Earned Income: The Bane of the Graduate Student’s Roth IRA

This is my contribution to The Roth IRA Movement started by Jeff Rose at Good Financial Cents. The post will briefly touch on the advantages of the Roth IRA account but will focus on how graduate students can determine whether or not they have earned income (now: taxable compensation). For more posts with greater detail on various aspects of the Roth IRA, please visit the Movement’s page. Also, I am not a CPA or financial advisor, so please do your own research and consult with a professional!

Having, I’m sure, motivated you that saving for retirement while in graduate school is both beneficial and necessary, I’ll return to the recommendation I made at the end of the second post – the Roth IRA. First I’ll tell you why the Roth IRA is a great choice and then I’ll show you what I dug up concerning earned income, which is necessary to contribute to an IRA but that you may or may not have as a graduate student.

Why Should I Tie My Money Up in a Tax-Advantaged Account?

I’m going to assume that your retirement savings are actually meant for retirement, meaning you intend to not withdraw any money from them for several decades. You should have a separate emergency fund and savings for shorter-term goals like a house down payment. In that case, the government has given us amazing options to get out of paying taxes while our money is compounding with special tax-advantaged accounts

If you keep your retirement savings in a non-tax-advantaged account, you have to pay tax on your earnings every single year, like you do with a regular interest-bearing checking or savings account. If you think back to our compound interest example, you know that a small tweak in your rate of return can have massive implications after decades of compounding. The exact rate that you pay will be dependent on the type of earnings you receive (ordinary income, long-term capital gains, short-term capital gains) and the tax bracket that you are in, but whatever it is will be a drag on your rate of return year after year. So if you know the money will be used only for the long-term, go for the tax advantaged account.

What Kind of Tax Advantaged Account Should I Use?

As a graduate student you don’t have access to your university’s 403(b), so assuming you don’t have any other employers (including yourself), you are limited to IRAs for tax-advantaged retirement accounts. There are two types of IRAs available: traditional and Roth.

The major difference between the traditional and Roth IRAs is when the money is taxed. It’s true that the contributed money grows tax-free, but you will be taxed when you put it in or when you take it out. With a traditional IRA, you contribute money pre-tax and the withdrawals from the account are taxed. With a Roth IRA, you contribute money post-tax and the withdrawals are tax-free. So the first thing you have to ask yourself is: will your tax rate in retirement be higher or lower than it is now? You have to weigh your current income against your retirement income as well a guess whether overall tax rates will increase or decrease. For graduate students, the answer is almost certainly that our tax rates are lower now than they will be in retirement – at least, we all expect to be making lots more money post-graduation! So the Roth IRA is likely the better choice.

Briefly, there are some other features of the Roth IRA worth knowing about (for more detail, visit The Roth IRA Movement):

- You may only contribute earned income (more on this next) up to $5,000 per year (if under age 50).

- There are income limits for contributing the full $5,000 – your modified AGI must be less than $107,000 for singles and $169,000 for married filing jointly (no problem!).

- You can begin removing money from the account at age 59.5.

- Removing money early will result in taxes and penalties unless it is a qualified distribution, such as in the cases of death, disability, or buying a first home (up to $10,000).

What the Heck is Earned Income?

Note: What I’m about to cover is not well-understood among graduate students and there are many different opinions. I have talked with several administrators at my university about this issue and have called the IRS hotline a few times but still have not found a totally satisfactory explanation of the situation, especially from the IRS. You may not like what I conclude, and honestly I don’t like it either. If you disagree with what I’ve written or find it inaccurate in any way, please comment and I will look into your objections.

Roth IRA (and traditional IRA) contributions must be “earned income.”

“Earned income includes all the taxable income and wages you get from working. There are two ways to get earned income: You work for someone who pays you or you work in a business you own or run.” (source)

Basically, the IRS is trying to prevent people who don’t have any incomes other than interest and dividends, child support, unemployment benefits, etc. from participating in and benefitting from tax-advantaged accounts. You have to work for the money that you contribute! But of course we do work for our universities, and they pay us – right? Not so fast…

Unfortunately, and crazily, for graduate students, we can get caught up in this definition of non-work as well. Many graduate students are paid by fellowships – in fact, it is prestigious to be paid by a fellowship.

“Scholarship and fellowship payments are compensation for IRA purposes only if shown in box 1 of Form W-2.” (IRS Publication 590 p. 7)

So if you are paid by a fellowship during the year and you receive something other than a W-2 at tax time (like a 1099-MISC), that pay does not count as earned income. If you receive a W-2, no matter if the source is a fellowship or a grant or something else, that is earned income.

Here is the really crazy part, from the instructions for the 1099-MISC:

“Do not use Form 1099-MISC to report scholarship or fellowship grants. Scholarship or fellowship grants that are taxable to the recipient because they are paid for teaching, research, or other services as a condition for receiving the grant are considered wages and must be reported on Form W-2. Other taxable scholarship or fellowship payments (to a degree or nondegree candidate) do not have to be reported by you to the IRS on any form.”

That means if you are paid by a 1099-MISC, your university is not paying you for any services such as teaching or research. There are not supposed to be any conditions requiring you to work for that money!

That is ludicrous and insulting. Of course we have to work to pursue our graduate degrees. We do research, we take classes, we teach. A PhD student woudn’t be retained by his program if he didn’t do the work expected of him, no matter how he was paid. We have the same jobs whether we receive 1099-MISCs or W-2s.

So perhaps there is a glimmer of hope for those receiving 1099-MISCs. Although I doubt your university’s very sophisticated tax professionals made a mistake, you could at least inquire at payroll as to why you received a 1099-MISC instead of a W-2. Perhaps (slim-to-nil, I imagine) there are conditions on your fellowship that you work and they should have given you a W-2 instead and you will be able to contribute to a Roth IRA.

