Evolving Personal Finance » Archive

Can a Net Income Boost Compensate for Not Having Earned Income?

Two weeks ago I got a great comment on my Roth IRAs for Graduate Students post from Joe. He asked “Why would you want fellowship income to be reported as earned income? The payroll tax (6.2%+1.45%) that must be withheld from wages … in my opinion, makes the unearned income classification better.” The payroll tax exception for 1099-MISC income wasn’t something I addressed in the Roth IRA post (although I mentioned it as a perk for some … Read entire article »

Filed under: budgeting, retirement, taxes

Proposed Series: Literature Review of Joint and Separate Accounts

During a conversation with my officemate about the diversity of comments concerning joint and separate money within marriage, she told me that during college she had read a sociology paper on the ideal number of accounts for a married couple (as she recalled, 5). It had not occurred to me that such topics would have been studied by researchers but I was immediately excited about the prospect of learning about such work. During college I … Read entire article »

Filed under: budgeting, marriage, the literature

Weekly Update 13

Kyle and I are in California for our 5-year college reunion! I hope that explains my commenting absence in the last couple days. I can’t spend much time writing about it now but I may do another mini-vacation post. Suffice to say, we are having a great time! Posts I Liked My Money Design listed four great, straightforward steps for evaluating the mutual funds available to you in a 401(k) or 403(b). I’m a little scared of … Read entire article »

Filed under: weekly update

How Do You Decide What to Spend on a Wedding Gift?

Today we’re going to discuss a point of etiquette! This post was inspired by a recent invitation we received to our first black tie wedding of our peer group. Since we’ve been married, Kyle and I have worked out a standard amount of money to spend on a wedding gift. We choose gifts from the couple’s registries that total to about $70-80 so with tax and (sometimes) shipping it’s usually around $80-90. That range is purely … Read entire article »

The Fact and Fiction Behind “Two Can Live as Cheaply as One”

Everyone’s heard the phrase “two can live as cheaply as one.” In one sense it’s absolutely true: when you live in a home by yourself and someone moves in with you – a roommate or spouse who pays his own way – your per capita expenses will go down. You have someone to split the rent and utilities with. But the way the phrase is usually applied is to married couples – as if just … Read entire article »

Filed under: budgeting, choices, frugality, goals, lifestyle creep, marriage, spending

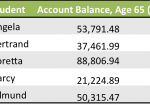

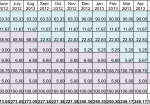

Targeted Savings Account Calculation: Cars through Aug2013

This weekend I re-projected the amount of money we need to save monthly into our Cars targeted savings account. I’d like to share my method with you so that you can see as an example how we decide how much to save into each savings account. The Cars account is a good one for this exercise because the payments we make out of it are very well-defined (unlike Travel or Appearance) but they’re shifting a … Read entire article »

Filed under: budgeting, cars, targeted savings

The Slippery Slope of Separate Money

One of the basic rules of marriage that we were introduced to in premarital counseling: Don’t keep track. Life is not 50:50, nor should it be. While both spouses should contribute to a marriage and household, it’s both fruitless and fodder for fights to try to make everything fair and even. At the moment, we keep our finances completely joint. We still have some leftover separate accounts, but all of our functioning money is joint. And … Read entire article »

Filed under: budgeting, marriage, personal, spending, targeted savings

Mini-Vacation Financials: Smoky Mountains Trip for a Wedding

This post as a case study example of how we use our Travel savings account to have a fun (and not too extravagant) weekend away for a wedding and to share some photos from our weekend! The Plan Kyle and I received a wedding invitation a few months ago from one of our very best college friends for her wedding in the Smoky Mountains. Of course we knew we would attend so we just had to decide … Read entire article »

Organic Search Terms

EPF’s organic search traffic has really spiked up in the past couple weeks – well, at least in comparison with what it used to be! Just last week I started looking at the search terms leading people to EPF (people, not bots). Today I’d like to take a look at a few of the search phrases. Post with the Most By far my most popular post in terms of being found by the wider internet is the … Read entire article »

Filed under: blogging, grad school, retirement

Weekly Update 12

April 22nd, 2012 | 11 Comments

This week we’ve been recovering from our trip to TN last weekend and looking forward to our 5-year college reunion next weekend! On Tuesday night we saw Bring It On at our local theater as part of their Broadway musicals series! I thought it was great! The plotlines and characters were completely different from the movie and I thought it was quite funny (especially the characters of Bridget and Skylar). Kyle was not quite as enthused … Read entire article »

Filed under: weekly update