Evolving Personal Finance » marriage

My Dream in 23 Years – What’s Yours?

One of the important components of the All Your Worth Balanced Money Formula is the Dream Fund. Of the 20% of take-home pay that is supposed to go toward savings, 25% of it is for your dreams – aside from retirement and all of that. When I was a kid I thought I would want to own a beach house. Maybe some other people want a plane, an around-the-world cruise, or to pay for their … Read entire article »

How Might Your Spouse’s Love Language Affect Your Finances?

I’m sure that many of you are familiar with Gary Chapman’s theory of the Five Love Languages (affiliate link – thanks for using!). But have you ever considered how your love language and your spouse’s love language might affect your spending habits and career? For those of you who haven’t read any material by Chapman, I’ll briefly summarize the idea: Every person has an emotional “love tank” that can be filled or emptied by their relationships (we’ll … Read entire article »

Filed under: books, marriage, psychology

Why Do Stay-at-Home Parents Need Their Own Credit Cards?

I read an article last week on CNN Money with a premise that I found absolutely ridiculous. The article covered a group of stay-at-home moms (parents?) who were protesting a portion of the Card Act that requires that credit issuers evaluate a credit applicant based on his/her individual income instead of household income. The result was that some stay-at-home parents with good credit scores have been denied credit cards when they applied for them in … Read entire article »

Filed under: credit cards, income, marriage

Joint and Separate Money Series: Odds and Ends

This is the third installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In each post in this series, I review the methodology and major findings of a paper in the field and then discuss how my husband and I fit into the results. I encourage you to share your reactions to the … Read entire article »

Filed under: marriage, the literature

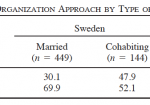

Joint and Separate Money Series: Individualized Marriage and Money Management

This is the second installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In each post in this series, I review the methodology and major findings of a paper in the field and then discuss how my husband and I fit into the results. I encourage you to share your reactions … Read entire article »

Filed under: marriage, the literature

Joint and Separate Money Series: Changes During the First Year of Marriage

This is the first installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In each post in this series, I review the methodology and major findings of a paper in the field and then discuss how my husband and I fit into the results. I encourage you to share your reactions … Read entire article »

Filed under: marriage, the literature

Are You Sure You Want to Spend $27000 on Your Wedding?

Today we are featuring a guest post from Edward Antrobus as part of this month’s Yakezie Blog Swap – click over to his blog to check out my participating post. Edward is a blogger, home cook, and construction worker. Enjoy! The cost of the average wedding is over $25,000. That number doesn’t even include the cost of the dress! (I’ve never understood that. Isn’t the wedding dress a wedding-related cost? Why wouldn’t you include it in the … Read entire article »

Proposed Series: Literature Review of Joint and Separate Accounts

During a conversation with my officemate about the diversity of comments concerning joint and separate money within marriage, she told me that during college she had read a sociology paper on the ideal number of accounts for a married couple (as she recalled, 5). It had not occurred to me that such topics would have been studied by researchers but I was immediately excited about the prospect of learning about such work. During college I … Read entire article »

Filed under: budgeting, marriage, the literature

The Fact and Fiction Behind “Two Can Live as Cheaply as One”

Everyone’s heard the phrase “two can live as cheaply as one.” In one sense it’s absolutely true: when you live in a home by yourself and someone moves in with you – a roommate or spouse who pays his own way – your per capita expenses will go down. You have someone to split the rent and utilities with. But the way the phrase is usually applied is to married couples – as if just … Read entire article »

Filed under: budgeting, choices, frugality, goals, lifestyle creep, marriage, spending

The Slippery Slope of Separate Money

One of the basic rules of marriage that we were introduced to in premarital counseling: Don’t keep track. Life is not 50:50, nor should it be. While both spouses should contribute to a marriage and household, it’s both fruitless and fodder for fights to try to make everything fair and even. At the moment, we keep our finances completely joint. We still have some leftover separate accounts, but all of our functioning money is joint. And … Read entire article »

Filed under: budgeting, marriage, personal, spending, targeted savings