Toeing into the E in EPF

I thought I’d take this Friday post to update you all on the random money goings-on around the EPF household. We are gearing up for our first financial transition, moving from the apartment Kyle’s lived in for 5 years (and I for 2 years) to a townhouse that’s both cheaper and closer to school and church. In addition we’ve had some other small bumps in the road and changes and are looking forward to some travel, so I’m collecting all of these little things into an update post.

The Move!!

I’m keeping track of all of our moving-related costs for a future post, but there really haven’t been many so far.

- application fee – paid

- security deposit (refundable) – paid

- overlapping rent (1 week) – wrote the check yesterday

- rental truck (around $55 + gas and per mile costs) – tomorrow

- pizza for the people helping us move – tomorrow

- water deposit $50 (refundable??) – will come with our first bill so probably not until October

- adding my car back to our insurance for 1 day to move it (< $1) – not sure when we’ll be billed

How our utility costs will shake out will remain uncertain for a couple months. We’re going from all-electric to electricity and gas and we don’t know if that will ultimately save or cost additional money. I looked up how much internet will be at our new address with our same (monopoly) company, and it’s going to be about $20/month less! So even if gas/electric end up being a little higher we’ll probably be paying less overall in utilities.

One of the ways we can help repay ourselves for our moving costs is by selling some of the household and personal items that have become obsolete, like our washer and dryer and possible ceiling fans. This apparently isn’t going to happen pre-move so I hope I can stay on the ball and sell/donate/throw away a bunch of stuff right after the move.

New Credit Cards

We actually opened TWO new credit cards in the last month! That’s crazy for us as we haven’t opened a new card in about two years.

We opened a new credit card a couple weeks ago with CapitalOne because we wanted to fill the “no foreign transaction fees” perk hole in our current set of cards in advance of our trip to Canada in a couple weeks. After my analysis of whether or not we should get the Chase Sapphire Preferred card, we ultimately decided to get a no-fee cash rewards card with a low minimum to get the (small) signup bonus. The crazy thing is the that credit limit on this card alone basically doubles our overall available credit. I guess we haven’t worked that hard to raise the credit limits on our current cards? (Not that this functionally matters, only for credit score tweaking.)

We also opened an Amazon (affiliate link – thanks for using!) credit card to get a free Kindle. It’s also a rewards card, actually, and has better points on dining than we’re getting with our other cards (aside from that quarter for the Freedom card), so we might use it for non-Amazon purchases from time to time.

Smartphones

It looks like I waited a bit too long to confirm my Republic Wireless invitation so it doesn’t seem I’ll be getting my new smartphone anytime soon – probably in a few months. I hope my dumphone holds out that long. Once we shell out for the phone, it will take a bit less than 1.5 years to break even over my current plan and after that it’s very cheap.

This week I WASHED KYLE’S SMARTPHONE and our efforts to resurrect it have been futile. We’re doing okay so far without any smartphones but our Canada trip is in a couple weeks and we may need to replace his phone by then so we don’t have to rely on maps and random wireless as much. His contract is over so he has the choice to get into another one (he doesn’t really care for them) to help with the upfront costs of the phone itself or not. He’s talking about getting an iPhone (surprising since he’s sort of anti-Apple) and if that ends up being the decision he’ll definitely get into a contract. I have no idea if that will be more or less expensive than what he’s currently paying. I’m also not sure if he should cancel his current plan since the phone is dead…?

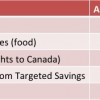

Travel and Personal Gifts Targeted Savings Account

As always, I’m looking forward to the next few months to see how our Targeted Savings account will do.

Our current balance is $600 and in the next couple weeks we have to pay our Canada trip ($550 for flights + $100 for hostel + $? for rental car, food, and Niagara Falls entertainment). I also expect us to spend about $800 on Christmas flights and $400 on gifts. I don’t know of any other significant travel we’ll be doing this fall that isn’t covered by our university – maybe $60 for gas for Thanksgiving driving – so we really just need to plan for the expenses I listed.

Between September and December we’re projected to save $1200 into our Travel and Personal Gifts account, so that won’t quite cover all these plans. Once we get back from Canada we’ll know exactly how much we’ll need to save, but it will probably be around $150/month extra. Yikes! If we’re able to sell some stuff in the move that will help pay those costs back faster and we can divert the rent savings to our Travel account that much faster.

What tidbits of financial changes have you experienced recently?

Filed under: budgeting, credit cards, targeted savings, transitions, travel · Tags: credit cards, destruction, moving, smartphone, wedding

Money Updates from the EPF Household

Money Updates from the EPF Household Why We’re Not Getting the Chase Sapphire Preferred Card Even Though It’s a Great Deal

Why We’re Not Getting the Chase Sapphire Preferred Card Even Though It’s a Great Deal Current Credit Cards Rewards Strategy

Current Credit Cards Rewards Strategy Winter 2012 Travel Plans

Winter 2012 Travel Plans

HAHAHAHAHAHA! You washed his smartphone, lol, man that’s funny. I mean, it sucks for you guys, sorry, but it IS funny. If it makes you feel any better, I dropped mine in the toilet once. That, also, was not able to be resurrected. Down for the count forever. For such powerful little devices, they sure are sensitive.

TB at BlueCollarWorkman recently posted..West Coast National Parks – A Blue Collar Roundup

It is funny. Thankfully the phone wasn’t particularly new and Kyle didn’t get mad at me. I almost always check his pockets…

Ah! That really sucks about the phone. But what can you do. Have fun in Canada, I love it here! I’m sure you’ll have a great time.

Gillian @ Money After Graduation recently posted..How rich is Christian Grey from 50 Shades of Grey?