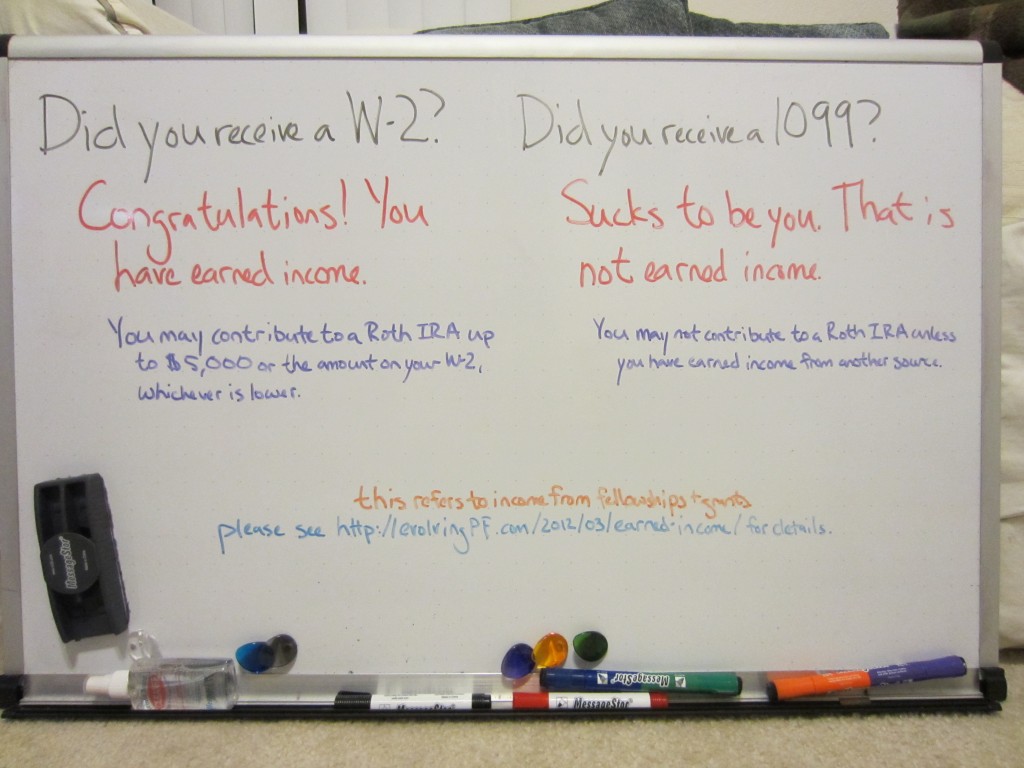

In summary, here is how the way you are paid relates to your ability to contribute to a Roth IRA:

Remember that if, in a calendar year, you receive any earned income, you can contribute up to that amount to a Roth IRA. For instance, if the bulk of your pay comes in the form of a 1099-MISC but during one semester you were paid with a W-2 for teaching, you can contribute to a Roth IRA in that year, up to $5,000 or the amount you were paid on the W-2, whichever is less.

In my next post I will suggest ways that graduate students being paid with 1099-MISCs can save for the future despite their lack of earned income.

In summary:

- Tax-advantaged retirement accounts can make your contributions grow super fast.

- Roth IRAs are great vehicles for graduate students with earned income.

- If you are paid by a W-2, you have earned income.

Did this post inspire you to contribute to a Roth IRA? What do you think about the earned income debate for fellowships?

Update 10/5/2015: The IRS has updated its language so that you now need “taxable compensation” to contribute to an IRA. This term supplanted “earned income,” but they have the same meaning with respect to grad student stipends. If your grad student stipend is reported on a W-2 (typical for assistantships), you can contribute to an IRA from it. If your grad student stipend is not reported on a W-2 (typical for fellowships), you can’t contribute to an IRA from it.

Update 9/1/2014: This has proved to be the all-time most popular post on this blog! I’m impressed that graduate students are so interested in the proper way to save for retirement! One note to update it is that in 2013, the under-50 IRA contribution limit was raised to $5,500. If you found this post helpful, would you please share this post on social media using the buttons below so more graduate students can see this vital information. Who knows, you may even spark an unexpected conversation among your friends!

Filed under: grad school, retirement · Tags: 1099-MISC, earned income, grad student, Roth IRA, W-2

Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income? How to Save When You Don’t Have Earned Income

How to Save When You Don’t Have Earned Income Grad Student Income Tax Site Up!

Grad Student Income Tax Site Up! Organic Search Terms

Organic Search Terms

I love your dry erase board! That is a nifty idea.

I also love the Roth IRA. It’s suuuuuuuuuch a great vehicle to invest for retirement!

WorkSaveLive recently posted..My Not-So-Secret Love Affair. Why the Roth IRA Makes My Heart Skip a Beat.

[…] […]

Wow, I didn’t know how confusing the earned income issue could be. Thanks for bringing this issue up

Nice work for someone who isn’t a CPA (at least I think you aren’t!).

My favorite part of the post? “Sucks to be you.” I can’t tell you how many times I would have liked to have written that on a dry erase board….

AverageJoe recently posted..The Roth IRA – Like Ice Cream, But in the Tax World

Um, no, not a CPA. Probably should put that in the post somewhere…

I’m glad you liked it! I was pretty PO’d while researching this!

Okay but what about those of us (me) who have Traditional IRAs? Do I roll everything over to a Roth? Do I open a Roth in addition to the traditional, even though I’ll probably just barely max out the traditional?

Frugal Portland recently posted..Pinterest and Frugal DIY: Hand soap

Why are you dissatisfied with your traditional IRA? If you want to convert it to a Roth there is a procedure for that – I don’t know the details but you basically just pay the income taxes you would have owed on what you contributed. So that’s an option, or just leaving it in the traditional IRA. As for opening a Roth IRA as well, you can only contribute up to $5,000 per year between the two accounts combined.

A lot of the reason people are so gung ho about the Roth IRA is because they already have 401(k)s so they have some taxable income for retirement and want to mix it up with non-taxable income. What’s your overall situation?

I never realized how complicated the phrase “earned income” really is! Great explanation.

Young Professional Finances recently posted..Roth IRA: My Meager Savings

I’ve been wary of Roth IRAs lately. It seems that there is more than a fair chance income tax structures will reduce in the near future. There also seems to be a large interest in other tax revenues other than income taxes.

No one can predict the future, but I have doubts we’ll be paying as much in income taxes in the decades to come. Maybe it’ll be a carbon tax, VAT or national sales tax.

Wayne @ Young Family Finance recently posted..Managing Your Finances Takes Time

You make a good point. I definitely think we’ll be paying more taxes in the future but perhaps they won’t be in the form of income taxes alone. Personally I’m still confident that I’m paying a low enough rate now to favor the Roth, but for people who are not confident I guess the best strategy is to have both pre-tax and post-tax accounts to hedge.

Hah! You were right, yours became a rant, too! The interesting thing is, we both want our Roths, but the IRS is our problem. Ack!

Nell @ Housewife Empire recently posted..You Can’t Fund a Roth IRA without a Joint – Dirty Secrets of the Marriage Tax Penalty

I’m curious how/why a universities decide to use the MISC-1099 vs W-2. Is there some incentive for them to use one over the other? Or is one required based on where the fellowship/stipend/salary comes from?

