Evolving Personal Finance » Archive

Feeling Financially Independent

This post was inspired by a Marketplace Money program from last July. The hosts asked all the guests and interviewees to briefly share about the time in their lives when the first felt financially independent. Many answered with “Well, I’m still not…” and others talked about signing their first lease, getting their first full-time job, paying their utilities, that type of thing. My answer to this question is a bit different and it hinges on the … Read entire article »

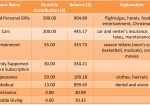

Our Short-Term Savings Accounts

The aspect of our financial situation of which I’m most proud is our short-term targeted savings accounts. I’m proud of them because they are a solution to a recurring monthly-budgeting problem – regular but infrequent expenses – that I came up with all on my own. (Not that I’m the only one, of course – I just did it independent of those others.) And I actually think they’re really fun. Targeted savings accounts: 1) Take the stress … Read entire article »

Filed under: budgeting, savings, targeted savings

Where Are My Resolutions?

It seems like the blogosphere has exploded with financial, health, and other goals this week – all for the first, I suppose. I love goals and I love watching other people accomplish them (or admit failure/delay). However, my husband and I haven’t made New Years goals of any sort. And why not? 1) New Years is not my favorite time for goal-setting – my favorite time for goal-setting is immediately. My last two major goal projects … Read entire article »

My Strategy for Market Volatility

2011 was an incredibly volatile year in the stock market. It seems like every day the indices move at least a percent. What’s a long-term, buy-and-hold investor to do? I have heard financial advisors suggest that you only check your portfolio balance once per year to prevent freaking out. I used to check my IRA balance about once per month to record my progress. Now that I listen to APM’s Marketplace daily I always know what’s going on … Read entire article »

Filed under: psychology, stock market

(Workouts + Vegetables) * Insurance = $$

In November I realized I was being rather irresponsible with our family finances because I didn’t know what the deductible and maximum out-of-pocket amounts were for our employer-sponsored health insurance. We don’t get a choice of plan and seem to change insurance companies yearly so I hadn’t checked our coverage for our current plan (Blue Cross Blue Shield of North Carolina). I downloaded the 86-page pdf booklet for our plan and found what I was … Read entire article »

Filed under: food, found money

How Much Money Am I Eating?

Recently my husband has accused me (jokingly?) of eating the greater part of our grocery budget. I eat low-carb/low-sugar and am considering transitioning to Paleo. Right now I’m still eating conventional meat, so that’s not as expensive as it could be, but I eat a lot more meat than my husband does. His staples are cereal, rice, etc. So I decided to evaluate. While I wouldn’t call this a typical week, it’s at least a random … Read entire article »

Paleo Personal Finance

I was pleased to stumble across personal finance advice in a very unexpected place – a book on the Paleo diet/lifestyle. I’m considering “going Paleo” so I’m currently reading The Paleo Solution: The Original Human Diet by Robb Wolf (affiliate link – thanks for using!). I knew that the Paleo lifestyle advocates getting lots of quality sleep and wasn’t surprised to find a whole chapter devoted to cortisol. Basically it just explains how we evolved to … Read entire article »

Filed under: books, debt, minimalism

Christmas 2011 Goals Recap

We did fairly well accomplishing our monetary goals for Christmas. Goal 1a: Cap spending at $10/recipient for extended family members. Result: While we didn’t succeed in capping each individual gift at $10, we did get the average under $10 – $9.65/recipient for Kyle’s extended family (about 15 recipients) and $5.30 for my extended family (one gift for a family). Goal 1b: Cap spending at $50/recipient for extended family members. Result: We succeeded in spending less than $50 per recipient … Read entire article »

Psyching Out My IRA

For the last six months or so I’ve wanted to max out my IRA. Like, I’m dying to. I’ve looked at our budget numerous times, attempting theoretical cuts here and there that could get me to the limit. I took my contribution from just under 10% of my gross income to about 16% but going the rest of the way is just not happening. Why do I want to max out my IRA? Two psychological precepts … Read entire article »

Filed under: budgeting, goals, retirement, savings, stock market

Awesome Financial Benefits to Being a Grad Student (and Terrible Detriments)

So, graduate school kind of sucks – especially Ph.D.s because they go on forever. (Can you tell I’ve been at it a while?) However, there are definitely some financial benefits to being in school, particularly the kind of school that pays you to be there (though not nearly as much as we’d be getting in the real world). Kyle and I collaborated on this list, but we’re represent a small slice of grad student experiences. … Read entire article »

Filed under: budgeting, grad school