Evolving Personal Finance » budgeting

Pulling Back the Veil on Our Daily Money Management

I thought it would be helpful for some to get really into the nitty-gritty of how we manage our money on a daily (or at least monthly) basis. It’s simple to say “we have joint accounts” or “we use Mint” but what does that really mean? (You can reference a copy of our current budget if you like.) Start with a Clean Slate On the first of the month the only money in our checking accounts is … Read entire article »

Filed under: budgeting, credit cards, found money, side income, spending, targeted savings

Long-Distance Marriage: Money Management

This is the second installment of our series on financially navigating a long-distance marriage. Check out the first installment and come back on subsequent Wednesdays for the third and fourth! The questions I asked about money management logistics were the ones that I was most interested in. My bias here is that Kyle and I keep totally joint money (both in the names on our accounts and how we think of them), but I wondered whether … Read entire article »

Money Management Systems Visualized

There are three basic money management systems that couples use: pooling, partial pooling, and independent. Those are the academic terms – I prefer to refer to them as joint, partly joint and partly separate, and separate. In this post I have visualizations of each of these money management styles, plus a variation of joint that I call joint with allowances. The main distinctions among the styles are into what type of account (joint or individual) … Read entire article »

Filed under: budgeting

Grocery Challenge Update for January 2013

Late last fall we realized that our grocery spending had really gotten out of hand, even though we increased our budget from $360 to $400 per month. In November we spent $484 and set ourselves a grocery challenge – several goals that we thought would help us reduce our grocery spending to under our budget. The first month of our challenge, December 2012, was not successful – we spent $502 – but I was feeling … Read entire article »

Upcoming Transition and a Potential Financial Overhaul

I believe I’ve mentioned this a few times on the blog but haven’t explained the full scenario: Kyle is striving to finish his PhD this spring (or, less optimistically, over the summer). He is currently looking for his first post-PhD job, a postdoctoral position, which is essentially additional training in the lab of another faculty member and will last 2-5 years. Good news: this job transition will come with approximately a 40% raise over his … Read entire article »

Filed under: budgeting, transitions

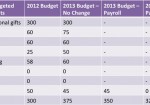

At Long Last, Our Budget(s)

A few weeks ago, Kyle and I finally sat down together to create a new iteration of our budget. We probably should have done it after we moved in August, reducing our rent by about $100/month, or after we got our annual cost-of-living raises in September. We put off incorporating that extra money into our budget because we weren’t sure how the fiscal cliff would be resolved and we didn’t want to get accustomed to … Read entire article »

Zillions of Gifts, on a Budget

Kyle and I finished our Christmas shopping this past weekend! Well, we essentially started and finished it this weekend so it went pretty fast. Giving gifts to only long-distance recipients is a double-edged sword – we have to shop online and early so that there is time for shipping, which goes against our procrastinating nature, but that means the shopping is done well in advance of Christmas and that reduces the stress! (“Well in advance” … Read entire article »

How to Tell If Your Means Are Just Not Enough

I write quite often on this blog about the virtue – nay, requirement – of living within your means. Even though I am earning a salary that many would consider laughable for my education and experience, I am determined not only to live within my means but give and save as well. I think everyone else should strive for this too – whatever your income, you shouldn’t be running up debt for your living expenses. However, … Read entire article »

Filed under: budgeting, choices, debt, frugality, grad school

When Top-Down and Bottom-Up Budgeting Clash

In my observation, there are two totally reasonable approaches to budgeting: top-down: decide where your money should go de novo without reference to your current spending i.e. percentage-based budgeting like the Balanced Money Formula (BMF) bottom-up: observe where your money goes and create a budget reflecting that, perhaps with small tweaks The bottom-up approach is the most straightforward for most people because, you know, they already have financial lives. They rent or have a mortgage, they eat, they pay … Read entire article »

Filed under: budgeting, transitions