We haven’t moved the $ yet, but this post did remind me that we need to make N’s 2011 contribution to his Roth IRA before April 15th. Thanks!

I have an email in to someone at my university that will hopefully answer your first question. I would imagine it has something to do with getting out of paying the employer’s side of Social Security and Medicare. In my limited investigation so far the administrators have told me if you’re on a fellowship you get a 1099-MISC, if you’re on your advisor’s grant you get a W-2. They have not yet mentioned this fellowship-in-exchange-for-services option that should go on the W-2. It might be a unicorn.

I’m not a graduate student, but I’m sure those who are will appreciate the thorough explanation you provided. If graduate students are indeed working for their money, and they receive a 1099, they should speak with someone at the university about issuing them a W-2. The fact that the university screwed up shouldn’t change the nature of the income. If it’s earned it’s earned.

I remember trying to open an IRA with Washington Mutual during my freshman year of college. At the time, the minimum was $1,000. Yeah. That was way too much money to tie up for a struggling college student. Although, now I wish I’d found a way to come up with the cash. Nowadays, there are so many options. You can open an IRA with very little money.

Shawanda @ You Have More Than You Think recently posted..What Not to Do When You’re Addicted to Debt

My developing understanding (though I’m still looking into it) of the justification of paying us with not-“earned income” is that the requirement is that we work (do research, etc.) to stay in the program but not explicitly for the fellowship money. Like, if you did no work they would kick you out of the program maybe at then end of the year? But it’s strange because when people are on fellowships and they take a leave of absence I believe their pay ceases for that time.

I agree that $1,000 is a high minimum. When I opened my IRA several years ago Fidelity had an account option of a monthly transfer of $50 or $100 but didn’t need a minimum balance. When I looked again for my sister a couple months ago, that option was no longer there and the minimum monthlys were about $200, which was too much for her. She decided to aggressively pay down debt and then save up the $3,000 needed to open a Vanguard IRA. While I hope she sticks to that plan, I think her savings would have been much more certain if she had been able to open the account right away.

This just kills me – absolutely kills me! I worked like crazy to be able to get my university’s presidential graduate fellowship and was receiving my stipend through that method for a year. I then applied for and received, after a LOT of hard work – an extremely competitive national fellowship from the department of defense (NDSEG). My stipend increased and I thought everything was great with the world.

However, I thought it was weird that the EITC and child tax credits didn’t seem to add anything to my federal return for 2010 even though that was the year we had our first child. I just assumed everything was right in the tax software and didn’t look into it. My wife and I had a second child in 2012 and while starting to file taxes for 2012 the total credit back was even less than in 2010 and 2011! With our current income we should be eligible for a hefty EITC as well as $1000 per child in alternative child credits. BUT these credits are all based on the amount of my “earned income.” If my wages were simply on a W-2 form then our refund for this year would be about $5,000.

So from the tax years 2010 – 2012 my wife and I will have missed out on about $10,000 – $12,000 in tax credits because our income came on a 1099-MISC form instead of a W-2 form! I feel like smashing my keyboard while typing this. These fellowships were developed to award exceptional academic candidates who EARNED them, but in the end I get payed just as much or sometimes less than my peers who didn’t get the fellowships and who are doing the exact same kind of WORK that I am.

I brought this up multiple times with the Department of Defense and I only get the answer that they are sorry for the “inconvenience” and that that is just the way it is in their contract. They have to send the funds straight to me and can’t set up a negotiation with my university to have them pay me the exact same money through a W-2.

Who wrote this law, and where is the common sense? My peers in the same department are “earning” their income doing the exact same work that I am!

Seriously, I better stop before I smash my keyboard.

Brad, I don’t know how to respond to you except to say that I’m sorry that you lost out on those tax credits due to the ridiculous tax arrangement between the universities and the federal government. I know you must be highly qualified to receive an NDSEG and it isn’t fair that your income is different from that of your labmates and classmates. I hope that the stipend increase makes up for the loss of the tax credits or at least that having those fellowships will boost your resume enough that you will get other funding or jobs that will make up for the loss of earned income over these years. I’m not surprised that the DoD was inflexible on this issue. Thank you for alerting me to your circumstances regarding these tax credits – it’s probably unusual for a student receiving unearned income to be married with two children, but that doesn’t mean that you shouldn’t receive the credits that other parents do (in a reasonable tax arrangement). How does the amount of your wife’s income play into being eligible for these credits – will earning more qualify you two?

I just discovered the same thing on my taxes this year. I was receiving a stipend based on teaching and got a W-2. Then I switched to a fellowship. The pay only went up about $50 a month. I did not receive a W-2 this year and after inquiring in to it discovered that I am on a fellowship and don’t receive one. Therefore, just like you I have no “earned” income and don’t qualify for credits and can’t contribute to a Roth. I have 2 kids and a wife as well. So, for me it means I miss out on over $7,000 a year in credits. Unfortunately, that $7,000 was always my safety net to pay for things like dental care, tires, summer vacation with family, etc… So, it puts us in a huge bind. I really hope the IRS changes this ruling for the exact reasons that you laid out that it is for work.

I don’t know what to say except that I’m very sorry you’re in this situation. Maybe you can talk to your advisor about how much this fellowship is costing you and have your funding source switched?? Or you or your wife could generate a side income?

I’ve hoping to get some work study in grad school.. and my recollection (hopefully I’m right)is that that’s W-2 income. Fingers crossed. I still want to max out my Roth IRA for 2013 if there’s any possible way.

Well Heeled Blog recently posted..High Prices in Fashion Magazines

When I did work-study in college I was paid with a W-2. And there’s “work” in “work-study” after all – they are explicitly paying you for some kind of service.

[…] those of us without earned income, the standard retirement advice does not apply. Not only do our workplaces (if we even have them) […]

[…] headaches for others. Frugal Toad has a great infographic that paints a good picture of IRAs.Earned Income: The Bane of the Graduate Student’s Roth IRA – Yes it says graduate student, but it’s not a prerequisite. What’s important is the […]

Fascinating, thanks!