Unfortunately we didn’t have time to fit in sight-seeing in Toronto. Basically we’re just attending the wedding and related events and then going to Niagara Falls (Canadian side) as we’ve never been there.

You can usually call the company and have them put your phone “on hold” (I don’t remember what they’re term for it is) but basically they’ll allow you to pay some sort of small fee (maybe $10/month) to keep the number and account active but not have you pay for the full service. You can also undo that at any point (I think typically you can’t do this for longer than 6 months) but at least that could give you guys a bit of time to figure out what you want to do next.

I have an iphone (3GS) and I’ve found that it’s fairly durable… I haven’t washed it but I have dropped it several (hundred) times and at least one of those times was into a sink that was running. It got wet but it’s still working (although now the ringer is struggling a bit… clearly this is my own fault… I might be just a tad bit accident prone 🙂 oops)

Julia recently posted..Actual Expenses: July 2012

Thanks for that info! I had no idea you could put a hold on the service. Kyle actually uses a Google voice number as his primary number though, so he wouldn’t care about abandoning the current one. It would be nice to know what phone/service/plan he wants next though before cutting off his current plan.

We actually are pretty careful with our electronics – not too clumsy. The phone-washing was just a catastrophic exception!

Seems like you’ve got everything covered – will the sale of some of your stuff make up for the shortfall in the gift/vacation fund for a month or 2?

Jeff @ Sustainable Life Blog recently posted..Honeymoon: Thailand pt 1 – Bangkok

Depends on how much we decide to sell. The washer/dryer is the big item, but that’ll only go for maybe $150. Kyle has told me he doesn’t want to sell our ceiling fans, so then all we’re left is small $5-20 apiece stuff. It’s very likely that we’ll give up on selling anything once we get rid of the washer/dryer. I’m not super concerned about getting to that $150/mo level because we do have such a break in our rent, so even if we have to borrow from our nest egg to cover Christmas I’m confident we’ll be able to continue aggressively saving in the spring.

I dropped my first cell phone in a bucket of water… less than 2 hours after I bought it! Plus I’ve washed more Bluetooth headsets than I can count.

I hate moving with a passion. One of my goals in life is to be able to afford a full service mover who will pack and upack everything for me.

Edward Antrobus recently posted..When You Assume… Well, You Know the Rest.

Oh man, that sucks! I almost lost a nice ring the same night my parents gave it to me. It really teaches you to be more careful!

This is our first move as a household and I don’t hate it so far, although it is taking a lot of time… We’ll see! All my previous moves have been really easy because I didn’t take much stuff with me.

[…] @ Evolving Personal Finance writes Toeing into the E in EPF – I washed my husband’s smartphone and other updates from our […]

[…] Toeing into the E in EPF was featured in the Yakezie Carnival. […]

[…] the border as the wedding is near Toronto. The total price was $546.40. We put these flights on our new Capital One credit card and applied the bonus and rewards we received from that purchase back to this account […]

[…] Kyle tried to find a ride to his retreat, but since he was actually attending two retreats in the same city he needed to be able to get back and forth and the other people attending both weren’t following the same schedule. So he needed the car. And since he was going out of town, we figured he should have a cell phone – mine, since I destroyed his. […]

[…] up in our Travel account and nowhere to spend it! Well, that’s not quite true. We have to fund our Christmas travel and gifts and that’s going to take more than all the money we’re projected to save between now and Jan […]

[…] for Christmas, all for the low low price of $625.20 plus approximately three tanks of gas! I’m so relieved that we had enough in our Travel and Personal Gifts savings account to cover these flights – I was afraid we were going to have to dip into our general savings […]

[…] optimize our rewards. Most of the time we decide not to open a new account but over the summer we each opened one new one for different purposes. (We never carry a balance and credit cards do not interfere with our ability to stick to our […]

[…] this year Kyle received an Amazon Kindle gift card (and the giver checked that we do in fact own a Kindle). Receiving that gift card, as well as considering some others, made me realize that we really […]

[…] Of course there is some influence of income or discretionary spending on exactly where this line is for you – purchasing an eReader might be responsible with only a few minutes of consideration for someone with a high income, whereas we deliberated for a couple days on it even when we were getting it for “free”. […]

[…] I destroyed Kyle’s smartphone at a time for us when it was very inopportune to not have any smartphones (moving i.e. no internet at home). Simultaneously, I had been waiting for my beta wave to come up with a new low-cost carrier. Since Kyle’s phone was more than two years old (and no longer under contract) we decided it was an okay time for him to get a new phone and contract. Since the iPhone 5 was set to be released soon, Kyle decided to wait to see how it was received. […]

[…] All our other cards are really for specialized occasions that come up very rarely. We have my first credit card, which is still open but used only occasionally to keep it active. We have a Macy’s card that we got when we registered for our wedding there (so that we could cash out returns if applicable instead of getting store credit – never did it!) and we only use that card when pairing it with a coupon/promotion gives us a deep discount. Finally, we got another card last summer that waives foreign transaction fees, so we will only use that abroad. […]

[…] to sell them – he even suggested we rent a storage unit to keep these craigslist appliances in! I ultimately talked him into selling them, saying that since we planned to live in this townhouse until we left Durham we would never need […]

[…] time we moved, we were able to sell our washer and dryer and some other small items so we more than offset the cost of the new household stuff we bought. […]

[…] know that Kyle and I are not much for credit card sign-up bonuses – we’re more about the long-term rewards or perks. I do keep an eye out for high sign-up […]

[…] keeping one base card and signing up for some others for special kinds of spending and once for a free Kindle. We even asked ourselves how many cards would be too many because we loved further optimizing our […]