Evolving Personal Finance » taxes

Marginal Tax Brackets, Deductions, and Credits Explained Graphically

Many US taxpayers have a difficult time understanding what marginal tax brackets are and the differences between credits and deductions. I will illustrate these three concepts for a hypothetical single taxpayer, Alex. Alex’s Gross Income Alex’s gross income is $225,000, all from his job, shown in solid red. Deductions Deductions reduce your amount of taxable income. Alex has deductions that can be found in lines 23 to 35 of his 1040 in the amount of $15,000 (patterned red). Examples of … Read entire article »

Filed under: taxes

What Is a Courtesy Letter and Does It Mean I Don’t Have to Pay Taxes?

I think that one of the most confusing points regarding grad student taxes is the nature of the “courtesy letter.” I have personally never received one from my university or funding agency but I know many students in my lab, department, and university who have. You may not even be sure what you have received is a “courtesy letter” at all, but I’ll let you in on a few of it likely characteristics: It’s confusingly worded. It … Read entire article »

Filed under: grad school, taxes

Grad Student Income Tax Site Up!

Hi there! This isn’t a normal posting day for EPF but I am just so excited to share this info with you I had to break the routine! The grad student income tax website that I’ve been working on for the past few months is now live! My partner, who works in the student loan office and is a CPA, did most of the writing and compiling and I helped in the research and editing to ensure that it addresses the particular tax challenges that grad students face. I think this is a great resource for students at our university and across the US. I hope fellowship recipients find it useful as they are preparing their taxes. If you have any comments or constructive criticism regarding the information or presentation, please email me … Read entire article »

Filed under: grad school, taxes

The Marriage Penalty and Itemizing Taxes

One of the lovely conversations about money I had over winter break was with my mother-in-law one morning while we were cooking breakfast. I had probably brought up the fiscal cliff or something similar, and the conversation wound up with me blurting out “Do you know how little money we make?” Oops! She was surprised to learn some details about our tax situation, but it makes sense that we have different impressions of the tax code … Read entire article »

Tax Lies Told to Graduate Students

Update February 2016: This short post has been expanded to a 10-part series of common grad student tax lies on Grad Student Finances. Check it out for more detail, explanation, applicability, references, etc.! My little university community service project for this fall is working with a staff member to compile a comprehensive reference document for graduate students preparing to file their taxes. The purpose is to help graduate students make sense of the tax-related forms they … Read entire article »

Filed under: grad school, taxes

What Happens to Your Taxes If We Go Over the Fiscal Cliff?

I listed to Marketplace every day and have hear many pieces on the fiscal cliff aka taxmageddon. Basically, there are a bunch of federal tax cuts and spending increases that are set to expire at the end of 2012 if Congress doesn’t take any action. Since the legislature is apparently completely paralyzed during our ever-lengthening election season, we won’t know if the fiscal cliff will be partially or completely prevented probably until the lame duck … Read entire article »

Filed under: taxes

Obligations on Your Side Hustle Money

Kyle has been volunteering with the production team at our church for about a year, mostly running the slides and handling the video-playing. One of the men who runs the sound board is taking a sabbatical and they are looking for someone to fill his weekends. Kyle has wanted to learn how to run a sound board for a while so this is a perfect opportunity. Plus, we found out that it is a paid … Read entire article »

Filed under: giving, retirement, side income, taxes, values

Taxes You Should Be Paying

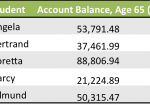

I had a really strange thought a couple weeks ago – hear me out and tell me what you think! Have you ever considered paying yourself what you think you should be paying in taxes? Do You Think Taxes Will Increase in the Future? I’m not sure if there is much debate over this issue, actually. The US national debt is 100% of GDP and we have among the lowest tax rates of our peer nations. Something … Read entire article »

Filed under: taxes

Can a Net Income Boost Compensate for Not Having Earned Income?

Two weeks ago I got a great comment on my Roth IRAs for Graduate Students post from Joe. He asked “Why would you want fellowship income to be reported as earned income? The payroll tax (6.2%+1.45%) that must be withheld from wages … in my opinion, makes the unearned income classification better.” The payroll tax exception for 1099-MISC income wasn’t something I addressed in the Roth IRA post (although I mentioned it as a perk for some … Read entire article »

Filed under: budgeting, retirement, taxes