Heather recently posted..Buy of the Day: Genius Hub

[…] Evolving Personal Finance: Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] @ Work Save Live added Earned Income: The Bane of the Graduate Student’s Roth IRA in his weekly […]

[…] to make a definitive statement… It’s so frustrating! I finished up my Roth IRA post today (going up Tuesday) and I’m glad to have found what I think is a definitive answer to […]

[…] order to contribute to a Roth IRA, you must have earned income. So if you get paid via fellowship, and get a 1099-MISC at the end of the year, the IRS does not […]

[…] Earned Income: The Bane of the Graduate Student’s Roth IRA was mentioned by Hedy @ Penny for My Thoughts. […]

[…] post in terms of being found by the wider internet is the one I did for the Roth IRA movement on the definition of earned income and whether or not graduate students can contribute to IRAs. Apparently people really want to know this […]

Why would you want fellowship income to be reported as earned income? The payroll tax (4.2%-6.2%+1.45%) that must be withheld from wages, along with the employer payroll tax (another 6.2%+1.45%), in my opinion, makes the unearned income classification better (as long as your university is properly classifying and reporting income consistent with laws and regulations)

Invested wisely, the return on that extra (up to) 15.3% of income, in my opinion, compensates for the loss of the tax-advantaged account.

And yes, yes, you lose the opportunity for Roth IRA contributions, but you can still make tax-deferred investments like US I-series savings bonds, or taxable low-turnover index mutual funds that defer tax on long term capital gains until sale.

Yes, that is a good point! I don’t know about you, but when I switched from being paid with a 1099-MISC to a W-2 I did not experience an decrease in before-taxes salary i.e. they employer doesn’t give the student what it would have paid in its half of payroll taxes, so you can only consider the student’s half a bonus. Perhaps you’re right than on balance it’s better to have the several percentage points increase in income invested in low-tax vehicles – I’m really not sure. My point isn’t so much that it’s better to be paid “earned income” but rather that we actually really DO work for our income so it’s a fictitious classification.

Actually thinking about it more, I think you probably have an argument. When you combine the payroll tax cut, the earned income tax credit, and if your university wouldn’t have given you their half of the payroll tax anyway, that is a good argument for the earned income classification if you intend on doing a maximum Roth contribution.

If you don’t make IRA contributions (and there are plenty of reasons why a grad student wouldn’t) then the unearned income classification is likely better, though.

Still, just because you perform compensated research, teaching, etc doesn’t mean that your income is “earned”. The IRS has complex rules for determining what counts as what. You (or your university) don’t get to just decide what is better in your particular situation. It does sound, though, like your university may not be correct in giving you a 1099-MISC.

I’m just a simple grad student, not a tax accountant, so I am not a reliable source for information 🙂

I had to look up the income limits for the EITC – we make too much (and don’t have a child) so we’ve never taken it. I think if someone qualifies for the EITC there’s a pretty small chance she’ll have room to save for retirement unless she lives in a REALLY low cost-of-living city. I agree that from a money-in-pocket standpoint not having earned income is probably better for someone uninterested in taking advantage of a Roth. I’m not totally sure of the downstream implications of not paying payroll taxes during those years but I’m personally not anticipating those programs being around to benefit me later, anyway.

I understand the IRS and universities have created rules to exclude fellowship recipients from having earned income. That is the way things stand. I just find their justification quite ridiculous and not reflective of reality for any PhD student I know. We are expected to work to stay in our programs and would be let go if we didn’t, but somehow that is not a condition of receiving our pay. And whether we’re paid by a fellowship or off our advisor’s grants we have the EXACT same job to perform – research, teaching, etc. If you have received a fellowship in grad school, what is your opinion? Did you work for your fellowship money? Or did you work for free, which your university enabled you to do by paying you?

[…] weeks ago I got a great comment on my Roth IRAs for Graduate Students post from Joe. He […]

[…] 4) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

Is earned income considered before or after tax? IF I made $5,000 earned income before tax, can I contribute all into Roth IRA account?

I believe it’s before tax, so yes. I assume that means you have some “unearned” income as well?

o_0

This is somehow the first I have heard of this. I was funded through my phd on a patchwork of scraps from different training grants and a post-graduation t32 (and of course no retirement benefits). I thought having a Roth was my only real shot at trying to have some sort of retirement account. I thought I had researched it pretty well. I paid full taxes on my stipend (1099t) even though they weren’t withheld. I earned a little extra on the side (W2) but less than I contributed to the IRA overall. I never saw any paperwork about having a “fellowship” until the t32…my PI handled the backend of finances and basically answered “that’s my problem” if anyone asked about the specifics.

It wasn’t easy on a grad student stipend living in the sf bay area but I was able to contribute about the equivalent to a year’s salary over my time there. I was particularly motivated in part because of a crappy medical diagnosis that has a nasty habit of knocking people out of the workforce early and the fact that even as a postdoc, I knew I wouldn’t have an external retirement account (now I am and I don’t and I work for a better employer than most).

What do I do now? If money was contributed to the Roth that should not have been contributed…what happens? Who could I even contact to find out? Given our collective financial status, not many accountants seem to be specialized in ‘grad student/postdoc’ regulations.

Sucks to be us…

1) Congratulations on getting through your PhD and postdoc on your various fellowships and grants, especially in the Bay area, and figuring out how to pay your taxes and such. That is a major accomplishment! Please don’t feel bad for not knowing all of this specific retirement information – very few people within universities do, in my observation.

2) You’re totally correct that most tax and retirement specialists have no idea how to deal with grad student and postdoc pay. I would say they give out more false information than correct information. Your best chance may be to find a professional who is truly curious enough to research the situation and not rely on their general advice and then ask to see the IRS documentation that led them to their conclusions.

3) If I were you and I decided to correct the over-contribution, I would hire a professional to figure out exactly how much I was allowed to contribute each year from my W-2s and other earned income, if any, and how to undo the contribution and pay the penalties. I would start by asking a local fee-only financial planner if she is able to do that and ask for a recommendation of another professional if she is not. If you decide to do this, the sooner you act the better as the penalties mount with time. Plenty of people other than grad students over-contribute to IRAs (for example, people who earn too much) so financial professionals should know how to undo part of the contribution even if they wouldn’t have been able to tell you on the front end not to do it. HOWEVER, I don’t know that I would correct the over-contribution now that it is done, given that it was an honest mistake due to vague/unknown IRS language and a number of years in the past.

4) As for your savings going forward, I suppose you should keep it in non-tax-deferred accounts (there are low-tax mutual fund options, I believe) until you have a 401(k) option and then throw as much of the money as you can in there.

[…] 5) Earned Income: The Bane of the Grad Student’s Roth IRA […]

I really appreciate this information. I was shocked last year, when, for the first time, I had to pay a penalty for “overcontributing” to my Roth IRA. I am a graduate student on fellowship, and every penny is scrimped and saved for the future. The amount that I put into my IRA was a sacrifice- then I had to pay a penalty, and to fix the problem so I’m not charged again next year, I have to pay a penalty to the company that manages my IRA to move the contribution into another year (where presumably I’ll have the same problem). I’m taking on some odd jobs so that I can contribute… It all seems like a complicated way to punish us for trying to be responsible about our retirement.

