, really … Read entire article »

Filed under: books, budgeting, credit cards, giving, savings

Small Steps to Speed Financial Accomplishment

Earlier this week I shared with you some of the ways my financial situation falls short of my ideals. I know what I should be doing but it seems difficult to actually get it done. I brainstormed a few steps I have taken in the past and should re-apply now. These tweaks are probably most useful for people who keep budgets and are auto-saving but want to find ways to be a bit more … Read entire article »

Filed under: budgeting, found money, goals, savings

I’m Not Perfect. Not Even Close.

Sometimes personal finance bloggers come across like they have everything figured out and their money management is running exactly right on autopilot. Often, people start blogging during or after getting out of a massive amount of debt and so they have a tight focus and seemingly boundless motivation. These are incredible achievements and should be commended. I’m sure these bloggers don’t seek to conceal their current imperfections from their readers but I think it comes … Read entire article »

Filed under: budgeting, retirement, savings