May 2012 Month in Review: Money

Like last month, this was a great one for coming in under budget overall! I think the key is that we have a high-limit grocery budget (in comparison with 6 months ago) and we’re getting our CSA boxes so we’re spending less out of pocket on food and have a lot of buffer in that area.

We spent a crazy amount of money this month but our targeted savings accounts were able to cover nearly all of it. See the bottom of our post for the amount of money I was able to zero out of our checking accounts!

One of our credit cards was stolen midway through the month. A bunch of fraudulent charges from Mexico showed up (and then foreign transaction fees) but Chase flagged them and overnighted new cards to us. (A day without our primary credit card – what would we do?!?!) It actually took us two calls to Chase to get it all resolved, which was a bit annoying.

The Everyday Budget

Things that stay the same every month and are not interesting to report:

- INCOME: our paychecks

- SAVINGS

- Roth contributions

- targeted savings accounts

- GIVING

- tithe

- EXPENSES

- rent

- cell phones

- internet

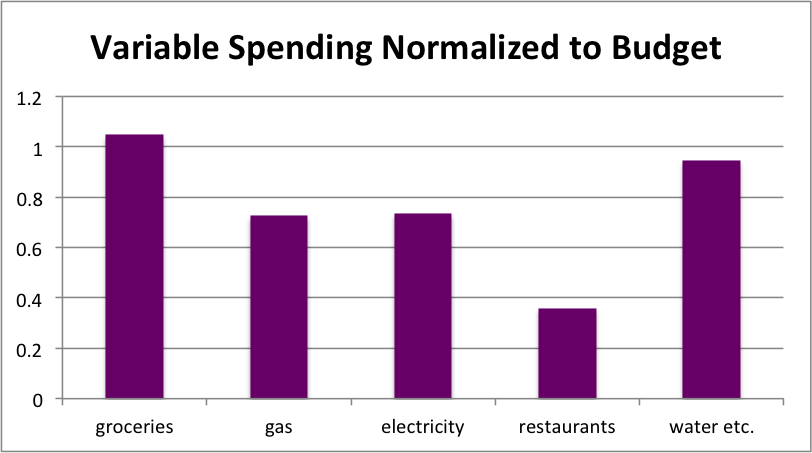

In terms of our discretionary/variable spending:

Groceries: We slightly exceeded our budget here. We visited grocery/warehouse stores nine times this month (a lot for us!) and the farmer’s market twice (not as much as I would like). The trip that put us over the top was to Costco to buy meat to share at a Memorial Day weekend cookout. I think we’re in good shape going into next month as we have a lot of food on hand.

Gas: I think we’re using about 2.5 tanks of gas each month, which is $90 if we fill up twice and $135 if we fill up three times. This was a two-times month.

Restaurants: We only went out once this month, and it was to a fundraiser hosted by a local restaurant where our friend’s coverband was playing. We had a Restaurant.com gift certificate so we only spent $18.49 on an entrée, an appetizer, and a beer. We also gave $3 to a friend to cover the meat at a cookout.

Every month we also have some random other transactions that aren’t covered in the budget but aren’t supposed to be taken out of a targeted savings account.

Income:

- I stopped by a table in the café outside my office and took a survey. As a result, I got $10 and made a $4 donation to the school.

- We redeemed $27.93 of credit card rewards as a statement credit.

- We received a very generous gift for our second wedding anniversary, but it didn’t go into the general budget.

Expenses:

- We purchased shoes this month but overspent our Appearance budget, so we had to cover $53.49 in the general budget.

- I paid my bursar bill this month, which was a $4.99 late charge from our library from a semester or two ago.

Spending Out of Targeted Savings

In total, we spent $973.63 out of our targeted savings accounts this month, whereas monthly we save $853. So it was a month made possible by this savings strategy!

Travel and Personal Gifts

We bought some chocolates and candies for our friend’s birthday. I also chipped in $10 for gas to my departmental retreat.

Cars

We paid for 6 months of car insurance this month, which was $418.47.

Entertainment

We renewed our season tickets to the Broadway musicals series at our local theater for the 2012-2013 season for $386. We also saw “The Hunger Games” – with out student discounts, the total was $15.

CSA and Local Food

I’ve decided to stop using this account for CSA overages and local food, at least for the summer.

Appearance

We spent $165 on 4 pairs of shoes. $109.49 of this came from the targeted savings account and the rest came out of the general budget. We’ll use some of the balance next month to repay our general budget.

Medical

No spending this month.

Electronics

No spending this month.

Charitable Giving

Lots of activity in this account this month!

- We donated $50 to our undergraduate institution after attending our reunion.

- We donated 67 cans of black beans ($40.32) to a local homeless shelter. We made a dinner for over 200 people at the shelter with a group from our church.

- We gave $20 to Jacob for his multiple sclerosis bike ride.

- We paid/donated a $20 cover charge for a concert our friend’s band did at a local café (where we spent the $18 on dinner). I thought this should come from “Entertainment” and Kyle thought “Charitable Giving,” but it was sort of both. We donated the money but we received a lot of ’70s and ’80s covers in return.