Sounds like you did the right thing and found some workarounds. I’m sorry you didn’t know about these silly technicalities earlier so you could have avoided the charges.

[…] or young professionals. The most searched-for post I’ve written by far answers the question of whether graduate students receiving compensation with 1099s can contribute to Roth IRAs. I want to have more posts like this that explore topics grad students may find difficult to find […]

[…] 4) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] Evolving Personal Finance wrote Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] 3) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] It’s a good thing the fiscal year doesn’t match up with the academic year and IRAs were only 3K when we were first putting money away in them, because there were some academic years when all our income was stipend. Though I think DH was paid the right way so maybe it would have been ok anyway given we were married. Evolving PF explains what earned income is and how stipends are counted. […]

[…] For an explanation of another confusing point about graduate student income, read my post on earned income and Roth IRAs. […]

[…] at the end of 15 and 30 years of the investment account, assuming that it is growing tax-free (in a Roth IRA, for instance) at a rate of 8%. In the first 15 years, the 15-year mortgage homeowner doesn’t […]

[…] which I am most proud is also the post that has generated the most search engine traffic – “Earned Income: The Bane of the Graduate Student’s Roth IRA”. I laid out what kinds of graduate student pay qualify as “earned income” for the purposes […]

[…] 3) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] 4) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] on the blog – I listed not paying them as an advantage to being paid with a 1099-MISC and I had a good exchange with a commenter (Joe) about whether it’s better to be paid with a 1099-MISC or W-2 for investing purposes. In […]

Emily, great job on this, very helpful! However, I wanted to point out a paragraph from publication 54 which is otherwise directed towards U.S. citizens living and working abroad. I think it clarifies what we’ve all been wanting to know (from p.17 http://www.irs.gov/pub/irs-pdf/p54.pdf “Scholarships and fellowships. Any portion of a scholarship or fellowship grant that is paid to you for teaching, research or other services

is considered earned income if you must include it in your gross income. If the payer of the grant is required to provide you with a Form W-2, Wage and Tax Statement, these amounts will be listed as wages.” I interpret this to mean that it is not just a W-2 that qualifies a grantee as having earned income but ALSO “any portion…of a…grant…paid to you for…research…is considered earned income if you must include it in your gross income.” And we know that the taxable portions of our grants must be included in gross income.

If you can punch a hole in this…please do! I need to decide very soon if I can make my full Roth contribution for this year or not. After reading this publication I think I have a strong case to count the taxable portion of my NSF DDIG grant as earned income.

Unfortunately this passage does not change my opinion on the 1099-MISC vs. W-2 being the key indicator of whether or not income is ‘earned.’ Even though it doesn’t directly apply to domestic students, it jives with the passages I quoted in this post that say that if work is required, a W-2 should be issued instead of a 1099-MISC. A fellowship could result in W-2 pay if work is required, but if you are paid by a fellowship and receive a 1099-MISC indicates that ‘no work was required.’

That said, I definitely think you have an argument – and it’s the same one I make, that we do in reality work no matter what kind of tax form we receive, and that it’s ridiculous to claim that our stipends are given without any expectations of work in return. Also take a look at Julia’s comment that says she received a W-2 for doing “no work.” I think that no one, not even the IRS, has definitive answers on these questions. But I’m not an advisor so I can’t make a recommendation!

Actually the IRS does have a definitive answer on it and they even have a form you can fill out and they will determine if your university is incorrect in paying you with a 1099 vs w-2. It is not uncommon for departments or whole universities to try to skate on this because they don’t think grad students will complain for fear of losing their letters of rec.

Ginger recently posted..Food plans are bad plans

I haven’t heard of this. Would you please give me more information? This is so exciting!

Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. All you have to do is request this form and the IRS will make its decision and often that does not agree with HR or the department. However, you have to decide, do you want to piss off your boss by doing this?

Ginger recently posted..Food plans are bad plans

This is so interesting. Have you used this form or seen anyone else use this form? I assume it would be to argue that a 1099-MISC box 3 employee should be a W-2 employee? It’s hard for me to see how grad student work would fit into this Q&A.

[…] 3) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] you haven’t checked out my old post on grad students and earned income recently, you really should. It’s my one post that continues to generate comments. The […]

[…] 4) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

What I have been reading elsewhere is that the calculation for what can be included in a Roth IRA contribution is: 1099-MISC Amount – (minus) Deduction for Employer-Equivalent Portion of Self-Employment Tax (from Schedule SE – Line 6; 1040 – Line 27).

Here is an example:

http://www.bankrate.com/brm/itax/tax_adviser/20070426_funding_Roth_IRA_a1.asp (Note: 1040 Line 26 in 2007 is now 1040 Line 27 for 2012)

In this post I am talking about income reported in 1099-MISC box 3. What you wrote about and what that article is about is self-employment income – 1099-MISC box 7. I haven’t researched self-employment income so I can’t offer informed opinions on that matter.

I need to correct that my previous post was too simplistic. 1099-MISC Amount counts as part of the calculation of earned income only if it is listed under Nonemployee Compensation, and only the part leftover in the net profit (Schedule C).

I’m not familiar with the Schedule C so I can’t comment on what makes for earned income for independent contractors.

[…] discussions of other confusing points about graduate student income, read my posts on earned income and Roth IRAs and Social Security […]

[…] own posts on grad student taxes have been on persistent lies, Social Security, and IRAs. I have a couple more planned for the next few months as […]

[…] very diverse – from people who had never seen a 1040 to people who were trying to argue that grad students should be paid with W-2s instead of 1099-MISCs. I think our speaker did a great job covering the material, which was very difficult and […]

[…] My university issues a courtesy letter when it has paid a student’s stipend with a fellowship through payroll and the student has not set up income tax withholdings. 1099-MISC box 3 income and courtesy letter income are from the same type of source, a fellowship or scholarship, but in the case of the 1099-MISC the student has had taxes withheld. Receiving 1099-MISC or courtesy letter income, at least at my university, means that the student is being paid through the non-compensatory payroll system. If the student were paid through the compensatory payroll system, she would receive a W-2. (Compensatory payroll is associated with being an employee, though I would certainly say that grad students receiving W-2s are still more “student” than “employee.” Compensatory means you are being compensated for your work, whereas non-compensatory or fellowship income means you are being paid for… being you, apparently. This hearkens back to the earned income debate.) […]

[…] 3) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] have in tax-advantaged account invested in the stock market, for instance. On the other hand, if you are paid by a fellowship and don’t have access to a tax-advantaged retirement account, perhaps paying down a mortgage is your best available investment […]

[…] 1) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] getting paid with a 1099 Misc instead of a W2 – no one believes this is “earned income,” which is what you need to contribute to a […]

[…] Earned Income: The Bane of the Graduate Student’s Roth IRA […]

Emily,

Thanks so much for this post. More students need to hear this information.

I am currently a graduate student in nutritional sciences at a public university in Florida. I have had my Roth IRA for about 2 years now. I am surprised time and time again that the university doesn’t do more to offer some sort of financial guidance/support to new students. This is a huge problem. I imagine that there are many students with investment products in a Roth without knowing the full requirements/regulations. Luckily, my graduate school uses W-2. Otherwise, I am not sure how I would have gotten out of this pickle!

Thank you so much for the encouragement!

I’ve been on a personal finance committee at my university for about a year now, thanks to running this blog! We created a great tax workshop with a tax professional last spring and we got an hour for it during next year’s orientation! So the new crop of students for next year WILL know that they have to pay taxes and how to set up witholdings/pay estimated taxes and I’ll make sure the earned income information is slipped in there as well. Change is possible. 🙂

[…] with your department’s payroll, even if you are on the non-compensatory payroll (receiving a 1099-MISC at tax time instead of a W-2). That way you will have an idea of how much your net pay will be […]

[…] I now cannot contribute to my Roth IRA from this portion of my income. Fellowship/1099-MISC box 3 income is not considered “earned income.” I hope this won’t turn out to matter much practically, though. I’ve already received $5,500 […]

[…] students. We (generally speaking) don’t pay Social Security taxes, but we also may not have the earned income necessary to contribute to IRAs. I frequently write about personal finance issues that are specific to graduate students because […]

[…] one of my posts. The post that I have gotten the most positive feedback on is my one clarifying what earned income is for a graduate student for the purposes of contributing to an IRA. I love seeing search queries coming in that I know are leading readers to that […]

[…] which means I’m being paid by a fellowship instead of a grant, which means that I don’t have “earned income,” which means that I have no work requirement for receiving my pay. Allegedly, I will be paid […]

[…] 2) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] 2) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] 3) Earned Income: The Bane of the Graduate Student’s Roth IRA […]

After reading these posts it is not hard to understand why so many people in this country are on anti-depressant medication.

I’m actually going to listen to a presentation next month on whether mental health issues are on the rise on academia… do I’ll ask about Roth IRA eligibility. 🙂

Interesting post. You could also be at some universities that issue neither a 1099 nor a W2 for stipend income – I don’t know how they get away with it. It’s totally ridiculous. We’re declared students when it’s convenient for them financially, but when it comes to everything else, we’re expected to act like employees, except with long hours and low pay. I understand that research is an integral part of the process for a PhD, but it’s absolutely preposterous at times – being a student and an employee are not mutually exclusive conditions We’re the backbone of the US publicly-funded research and undergraduate teaching and we’re paid like crap. All so that we can get a PhD and get paid like crap as a post-doc or adjunct (if you choose to go those routes after the degree).

The explicit low pay itself doesn’t bother me as much as the lack of benefits that real employees get. You are right that sometimes we are treated like employees (those of us that are W-2) and sometimes not, depending on what is best for the university probably. The stipulation in the tax code about not being required to work to receive a fellowship really bothers me and makes me feel the universities and departments are being very dishonest about something that should be black-and-white.

When a student is issued neither a W-2 nor 1099-MISC, that indicates she was on a fellowship or training grant (non-compensatory pay) and did not have taxes withheld.

[…] won’t go into detail about this because I’ve written a whole post on the definition of earned income with respect to grad student pay and how many grad students who are able to save for retirement […]

So glad I found this post! Unfortunately the issue remains murky – after discussing with a CPA this is what he pointed out – for students who were issued NEITHER a W-2 nor a 1099 – Form 1040 line 7 says to report “Scholarship and fellowship grants not reported on Form W-2” Of course, line 7 is the amount used to calculate your “earned income” (along with a couple other lines not applicable in most situations). Having this earned income seems to qualify for Roth IRA contributions – what do you/others think?

I have to stand by my conclusion in the post (although the IRS language has now been updated to “taxable compensation”) – sorry! I disagree that line 7 equates with earned income/taxable compensation. Taxable compensation for the purposes of an IRA is defined quite clearly in Publication 590.

[…] (For more info – Emily at EvolvingPF has written before about how taxable compensation and earned income affect one’s ability to contribute to an IRA, in a way that can be particularly limiting for […]

Hey Emily!

Great blog, so interesting to see it as a first year graduate student. It looks like I won’t be able to contribute to my Roth. What did you and your husband do for retirement savings during the year(s) that you two were in grad school and couldn’t contribute to Roth? Did you guys open taxable accounts? Or just keep in savings?

Sorry to hear that!

Tbh for my first few years of grad school I didn’t know about this eligibility issue so I just contributed. Looking back though and doing the math, we actually did have enough earned income/taxable compensation in each calendar year that our contributions were legitimate. For example, I had a couple side jobs during my postbac fellowship, and even though I had a fellowship in both my first and second years of grad school, in the summer between I had an assistantship. Later on, we received w-2s. So we were eligible to contribute to IRAs throughout our time in grad school. Keep those kind of income sources and income changes in mind – if you have taxable compensation at any point in the calendar year, you are eligible to contribute up to $5,500 or the amount you earned, whichever is less.

If I didn’t have those bits of taxable compensation during my first few years of grad school, I would have saved for retirement in a taxable account. IMO your eligibility to contribute to a tax-advantaged account should not change your goals – either you’re ready to save for retirement or you aren’t, and your choice of investments should reflect your goals and time horizon. I would have bought the same underlying mutual funds inside or outside of an IRA (as index funds, they are pretty low-turnover), but you might also consider buying particularly tax-efficient investments. Once you do have access to an IRA, you can choose to keep your taxable money where it is or pull it over to the IRA.

Thanks for the informative post. I am starting a fellowship, and I have reason to believe I may get a 1099-MISC. If I have cash savings from my previous job, that I paid taxes on…can I add those to my Roth IRA during my two years in fellowship?