Budget Adjustments

This was our first month with our new lower Cars savings rate and increased Medical savings rate ($45 shift). Other than that, we didn’t make any changes.

This month we have a whopping $185.13 left over! I think we do, anyway – it’s such a large amount that I keep checking my math over and over to make sure. I’m transferring it to our nest egg, thus reducing our debt-to-ourselves considerably. 🙂

How was May on your budget? What has been your largest amount of budget leftovers, and over how many months was it gathered? Do you have any particularly good or bad experiences dealing with a stolen credit card or similar?

Filed under: month in review · Tags: cover band, donations, restaurant.com, targeted savings

July 2012 Month in Review: Money

July 2012 Month in Review: Money November 2012 Month in Review: Money

November 2012 Month in Review: Money June 2012 Month in Review: Money

June 2012 Month in Review: Money April 2012 Month in Review: Money

April 2012 Month in Review: Money

I’m posting our May update next Monday but it was a little rough for us. Similar to you we did a great job sticking to our normal budget, but it was our various savings account that got destroyed. We spent over $1300 in car repairs (new tires and struts), had the car insurance premiums, HOA dues, and a few other things.

Good work overall though…that sucks about the CC getting stolen but at least Chase was all over it.

WorkSaveLive recently posted..Blog Income and Site Statistics May 2012

Where did the money for those incidentals come from? I can’t recall if you do targeted savings or not.

I actually have yet to have a credit card stolen! At least Chase overnighted a new card to you!

9 times to a grocery store is pretty normal for me probably since I tend to stop 2-3 times a week on my walk home from work. But I can also see that being abnormal if you drive to the grocery store.

I’m loving my summer gas usage! I think I’m using about 3/4 of a tank per month or so versus the previous 1.25 tanks per month from the winter. My 16 mile round trip sport season ended in March, so now I’m just down to the sports I can walk to and the 4-5 mile round trip one, so that makes a huge difference in my gas usage.

What did you end up doing with your anniversary gift?

Yay for reducing your debt to yourselves considerably 🙂 I always love doing that! I borrowed about $8,000 or so from myself for my down payment back in December and it was so nice to pay it all back with my January bonus – that made me feel much better, especially when things went south on the deal.

I think my largest budget leftover might have been $600, but most of that was mysterious extra money in my checking account and no more than half of it budget leftover. I find that on the months with travel, there is more budget leftover because I’m spending out of the travel category instead of the normal food/entertainment categories. I put $350 from May’s budget leftover to make the travel category less negative and I left the rest in the checking account to accumulate for next month.

Leigh recently posted..Money Mindsets: Spending

We’ve had our cc number stolen a few times but have had no ill effects. This one was the weirdest because it should have been easy for them to identify and remove all of the charges (all in Mexico to ONE company) yet they didn’t get it all done right away.

Each of those trips to the grocery store were pretty significant buys – but I think the number was a bit high because on a few days we visited two stores to maximize our spending-less.

So far the anniversary check has not been deposited! And while it should be soon, we haven’t made a formal decision. We decided to go on our short trip to Chicago so some of it might get spent there. We were out of town last weekend so we haven’t had a chance to sit down and plan what to do with it yet, and probably won’t until sometime next week. We also just received our state tax refund so that money can go to repay ourselves as well!

That’s a lot of things going on in there – awesome charity contributions!

Jeff @ Sustainable Life Blog recently posted..May 2012 Monthly Review

Not every month is like that! We save $58/month to that account so some months we make donations and some we don’t.

May was an amazing month for us financially, but I’m not sure I can brag since we really HAD to have a good month after we didn’t hit our goals in April. I think you should put the dinner under “charitable” since you wouldn’t have gone out to eat had it not been for charity. We are the same way. We never go out to eat, unless it’s for a birthday or charity. One of my best friends invited us out to dinner this weekend for her birthday and I’m so torn! Do I go and just order a drink? Do we both go, pay for a sitter, buy dinner, each have a drink because she’s my good friend? I’m just going to pout about it until Jeff gets home tonight and we will hopefully decide then. It’s tough being frugal!

Michelle recently posted..Take That, Debt Monster!

Great job meeting your goals in May!

Well, the food we ate definitely wouldn’t count as a charitable donation because the food money didn’t go to the cause, only our covercharge did. We could have attended, paid the covercharge, and not had anything to eat or drink.

I would go out with my friend, perhaps without my husband. I actually have gone out lots of times in the past couple years without having anything to eat or drink because I’ve been on a strict diet. If you both go maybe you can trade babysitting duties with another couple instead of paying for a sitter?

Good work! You’re doing an outstanding job.

Kathleen @ Frugal Portland recently posted..Update on my eBay venture

Good job on keeping such detailed track of your expenses. I track our income/expenses/savings, but haven’t been attentive enough to track every single purchase.

Good work on the donations!

Julie @ Freedom 48 recently posted..The Globe and Mail’s “Me and My Money”

We use Mint so it’s quite easy. And we don’t make all that many purchases!