Unfortunately, no. If your fellowship income (not reported on a W-2) is your only income during the calendar year, you are not eligible to contribute to an IRA. It doesn’t matter what the source of the money is that you actually contribute as money is fungible. What matter is your eligibility in that calendar year, which is based on your income in that calendar year.

Hi!

Quick question: What happens if you don’t receive anything?

I’m currently on an NSF postdoc fellowship, where I don’t get any paper forms because NSF reasons. I report the income on my W-2 because it is taxable, but I don’t receive anything.

I assume this means no Roth IRA, right? If so, which congressperson to I call to complain about this BS!

I haven’t looked into postdoc pay as extensively as I have grad student, so I’m not sure if it’s exactly the same situation. But yes, I think you need to assume your income is taxable and needs to be included on your 1040, even though there’s no tax form associated with it.

For postdocs, a possible correlating marker for IRA eligibility could be FICA tax. If you aren’t paying FICA, you aren’t receiving wages, and if you aren’t receiving wages, I don’t think you can argue that you have taxable compensation. That’s just a guess though.

I’d complain to the NSF itself, actually! They should give you some kind of tax guidance.

I’ll spend some time looking into postdoc fellowship tax stuff – I’m sorry I don’t have a full answer right now

Postdocs don’t pay FICA, or at least NSF postdoc fellows don’t. So no IRA-depositable wages, which was what I concluded too… but still taxable? Annoying.

NSF explicitly states that they do not offer tax advice. How nice.

There has been some debate about postdocs with fellowships having to pay FICA tax (postdocs that are university employees definitely do)… Basically, the idea that postdoc fellows are truly receiving non-compensatory pay has been questioned (rightfully!), but if that debate hasn’t touched the NSF yet that’s fine.

I dunno, I think I’d rather have the FICA tax break than the IRA eligibility if it were one or the other… You can still invest with a tax-efficient strategy and get the money into tax-advantaged accounts with your next job, or develop a side income for the IRA eligibility. Then again, maybe I’m discounting future Social Security benefits too much.

NSF may not give tax advice, but they still need to provide tax documents, just like every other institution that does not give tax advice either but are required to provide tax documents.

I mean, if you were to get chosen for an audit, how are you supposed to prove that this was indeed the correct amount? You might remember now as you are filling out your tax forms, but you have to be able to substantiate this for at least the next 3 to 7 years…?

This is why I am wondering if they have a webpage for you to do a lookup and print out the form for yourself.

According to Chris Berner, Operational Accountant of NSF’s Division of Financial Management:

“Fellows are not in any sense employees of the National Science Foundation. Therefore, no funds will be deducted from the stipends; no Social Security taxes will be paid by the Foundation; no W-2 or 1099 forms will be issued; and provision must be made by you for the filing of any necessary estimate of taxes due and for payment of all income taxes which may become due. A statement of funds received (including the fellowship allowance) will be issued by the Division of Financial Management of the Foundation upon your written request.”

So if a fellow were to get audited, we’d need to send a letter to the Division of Financial Management to confirm we got paid what we said we did… meaning only then would we have any idea ourselves of whether or not we filed correctly, but NSF would have no liability in that regard. Which I suspect is the point of telling us nothing.

I miss the 1098-T’s of grad school. At least they existed!

My grad school didn’t issue 1098-Ts if the scholarship income exceeded the qualified education expenses, i.e., exactly the situation the majority of the PhD students were in. They weren’t required to, but still – not cool!

Matan,

Can you access your 1099-MISC online if they won’t send you a paper copy?

See my previous post on 2/25/2013. It seems you might able to partially count it as earned income, but only if it is listed under Nonemployee Compensation.

Tax Policy falls under the jurisdiction of the Ways and Means Committee:

http://waysandmeans.house.gov/subcommittee/select-revenue-measures/

Please do let us all know what you find out. I would be happy to participate in a petition if you decide to start one.

Thank you!

The point is that no tax forms were generated for this postdoc fellowship – 1099-MISC or otherwise. Postdoc fellows, like grad students, are most assuredly not self-employed.

My husband once had a post-doc (also government) and we reported this amount under Other Income listed as Prize/Award (ie, not Wages). I don’t recall the specifics of the tax form, but I am quite certain I had something in order to research how the income should be reported on the 1040.

More recently, my son did a project for a university and received a 1099-MISC – Nonemployee Compensation, and this was considered self-employment income.

Either way, it seems strange to not get a tax document for income needing to be reported, especially from a government institution like NSF.

Universities hire independent contractors frequently for short-term work (my main income right now is as an independent contractor for various universities), and sometimes they might even be students at the university (though that gets tricky), but that situation is quite distinct from grad students who receive stipends for their work as RAs or TAs (for which they will receive W-2s) and fellows (for which there is no tax documentation required).

I’m planning to report my postdoc pay from 2015 in 1040 Line 21 “Other income,” but that’s because it’s reported on a 1099-MISC in box 3. That line is also my best guess for postdoc fellows who don’t have any documentation, but I don’t have IRS tax code justification for it at this point.

I agree that a lack of documentation seems strange, but the IRS does not require universities to report non-compensatory income to either itself or the recipients. Some universities use a 1099-MISC or 1098-T as a courtesy to the student, but they don’t have to.

Emily, an important point for anyone who already contributed to an IRA and then only as the tax filing deadline rolls around discovers that they’re not eligible because their income is non-taxable: You can undo the contribution and not pay any penalties, either for early withdrawal or for excess contribution.

E.g. suppose that last year (2015) you contributed to your IRA, and now you’re doing your taxes and you realize that you’re going to get socked with a 6% penalty for excess contributions. You have until your filing deadline – April 15 for most of us – to withdraw the money you contributed (plus any net earnings, or minus any net losses), and it will be as if you never made the contribution. You will NOT be charged an excess contribution penalty. You will NOT be charged an early distribution penalty. You WILL be taxed on the amount you withdraw, because you’ll need to state it as income on your return.

If you have an extension to file, that comes with an extension to reverse out of your contribution.

Great addition – thanks!

A relevant note: if you have a spouse who has adequate earned income, and ifyou file “Married, filing jointly,” they can contribute to your Roth IRA, even if you have zero earned income. Of course, there are a few gotchas, but this generally works well. See:

https://www.irs.gov/Retirement-Plans/Plan-Participant,-Employee/Retirement-Topics-IRA-Contribution-Limits

Great addition! I’m surprised that info wasn’t in the post already, actually!

The flip-side is that if you don’t have earned income, then you don’t owe any payroll taxes. That means with a $30K fellowship you have an extra $1,800 to invest in a taxable account.

Fun story: I used to think that, but actually graduate students don’t/shouldn’t pay payroll taxes as they have an automatic FICA exemption for their degree-related work.

FYI, may be hope for the future. Senators Warren & Lee introduced bill to make it allowable for Fellowship monies to count towards Roth contributions

“Graduate Student Savings Act of 2016”

http://www.warren.senate.gov/?p=press_release&id=1157

That edit is exactly what we need!! Thanks for sharing this with me.

http://www.finance.senate.gov/hearings/open-executive-session-to-consider-the-miners-protection-act-of-2016-and-the-retirement-enhancement-and-savings-act-of-2016

Update: finace Committee holding a hearing at 10am on Sept 21st. Link for live video, apparently, if you want to listen in. Bummer is they are proposing it not take effect until after tax year of 2016, but that is better than nothing, that is for sure.

I didn’t catch the hearing. How did it go?

https://ttlc.intuit.com/questions/2802011-fellowship-income-and-ira-contribution

Clear as mud… but gross income included the amounts used for living expenses… and in some interpretations, may therefore qualify one for an IRA contribution…

It is obvious that the Retirement enhancement and savings act of 2016 is a super good idea and necessary.

Grad Students would be actively advocating for this bill.. .and thanking the sponsors via phone calls.

I’m afraid that the proposal for the retirement enhancement and saving act clarifies in itself that fellowship income is not eligible for IRA contribution. And I agree that grad students should be advocating and talking to their representatives!

[Apologies if someone else mentioned this and I overlooked it.]

If you do have earned income and are eligible to contribute to a Roth IRA, keep in mind that the contribution money doesn’t have to come from you. For example, if your parents have the wherewithal and you don’t mind accepting a gift from them, *they* can contribute to *your* Roth (or regular) IRA. You don’t even have to be their dependent.

Note that the same restrictions apply, i.e. total Roth contributions can’t exceed the total amount of *your* earned income/taxable compensation, up to the maximum annual contribution limit. (If you have both Roth and other types of IRAs, there are additional limits that affect the combined contributions.)

This applies to minors as well. So parents can set up a “Custodial Roth IRA” for a minor child who has a part-time job, and make the permitted contributions to it themselves.

Such contributions are considered gifts to the IRA owner. As long as the total amount of *all* gifts – not just these contributions – from a given contributor to a given recipient during the year is below the annual individual gift limit, there are no filing or tax implications for the contributors (also no tax benefits). Recipients are never responsible for gift tax.

This is a nice way to get nearly/newly-adult children/grandchildren/godchildren/whatever started with retirement savings before you’re earning enough to cover contributions as well as living expenses on your own.

Source: many, including

http://finance.zacks.com/can-parent-adult-child-roth-ira-5552.html

Great addition to this article! It would be a great perk to have a parent willing to fund an IRA if you have taxable compensation/earned income.

In their ad some 25+ years ago, TRowePrice had suggested parental help in funding an IRA, so some 20 years, that’s exactly what I did for my child.

You cannot open an account with Fidelity until you are 18, but it is well worth the wait since they have low fees for buying/selling stocks right within a Roth IRA. In addition to their tools for comparing mutual funds, you can set up a WatchList with Alerts when stocks go up/down to your advantage, and even have it buy/sell your stocks when it reaches your specified thresholds.

MarketWatch.com/investing/stock/ is an excellent resource for researching stocks and trends.

Hold the phone… did the Graduate Student Savings Act of 2016 pass?

What does this mean? What changed?

It did not pass. 🙁

Thank you, this was very helpful. It also applies to NIH post-doc fellows called IRTA’s which receive a taxable grant. I don’t know why I can’t just fund my IRA from my savings. That doesn’t seem right.

Yes, this exclusion applies at the postdoc level as well. I’m sorry to hear of your frustration. If you’re married and your spouse has taxable compensation, you can contribute to a spousal IRA. Other than that, you could consider generating a side income.

Hi Emily,

I am an undergraduate fellow working at the NIH for the summer and I am receiving a tax form 1099G for my stipend. According to your video, this means I am not allowed to contribute this money to my Roth IRA.

Additionally, I receive some “overflow” money for scholarships (this comes to around +5000) and I also receive income for working in my lab at my home university, and I receive a W2 for this.

This means that by next April, I have 11,700 dollars in non-taxed/non-withheld income, and probably around 3000 or so in withheld income from my lab.

So, my two questions are:

1. Do I need to pay taxes on my “overflow” scholarship money? I know I need to pay them on my NIH summer stipend, but I am not sure about scholarship excess.

2. Am I ONLY allowed to contribute the money I make from my lab to my Roth, since this is the only money that has tax withheld from it? If I pay taxes only my stipend/scholarship overflow next April, does this mean I am allowed to contribute it after that, or will this money just be sitting in cash savings until I use it? If I am not allowed to contribute it to my Roth, then I will probably just contribute it to a taxed investment fund and pay the long term capital gains tax on it.

1. Yes, to the extent that your scholarship income exceeds your qualified education expenses, it it taxable. See: “How Do I Calculate and Report My Taxable Income?”

2. You are only allowed to contribute to an IRA up to your amount of taxable compensation (i.e., W-2 in this case). The key word in “taxable compensation” is “compensation” rather than “taxable.” It doesn’t matter if you eventually pay tax on your scholarship income; it is not compensation. It’s a great idea to use a taxable investment account for any additional investing you want to do. See: “Fellowship Recipients Can Save for Retirement Outside an IRA.”

Wow, thanks so much! This makes everything a lot more clear. Unfortunately, I will have to pay the long term capital gains tax, but I do have an added advantage of being able to withdraw this money if needed (though, ideally I would like to keep it growing!) without a tax consequence

[…] Retirement Arrangement (IRA). However, only compensatory pay (aka ‘taxable compensation’ or ‘earned income’) is eligible to be contributed to an IRA. Graduate students who receive only non-compensatory […]

[…] Earned Income: The Bane of the Graduate Student’s Roth IRA […]

[…] Further reading: Earned Income: The Bane of the Grad Student’s Roth IRA […]

[…] taxable compensation (previously known as earned income) can be contributed to an IRA. A graduate student’s stipend is taxable compensation if it is […]

[…] Further reading: Earned Income: The Bane of the Graduate Student’s Roth IRA […]

The SECURE act, enacted in December of 2019, now removes the obstacle of compensation/earned income with “The term ‘compensation’ shall include any amount which is included in the individual’s gross income and paid to the individual to aid the individual in the pursuit of graduate or postdoctoral study.”